GameStop 2005 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2005 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

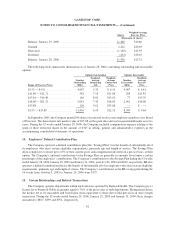

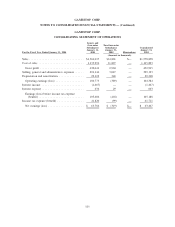

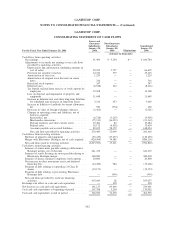

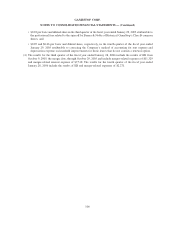

GAMESTOP CORP.

CONSOLIDATING STATEMENT OF CASH FLOWS

For the Fiscal Year Ended January 28, 2006

Issuers and

Guarantor

Subsidiaries

January 28,

2006

Non-Guarantor

Subsidiaries

January 28,

2006 Eliminations

Consolidated

January 28,

2006

(Amounts in thousands)

Cash flows from operating activities:

Net earnings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 91,490 $ 9,294 $— $ 100,784

Adjustments to reconcile net earnings to net cash flows

provided by operating activities:

Depreciation and amortization (including amounts in

cost of sales) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 58,932 7,727 — 66,659

Provision for inventory reserves. . . . . . . . . . . . . . . . . 24,726 377 — 25,103

Amortization of loan cost . . . . . . . . . . . . . . . . . . . . . 1,229 — — 1,229

Amortization of original issue discount on senior

notes. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 316 — — 316

Restricted stock expense . . . . . . . . . . . . . . . . . . . . . . 347 — — 347

Deferred taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (8,528) 312 — (8,216)

Tax benefit realized from exercise of stock options by

employees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12,308 — — 12,308

Loss on disposal and impairment of property and

equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11,648 — — 11,648

Increase in deferred rent and other long-term liabilities

for scheduled rent increases in long-term leases . . . . 3,216 453 — 3,669

Increase in liability to landlords for tenant allowances,

net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 936 (734) — 202

Decrease in value of foreign exchange contracts . . . . . (2,421) — — (2,421)

Changes in operating assets and liabilities, net of

business acquired

Receivables, net . . . . . . . . . . . . . . . . . . . . . . . . . . (6,728) (3,267) — (9,995)

Merchandise inventories . . . . . . . . . . . . . . . . . . . . (75,311) (16,052) — (91,363)

Prepaid expenses and other current assets . . . . . . . . 19,402 82 — 19,484

Prepaid taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18,172 (4,562) — 13,610

Accounts payable and accrued liabilities . . . . . . . . . 89,675 58,379 — 148,054

Net cash flows provided by operating activities . . . . 239,409 52,009 — 291,418

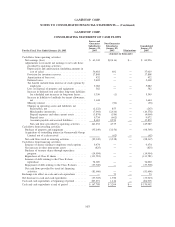

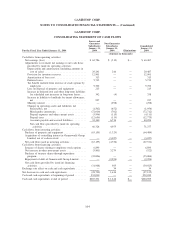

Cash flows from investing activities:

Purchase of property and equipment . . . . . . . . . . . . . . . (93,419) (17,277) — (110,696)

Merger with Electronics Boutique, net of cash acquired . . (920,504) 34,388 — (886,116)

Net cash flows used in investing activities . . . . . . . . . . . (1,013,923) 17,111 — (996,812)

Cash flows from financing activities:

Issuance of senior notes payable relating to Electronics

Boutique merger, net of discount . . . . . . . . . . . . . . . . 641,472 — — 641,472

Issuance of senior floating rate notes payable relating to

Electronics Boutique merger . . . . . . . . . . . . . . . . . . . 300,000 — — 300,000

Issuance of shares relating to employee stock options . . . 20,800 — — 20,800

Net increase in other noncurrent assets and deferred

financing fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (14,450) 984 — (13,466)

Payment of debt relating to repurchase of Class B

shares . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (12,173) — — (12,173)

Payment of debt relating to pre-existing Electronics

Boutique debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (956) — (956)

Net cash flows provided by (used in) financing

activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 935,649 28 — 935,677

Exchange rate effect on cash and cash equivalents . . . . . . . — 318 — 318

Net decrease in cash and cash equivalents . . . . . . . . . . . . . 161,135 69,466 — 230,601

Cash and cash equivalents at beginning of period . . . . . . . . 167,788 3,204 — 170,992

Cash and cash equivalents at end of period . . . . . . . . . . . . 328,923 72,670 — 401,593

102

GAMESTOP CORP.

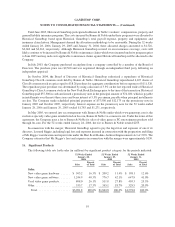

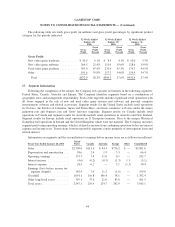

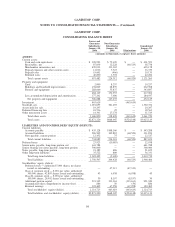

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)