GameStop 2005 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2005 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

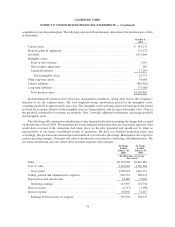

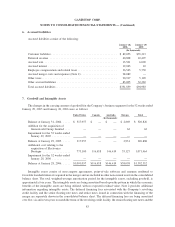

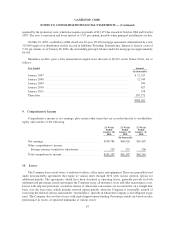

completion of our integration plans. The following represents the preliminary allocation of the purchase price (table

in thousands):

October 8,

2005

Current assets ....................................................... $ 541,171

Property, plant & equipment ............................................ 231,172

Goodwill . . . ........................................................ 1,071,464

Intangible assets:

Point-of-sale software................................................ 3,150

Non-compete agreements ............................................. 282

Leasehold interests .................................................. 17,299

Total intangible assets.............................................. 20,731

Other long-term assets ................................................. 38,068

Current liabilities ..................................................... (420,962)

Long-term liabilities .................................................. (37,688)

Total purchase price ................................................. $1,443,956

In determining the purchase price allocation, management considered, among other factors, the Company’s

intention to use the acquired assets. The total weighted-average amortization period for the intangible assets,

excluding goodwill, is approximately four years. The intangible assets are being amortized based upon the pattern

in which the economic benefits of the intangible assets are being utilized, with no expected residual value. None of

the goodwill is deductible for income tax purposes. Note 7 provides additional information concerning goodwill

and intangible assets.

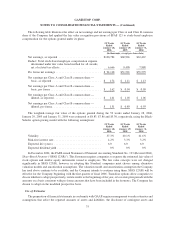

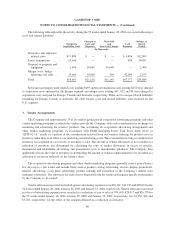

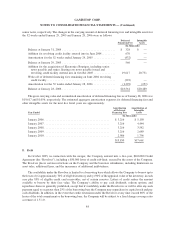

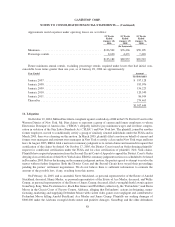

The following table summarizes unaudited pro forma financial information assuming the merger had occurred

on the first day of fiscal 2004. The unaudited pro forma financial information does not necessarily represent what

would have occurred if the transaction had taken place on the date presented and should not be taken as

representative of our future consolidated results of operations. We have not finalized integration plans, and

accordingly, this pro forma information does not include all costs related to the merger. Management also expects to

realize operating synergies. Synergies will come from reduced costs in logistics, marketing, and administration. The

pro forma information does not reflect these potential expenses and synergies:

52 Weeks

Ended

January 28,

2006

52 Weeks

Ended

January 29,

2005

(In thousands, except per

share data)

Sales ................................................... $4,393,890 $3,827,685

Cost of sales ............................................. 3,154,928 2,786,554

Gross profit ............................................ 1,238,962 1,041,131

Selling, general and administrative expenses ...................... 930,767 788,413

Depreciation and amortization ................................ 94,288 77,964

Operating earnings ....................................... 213,907 174,754

Interest income ........................................... (6,717) (1,998)

Interest expense ........................................... 85,056 72,217

Earnings before income tax expense .......................... 135,568 104,535

78

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)