GameStop 2005 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2005 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

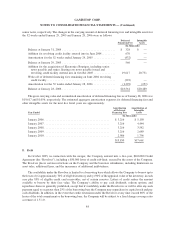

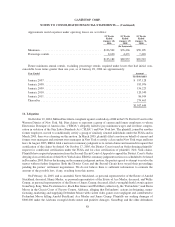

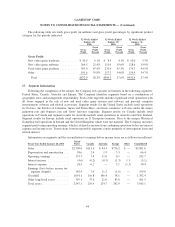

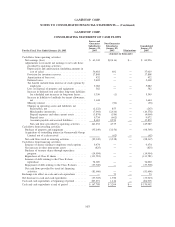

The following table sets forth gross profit (in millions) and gross profit percentages by significant product

category for the periods indicated:

Gross

Profit

Gross

Profit

Percent

Gross

Profit

Gross

Profit

Percent

Gross

Profit

Gross

Profit

Percent

52 Weeks Ended

January 28,

2006

52 Weeks Ended

January 29,

2005

52 Weeks Ended

January 31,

2004

Gross Profit:

New video game hardware ........... $ 30.9 6.1% $ 8.5 4.1% $ 10.6 5.3%

New video game software ........... 266.5 21.4% 151.9 19.6% 128.6 19.9%

Used video game products ........... 383.0 47.4% 231.6 45.3% 179.3 44.5%

Other ........................... 191.6 35.8% 117.3 34.0% 114.4 34.7%

Total ......................... $872.0 28.2% $509.3 27.6% $432.9 27.4%

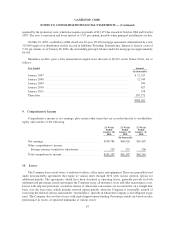

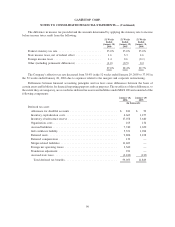

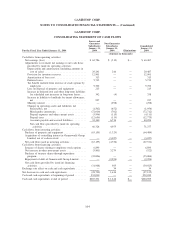

17. Segment Information

Following the completion of the merger, the Company now operates its business in the following segments:

United States, Canada, Australia and Europe. The Company identifies segments based on a combination of

geographic areas and management responsibility. Each of the segments includes significant retail operations with

all stores engaged in the sale of new and used video game systems and software and personal computer

entertainment software and related accessories. Segment results for the United States include retail operations

in 50 states, the District of Columbia, Guam and Puerto Rico, electronic commerce web sites under the names

gamestop.com and ebgames.com and Game Informer magazine. Segment results for Canada include retail

operations in Canada and segment results for Australia include retail operations in Australia and New Zealand.

Segment results for Europe include retail operations in 11 European countries. Prior to the merger, Historical

GameStop had operations in Ireland and the United Kingdom which were not material. The Company measures

segment profit using operating earnings, which is defined as income from continuing operations before net interest

expense and income taxes. Transactions between reportable segments consist primarily of intersegment loans and

related interest.

Information on segments and the reconciliation to earnings before income taxes are as follows (in millions):

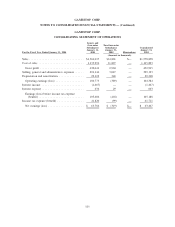

Fiscal Year Ended January 28, 2006

United

States Canada Australia Europe Other Consolidated

Sales ...................... $2,709.8 $111.4 $ 94.4 $176.2 $ — $3,091.8

Depreciation and amortization .... 58.6 2.6 1.9 3.3 — 66.4

Operating earnings ............ 173.7 7.9 11.0 0.1 — 192.7

Interest income ............... (4.6) (0.2) (0.3) (1.3) 1.3 (5.1)

Interest expense .............. 28.4 0.2 — 3.1 (1.3) 30.4

Earnings (loss) before income tax

expense (benefit)............ 142.4 7.9 11.2 (1.6) — 159.9

Goodwill ................... 1,091.1 116.8 146.4 38.1 — 1,392.4

Other long-lived assets ......... 359.1 37.6 21.0 83.8 — 501.5

Total assets. . . ............... 2,347.1 210.4 214.7 242.9 — 3,015.1

94

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)