GameStop 2005 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2005 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

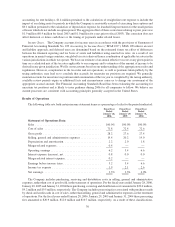

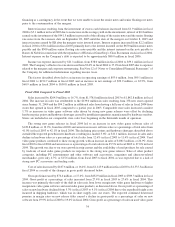

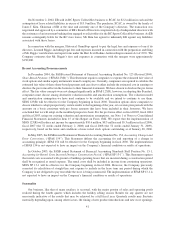

Contractual Obligations

The following table sets forth our contractual obligations (in millions) as of January 28, 2006:

Contractual Obligations Total

Less Than

1 Year 1-3 Years 3-5 Years

More Than

5 Years

Payments Due by Period

In millions

Long-Term Debt(1)................. $1,479.4 $ 91.4 $168.8 $156.3 $1,062.9

Operating Leases .................. $1,017.4 $197.1 $339.3 $206.5 $ 274.5

Purchase Obligations(2) ............. $ 420.9 $420.9 $ — $ — $ —

Involuntary Employment Termination

Costs(3) ....................... $ 10.2 $ 10.2 $ — $ — $ —

Total ........................... $2,927.9 $719.6 $508.1 $362.8 $1,337.4

(1) The long-term debt consists of $650.0 million (principal value), which bears interest at 8.0%, $300.0 million of

floating rate notes which currently bear interest at 8.4%, $24.3 million which bears interest at 5.5% and

$9.3 million which bears interest at 5.4%. Amounts include contractual interest payments (using the interest

rate as of January 28, 2006 for the floating rate notes).

(2) Purchase obligations represent outstanding purchase orders for merchandise from vendors. These purchase

orders are generally cancelable until shipment of the products.

(3) Involuntary employment termination costs include known amounts committed to approximately 680 employ-

ees, primarily in general and administrative functions in EB’s Pennsylvania corporate office and distribution

center and Nevada call center, which are expected to be closed in the first half of fiscal 2006. Termination of

these employees began in October 2005 and is expected to be completed by July 2006.

In addition to minimum rentals, the operating leases generally require the Company to pay all insurance, taxes

and other maintenance costs and may provide for percentage rentals. Percentage rentals are based on sales

performance in excess of specified minimums at various stores. Leases with step rent provisions, escalation clauses

or other lease concessions are accounted for on a straight-line basis over the lease term, including renewal options

for those leases in which it is reasonably assured that the Company will exercise the renewal option. The Company

does not have leases with capital improvement funding.

The Company intends to sell the 315,000 square foot distribution facility located in Sadsbury Township,

Pennsylvania in fiscal 2006. Under the terms of the mortgage agreement on this facility, we could be liable for an

early-termination payment of approximately $0.8 million when we sell the facility and retire the mortgage. This

early-termination payment is recorded in accrued liabilities in the consolidated balance sheet as of January 28, 2006

as the Company intends to retire the mortgage if the building is sold in fiscal 2006 and expects to be liable for the

early-termination penalty.

The Company has entered into employment agreements with R. Richard Fontaine, Daniel A. DeMatteo Steven

R. Morgan and David W. Carlson. The terms of the employment agreement for Mr. Fontaine and Mr. DeMatteo

commenced on April 11, 2005 and continue for a period of three years thereafter, with automatic annual renewals

thereafter unless either party gives notice of non-renewal at least six months prior to automatic renewal. The term of

the employment agreement for Mr. Morgan commenced on December 9, 2005 and continues through February 12,

2008, with automatic annual renewals thereafter unless either party gives notice of non-renewal at least six months

prior to automatic renewal. The term of the employment agreement for Mr. Carlson commenced on April 3, 2006

and continues for a period of two years thereafter, with automatic annual renewals thereafter unless either party

gives notice of non-renewal at least six months prior to automatic renewal. Mr. Fontaine’s minimum annual salary

during the term of his employment under the employment agreement shall be no less than $650,000. Mr. DeMatteo’s

minimum annual salary during the term of his employment under the employment agreement shall be no less than

$535,000. The Board of Director’s of the Company has set Mr. Fontaine’s and Mr. DeMatteo’s salaries for fiscal

2006 at $1,000,000 and $800,000, respectively. Mr. Morgan’s minimum annual salary during the term of his

39