GameStop 2005 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2005 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

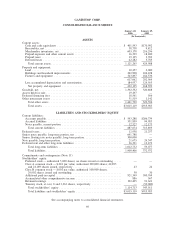

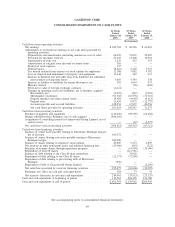

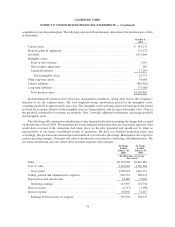

GAMESTOP CORP.

CONSOLIDATED STATEMENTS OF CASH FLOWS

52 Weeks

Ended

January 28,

2006

52 Weeks

Ended

January 29,

2005

52 Weeks

Ended

January 31,

2004

(In thousands)

Cash flows from operating activities:

Net earnings ............................................ $100,784 $ 60,926 $ 63,467

Adjustments to reconcile net earnings to net cash flows provided by

operating activities:

Depreciation and amortization (including amounts in cost of sales) . . . 66,659 37,019 29,487

Provision for inventory reserves ............................ 25,103 17,808 12,901

Amortization of loan cost ................................. 1,229 432 313

Amortization of original issue discount on senior notes............ 316 — —

Restricted stock expense . ................................. 347 — —

Deferred taxes . . ....................................... (8,216) 5,402 5,713

Tax benefit realized from exercise of stock options by employees . . . . 12,308 5,082 9,702

Loss on disposal and impairment of property and equipment . . ...... 11,648 382 213

Increase in deferred rent and other long-term liabilities for scheduled

rent increases in long-term leases . . ....................... 3,669 5,349 338

Increase in liability to landlords for tenant allowances, net . . . ...... 202 1,644 937

Minority interest ....................................... — (96) (298)

Decrease in value of foreign exchange contracts ................. (2,421) — —

Changes in operating assets and liabilities, net of business acquired

Receivables, net ...................................... (9,995) (267) (1,954)

Merchandise inventories ................................ (91,363) (10,578) (72,712)

Prepaid expenses and other current assets . . . ................. 19,484 (4,060) (4,111)

Prepaid taxes . ....................................... 13,610 9,072 (12,775)

Accounts payable and accrued liabilities . . . ................. 148,054 17,872 40,056

Net cash flows provided by operating activities . . . ............ 291,418 145,987 71,277

Cash flows from investing activities:

Purchase of property and equipment ........................... (110,696) (98,305) (64,484)

Merger with Electronics Boutique, net of cash acquired . ............ (886,116) — —

Acquisition of controlling interest in Gamesworld Group Limited, net of

cash received . . . ....................................... — (62) (3,027)

Net cash flows used in investing activities ....................... (996,812) (98,367) (67,511)

Cash flows from financing activities:

Issuance of senior notes payable relating to Electronics Boutique merger,

net of discount . . ....................................... 641,472 — —

Issuance of senior floating rate notes payable relating to Electronics

Boutique merger ....................................... 300,000 — —

Issuance of shares relating to employee stock options. . . ............ 20,800 9,474 6,899

Net increase in other noncurrent assets and deferred financing fees ..... (13,466) (825) (522)

Purchase of treasury shares through repurchase program. ............ — (14,994) (35,006)

Repurchase of Class B shares ................................ — (111,781) —

Issuance of debt relating to the Class B share repurchase ............ — 74,020 —

Repayment of debt relating to the Class B shares . ................. (12,173) (37,500) —

Repayment of debt relating to pre-existing debt of Electronics

Boutique . ............................................ (956) — —

Repayment of debt of Gamesworld Group Limited ................ — — (2,296)

Net cash flows provided by (used in) financing activities ............ 935,677 (81,606) (30,925)

Exchange rate effect on cash and cash equivalents ................. 318 73 34

Net increase (decrease) in cash and cash equivalents . . . ............ 230,601 (33,913) (27,125)

Cash and cash equivalents at beginning of period . . ................. 170,992 204,905 232,030

Cash and cash equivalents at end of period . ....................... $401,593 $ 170,992 $204,905

See accompanying notes to consolidated financial statements.

69