GameStop 2005 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2005 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

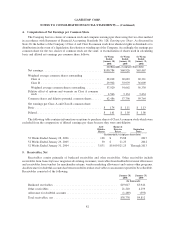

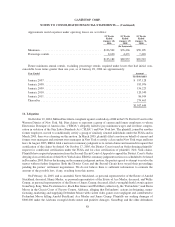

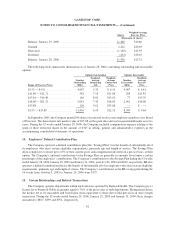

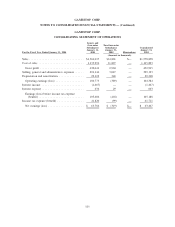

Shares

Weighted-Average

Exercise Price

(Thousands of shares)

Balance, January 29, 2005 ................................... 11,406 $10.86

Granted ................................................. 2,222 $20.63

Exercised ............................................... (1,740) $11.95

Forfeited ................................................ (432) $19.45

Balance, January 28, 2006 ................................... 11,456 $12.31

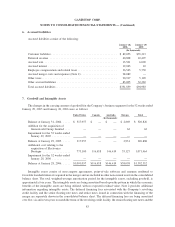

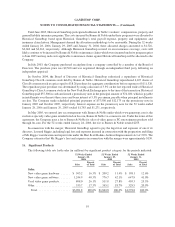

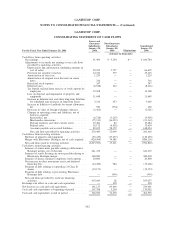

The following table summarizes information as of January 28, 2006 concerning outstanding and exercisable

options:

Range of Exercise Prices

Number

Outstanding

(000s)

Weighted-

Average

Remaining

Life

Weighted-

Average

Contractual

Price

Number

Exercisable

(000s)

Weighted-

Average

Exercise

Price

Options Outstanding Options Exercisable

$3.53 — $4.51 ................ 4,987 5.32 $ 4.41 4,987 $ 4.41

$11.80 — $12.71............... 542 7.18 $11.88 284 $11.85

$15.10 — $16.48............... 166 8.01 $15.62 77 $15.79

$18.00 — $21.25............... 5,641 7.45 $18.85 2,961 $18.09

$35.88 ...................... 120 9.62 $35.88 — $ —

$3.53 — $35.88 ............... 11,456 6.55 $12.31 8,309 $ 9.64

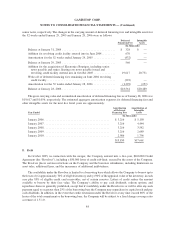

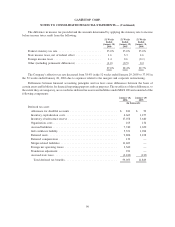

In September 2005, the Company granted 50 shares of restricted stock to non-employee members of its Board

of Directors. The shares had a fair market value of $35.88 on the grant date and vest in equal installments over two

years. During the 52 weeks ended January 28, 2006, the Company included compensation expense relating to the

grant of these restricted shares in the amount of $347 in selling, general and administrative expenses in the

accompanying consolidated statements of operations.

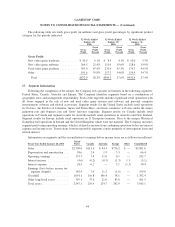

14. Employees’ Defined Contribution Plan

The Company sponsors a defined contribution plan (the “Savings Plan”) for the benefit of substantially all of

its employees who meet certain eligibility requirements, primarily age and length of service. The Savings Plan

allows employees to invest up to 15% of their current gross cash compensation invested on a pre-tax basis, at their

option. The Company’s optional contributions to the Savings Plan are generally in amounts based upon a certain

percentage of the employees’ contributions. The Company’s contributions to the Savings Plan during the 52 weeks

ended January 28, 2006, January 29, 2005 and January 31, 2004, were $1,196, $992 and $849, respectively. EB also

sponsors a defined contribution plan for the benefit of substantially all of its employees who meet certain eligibility

requirements, primarily age and length of service. The Company’s contributions to the EB savings plan during the

16 weeks from October 9, 2005 to January 28, 2006 were $137.

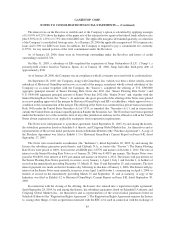

15. Certain Relationships and Related Transactions

The Company operates departments within ten bookstores operated by Barnes & Noble. The Company pays a

license fee to Barnes & Noble in amounts equal to 7.0% of the gross sales of such departments. Management deems

the license fee to be reasonable and based upon terms equivalent to those that would prevail in an arm’s length

transaction. During the 52 weeks ended January 28, 2006, January 29, 2005 and January 31, 2004, these charges

amounted to $857, $859 and $974, respectively.

92

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)