GameStop 2005 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2005 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.On November 2, 2002, EB sold its BC Sports Collectibles business to SCAC for $2.2 million in cash and the

assumption of lease related liabilities in excess of $13.0 million. The purchaser, SCAC, is owned by the family of

James J. Kim, Chairman of EB at the time and currently one of the Company’s directors. The transaction was

negotiated and approved by a committee of EB’s Board of Directors comprised solely of independent directors with

the assistance of an investment banking firm engaged to solicit offers for the BC Sports Collectibles business. As EB

remains contingently liable for the BC store leases, Mr. Kim has agreed to indemnify EB against any liabilities

associated with these leases.

In connection with the mergers, Historical GameStop agreed to pay the legal fees and expenses of one if its

directors, Leonard Riggio, including legal fees and expenses incurred in connection with the preparation and filing

of Mr. Riggio’s notification and report form under the Hart Scott Rodino Antitrust Improvements Act of 1976. The

Company estimates that Mr. Riggio’s fees and expenses in connection with the mergers were approximately

$150,000.

Recent Accounting Pronouncements

In December 2004, the FASB issued Statement of Financial Accounting Standard No. 123 (Revised 2004),

Share-Based Payment, (“SFAS 123(R)”). This Statement requires companies to expense the estimated fair value of

stock options and similar equity instruments issued to employees. Currently, companies are required to calculate the

estimated fair value of these share-based payments and can elect to either include the estimated cost in earnings or

disclose the pro forma effect in the footnotes to their financial statements. We have chosen to disclose the pro forma

effect. The fair value concepts were not changed significantly in SFAS 123(R), however, in adopting this Standard,

companies must choose among alternative valuation models and amortization assumptions. The valuation model

and amortization assumption we have used continue to be available and we intend to continue to use them.

SFAS 123(R) will be effective for the Company beginning in fiscal 2006. Transition options allow companies to

choose whether to adopt prospectively, restate results to the beginning of the year, or to restate prior periods with the

amounts on a basis consistent with pro forma amounts that have been included in their footnotes. We have

concluded that we will adopt on the modified prospective basis. For the pro forma effect on fiscal 2005, fiscal 2004

and fiscal 2003, using our existing valuation and amortization assumptions, see Note 1 of Notes to Consolidated

Financial Statements included in Item 15 of this Report on Form 10-K. We expect that the implementation of

SFAS 123(R) will reduce net income by approximately $10.6 million, $8.5 million and $5.3 million in fiscal 2006,

fiscal 2007 (the 52 weeks ended February 2, 2008) and fiscal 2008 (the 52 weeks ended January 31, 2009),

respectively, based on the terms and conditions of non-vested stock options outstanding as of January 28, 2006.

In May 2005, the FASB issued Statement of Financial Accounting Standard No. 154, Accounting Changes and

Error Corrections, (“SFAS 154”). This Statement defines the accounting for and reporting of a change in

accounting principle. SFAS 154 will be effective for the Company beginning in fiscal 2006. The implementation

of SFAS 154 is not expected to have an impact on the Company’s financial condition or results of operations.

In October 2005, the FASB issued Statement of Financial Accounting Standards Staff Position No. 13-1,

Accounting for Rental Costs Incurred During a Construction Period, (“SFAS SP 13-1”). This Statement requires

that rental costs associated with ground or building operating leases that are incurred during a construction period

shall be recognized as rental expense. The rental costs shall be included in income from continuing operations.

SFAS SP 13-1 will be effective for the Company beginning in fiscal 2006. However, the Company previously

corrected its calculation of straight-line rent expense to include in the lease term any period during which the

Company is not obligated to pay rent while the store is being constructed. The implementation of SFAS SP 13-1 is

not expected to have an impact on the Company’s financial condition or results of operations.

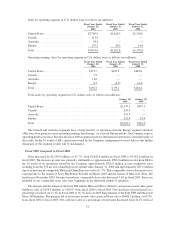

Seasonality

Our business, like that of many retailers, is seasonal, with the major portion of sales and operating profit

realized during the fourth quarter which includes the holiday selling season. Results for any quarter are not

necessarily indicative of the results that may be achieved for a full fiscal year. Quarterly results may fluctuate

materially depending upon, among other factors, the timing of new product introductions and new store openings,

41