GameStop 2005 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2005 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

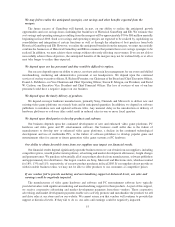

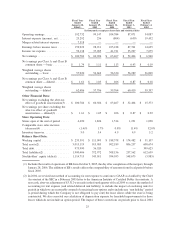

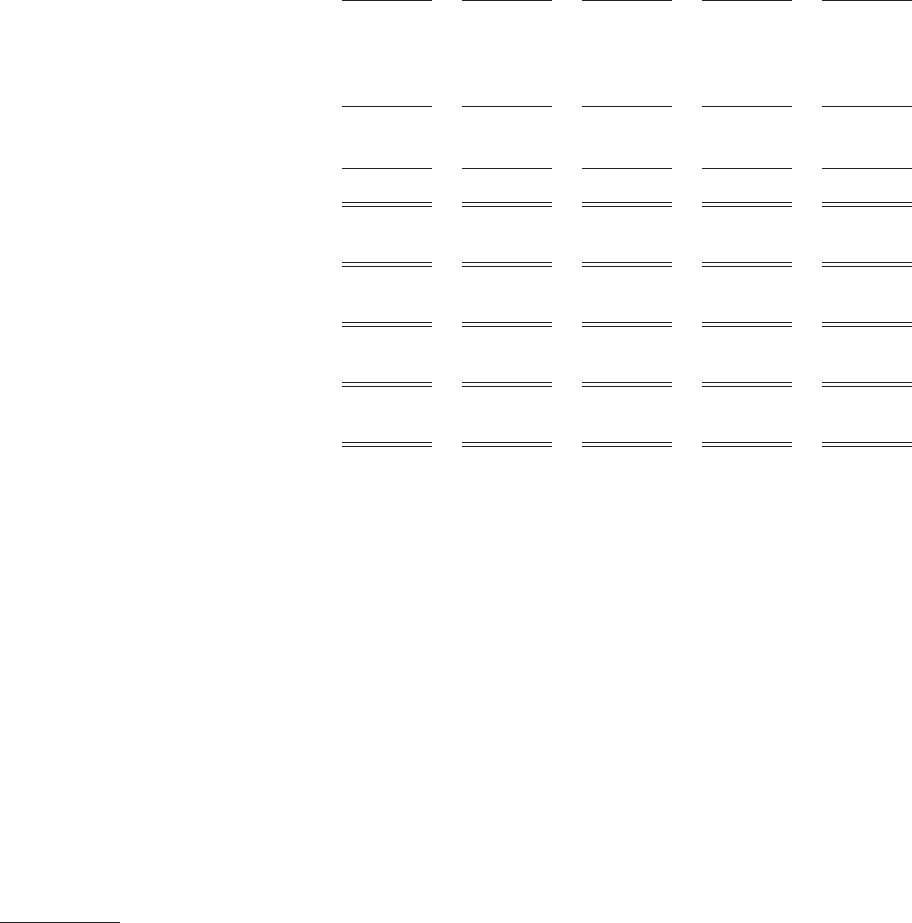

Fiscal Year

Ended

January 28,

2006(1)

Fiscal Year

Ended

January 29,

2005

Fiscal Year

Ended

January 31,

2004

Fiscal Year

Ended

February 1,

2003

Fiscal Year

Ended

February 2,

2002

In thousands, except per share data and statistical data

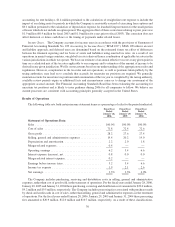

Operating earnings ............... 192,732 99,147 104,384 87,071 34,087

Interest expense (income), net ....... 25,292 236 (804) (630) 19,452

Merger-related interest expense ...... 7,518 — — — —

Earnings before income taxes ....... 159,922 98,911 105,188 87,701 14,635

Income tax expense............... 59,138 37,985 41,721 35,297 7,675

Net earnings .................... $ 100,784 $ 60,926 $ 63,467 $ 52,404 $ 6,960

Net earnings per Class A and Class B

common share — basic .......... $ 1.74 $ 1.11 $ 1.13 $ 0.93 $ 0.19

Weighted average shares

outstanding — basic . ........... 57,920 54,662 56,330 56,289 36,009

Net earnings per Class A and Class B

common share — diluted ......... $ 1.61 $ 1.05 $ 1.06 $ 0.87 $ 0.18

Weighted average shares

outstanding — diluted ........... 62,486 57,796 59,764 60,419 39,397

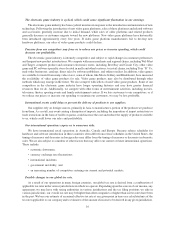

Other Financial Data:

Net earnings excluding the after-tax

effect of goodwill amortization(3) . . $ 100,784 $ 60,926 $ 63,467 $ 52,404 $ 15,373

Net earnings per share excluding the

after-tax effect of goodwill

amortization — diluted(3) ........ $ 1.61 $ 1.05 $ 1.06 $ 0.87 $ 0.39

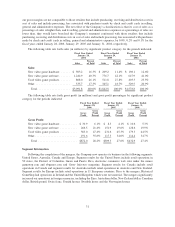

Store Operating Data:

Stores open at the end of period ..... 4,490 1,826 1,514 1,231 1,038

Comparable store sales increase

(decrease)(4) .................. (1.4)% 1.7% 0.8% 11.4% 32.0%

Inventory turnover................ 5.0 5.4 4.9 4.9 5.2

Balance Sheet Data:

Working capital ................. $ 233,591 $ 111,093 $ 188,378 $ 174,482 $ 31,107

Total assets(2)................... 3,015,119 915,983 902,189 806,237 608,674

Total debt ...................... 975,990 36,520 — — 399,623

Total liabilities(2) ................ 1,900,406 372,972 308,156 257,562 612,659

Stockholders’ equity (deficit)........ 1,114,713 543,011 594,033 548,675 (3,985)

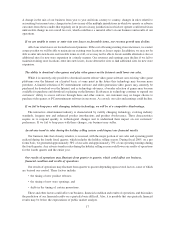

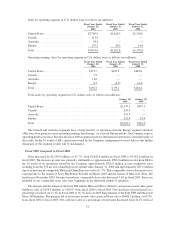

(1) Includes the results of operations of EB from October 9, 2005, the day after completion of the mergers, through

January 28, 2006. The addition of EB’s results affects the comparability of amounts from fiscal periods before

fiscal 2005.

(2) In 2004, we revised our method of accounting for rent expense to conform to GAAP, as clarified by the Chief

Accountant of the SEC in a February 2005 letter to the American Institute of Certified Public Accountants. A

non-cash, after-tax adjustment of $3,312 was made in the fourth quarter of fiscal 2004 to correct the method of

accounting for rent expense (and related deferred rent liability) to include the impact of escalating rents for

periods in which we are reasonably assured of exercising lease options and to include any “rent holiday” period

(a period during which the Company is not obligated to pay rent) the lease allows while the store is being

constructed. We also corrected our calculation of depreciation expense for leasehold improvements for those

leases which do not include an option period. The impact of these corrections on periods prior to fiscal 2004

25