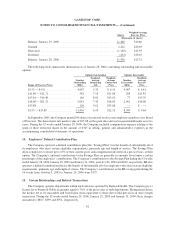

GameStop 2005 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2005 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

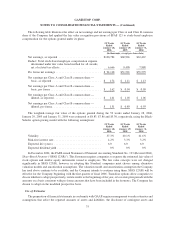

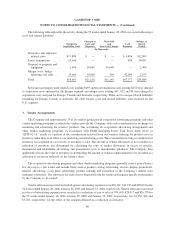

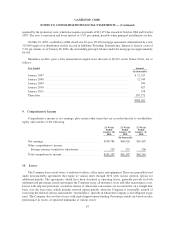

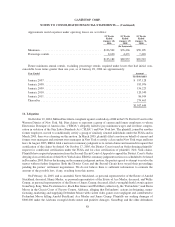

4. Computation of Net Earnings per Common Share

The Company has two classes of common stock and computes earnings per share using the two-class method

in accordance with Statement of Financial Accounting Standards No. 128, Earnings per Share. As discussed in

Note 20, the holders of the Company’s Class A and Class B common stock have identical rights to dividends or to

distributions in the event of a liquidation, dissolution or winding up of the Company. Accordingly, the earnings per

common share for the two classes of common stock are the same. A reconciliation of shares used in calculating

basic and diluted net earnings per common share follows: 52 Weeks

Ended

January 28,

2006

52 Weeks

Ended

January 29,

2005

52 Weeks

Ended

January 31,

2004

(In thousands, except per share data)

Net earnings ..................................... $100,784 $60,926 $63,467

Weighted average common shares outstanding

Class A ...................................... 28,018 20,683 20,321

Class B ...................................... 29,902 33,979 36,009

Weighted average common shares outstanding .......... 57,920 54,662 56,330

Dilutive effect of options and warrants on Class A common

stock ........................................ 4,566 3,134 3,434

Common shares and dilutive potential common shares ...... 62,486 57,796 59,764

Net earnings per Class A and Class B common share:

Basic .......................................... $ 1.74 $ 1.11 $ 1.13

Diluted......................................... $ 1.61 $ 1.05 $ 1.06

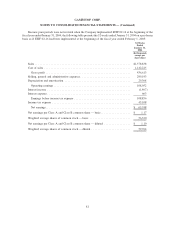

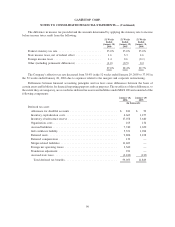

The following table contains information on options to purchase shares of Class A common stock which were

excluded from the computation of diluted earnings per share because they were anti-dilutive:

Anti-

Dilutive

Shares

Range of

Exercise

Prices

Expiration

Dates

(In thousands, except per share data)

52 Weeks Ended January 28, 2006 ................ 120 $ 35.88 2015

52 Weeks Ended January 29, 2005 ................ 30 $ 21.25 2012

52 Weeks Ended January 31, 2004 ................ 3,831 $18.00-$21.25 Through 2013

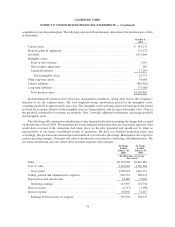

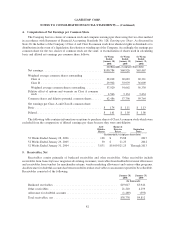

5. Receivables, Net

Receivables consist primarily of bankcard receivables and other receivables. Other receivables include

receivables from Game Informer magazine advertising customers, receivables from landlords for tenant allowances

and receivables from vendors for merchandise returns, vendor marketing allowances and various other programs.

An allowance for doubtful accounts has been recorded to reduce receivables to an amount expected to be collectible.

Receivables consisted of the following:

January 28,

2006

January 29,

2005

(In thousands)

Bankcard receivables ........................................ $19,017 $5,946

Other receivables ........................................... 21,210 4,259

Allowance for doubtful accounts . . .............................. (1,489) (393)

Total receivables, net ........................................ $38,738 $9,812

82

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)