GameStop 2005 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2005 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

accounting for rent holidays, $1.4 million pertained to the calculation of straight-line rent expense to include the

impact of escalating rents for periods in which the Company is reasonably assured of exercising lease options and

$0.1 million pertained to the calculation of depreciation expense for leasehold improvements for the small portion

of leases which do not include an option period. The aggregate effect of these corrections relating to prior years was

$1.9 million ($0.9 million for fiscal 2003 and $1.0 million for years prior to fiscal 2003). The correction does not

affect historical or future cash flows or the timing of payments under related leases.

Income Taxes. The Company accounts for income taxes in accordance with the provisions of Statement of

Financial Accounting Standards No. 109 Accounting for Income Taxes (“SFAS 109”). SFAS 109 utilizes an asset

and liability approach, and deferred taxes are determined based on the estimated future tax effect of differences

between the financial reporting and tax bases of assets and liabilities using enacted tax rates. As a result of our

operations in many foreign countries, our global tax rate is derived from a combination of applicable tax rates in the

various jurisdictions in which we operate. We base our estimate of an annual effective tax rate at any given point in

time on a calculated mix of the tax rates applicable to our company and to estimates of the amount of income to be

derived in any given jurisdiction. We file our tax returns based on our understanding of the appropriate tax rules and

regulations. However, complexities in the tax rules and our operations, as well as positions taken publicly by the

taxing authorities, may lead us to conclude that accruals for uncertain tax positions are required. We generally

maintain accruals for uncertain tax positions until examination of the tax year is completed by the taxing authority,

available review periods expire or additional facts and circumstances cause us to change our assessment of the

appropriate accrual amount. The Financial Accounting Standards Board has been evaluating the accounting for

uncertain tax positions and is likely to issue guidance during 2006 for all companies to follow. We believe our

current processes are consistent with accounting principles generally accepted in the United States.

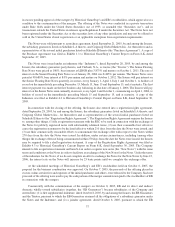

Results of Operations

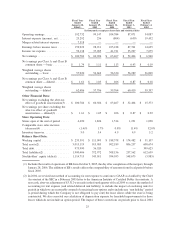

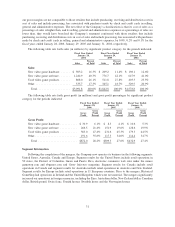

The following table sets forth certain income statement items as a percentage of sales for the periods indicated:

Fiscal Year

Ended

January 28,

2006

Fiscal Year

Ended

January 29,

2005

Fiscal Year

Ended

January 31,

2004

Statement of Operations Data:

Sales .......................................... 100.0% 100.0% 100.0%

Cost of sales .................................... 71.8 72.4 72.6

Gross profit ..................................... 28.2 27.6 27.4

Selling, general and administrative expenses ............. 19.4 20.2 19.0

Depreciation and amortization ........................ 2.2 2.0 1.8

Merger-related expenses ............................ 0.4 — —

Operating earnings ................................ 6.2 5.4 6.6

Interest expense (income), net ........................ 0.8 0.0 0.0

Merger-related interest expense ....................... 0.2 — —

Earnings before income taxes ........................ 5.2 5.4 6.6

Income tax expense ............................... 1.9 2.1 2.6

Net earnings ..................................... 3.3% 3.3% 4.0%

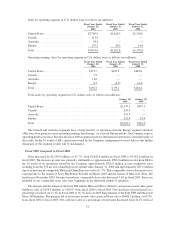

The Company includes purchasing, receiving and distribution costs in selling, general and administrative

expenses, rather than cost of goods sold, in the statement of operations. For the fiscal years ended January 28, 2006,

January 29, 2005 and January 31, 2004 these purchasing, receiving and distribution costs amounted to $20.6 million,

$9.2 million and $9.5 million, respectively. The Company includes processing fees associated with purchases made

by check and credit cards in cost of sales, rather than selling, general and administrative expenses, in the statement

of operations. For the fiscal years ended January 28, 2006, January 29, 2005 and January 31, 2004 these processing

fees amounted to $20.9 million, $12.0 million and $10.7 million, respectively. As a result of these classifications,

30