GameStop 2005 Annual Report Download - page 105

Download and view the complete annual report

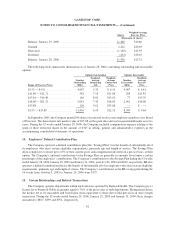

Please find page 105 of the 2005 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.19. Repurchase of Equity Securities

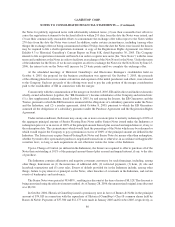

In March 2003, the Historical GameStop Board of Directors authorized a common stock repurchase program

for the purchase of up to $50,000 of Historical GameStop’s Class A common shares. Historical GameStop was

authorized to repurchase shares from time to time in the open market or through privately negotiated transactions,

depending on prevailing market conditions and other factors. During the 52 weeks ended January 29, 2005,

Historical GameStop repurchased 959 shares at an average share price of $15.64. During the 52 weeks ended

January 31, 2004, Historical GameStop repurchased 2,304 shares at an average share price of $15.19. From the

inception of this repurchase program through January 29, 2005, Historical GameStop repurchased 3,263 shares at

an average share price of $15.32, totaling $50,000, and, as of January 29, 2005, had no amount remaining available

for purchases under this repurchase program. The repurchased shares were held in treasury until the consummation

of the merger, at which time they were retired.

In October 2004, the Board of Directors of Historical GameStop authorized a repurchase of Historical

GameStop’s Class B common stock held by Barnes & Noble. Historical GameStop repurchased 6,107 shares of

Class B common stock at a price equal to $18.26 per share for aggregate consideration before expenses of $111,520.

The repurchased shares were immediately retired.

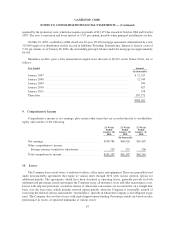

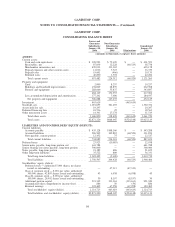

20. Shareholders’ Equity

The holders of Class A common stock and Class B common stock generally have identical rights except that

holders of Class A common stock are entitled to one vote per share while holders of Class B common stock are

entitled to ten votes per share on all matters to be voted on by stockholders. Holders of Class A common stock and

Class B common stock will share in an equal amount per share in any dividend declared by the board of directors,

subject to any preferential rights of any outstanding preferred stock. In the event of our liquidation, dissolution or

winding up, all holders of common stock, regardless of class, are entitled to share ratably in any assets available for

distribution to holders of shares of common stock after payment in full of any amounts required to be paid to holders

of preferred stock.

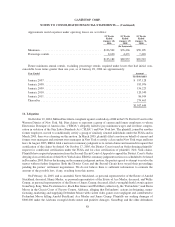

In connection with the merger, the Company adopted a rights agreement substantially similar to the rights

agreement adopted by Historical GameStop. Under the Company’s rights agreement, one right (a “Right”) is

attached to each outstanding share of the Company’s Class A common stock and Class B common stock (together

the “Common Stock”). Each Right entitles the holder to purchase from the Company one one-thousandth of a share

of a series of preferred stock, designated as Series A Junior Participating Preferred Stock (the “Series A Preferred

Stock”), at a price of $100.00 per one one-thousandth of a share. The Rights will be exercisable only if a person or

group acquires 15% or more of the voting power of the Company’s outstanding Common Stock or announces a

tender offer or exchange offer, the consummation of which would result in such person or group owning 15% or

more of the voting power of the Company’s outstanding Common Stock.

If a person or group acquires 15% or more of the voting power of the Company’s outstanding Common Stock,

each Right will entitle a holder (other than such person or any member of such group) to purchase, at the Right’s

then current exercise price, a number of shares of Common Stock having a market value of twice the exercise price

of the Right. In addition, if the Company is acquired in a merger or other business combination transaction or 50%

or more of its consolidated assets or earning power are sold at any time after the Rights have become exercisable,

each Right will entitle its holder to purchase, at the Right’s then current exercise price, a number of the acquiring

company’s common shares having a market value at that time of twice the exercise price of the Right. Furthermore,

at any time after a person or group acquires 15% or more of the voting power of the outstanding Common Stock of

the Company but prior to the acquisition of 50% of such voting power, the Board of Directors may, at its option,

exchange part or all of the Rights (other than Rights held by the acquiring person or group) at an exchange rate of

one one-thousandth of a share of Series A Preferred Stock or one share of the Company’s Common Stock for each

Right.

96

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)