GameStop 2005 Annual Report Download - page 42

Download and view the complete annual report

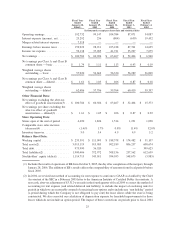

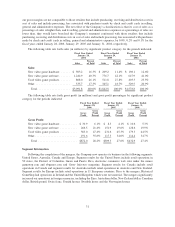

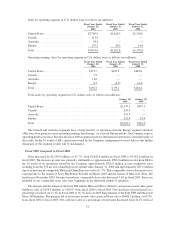

Please find page 42 of the 2005 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2004 to 40.3% in fiscal 2005, due to the increase in new hardware sales as a percentage of total sales. Used video

game product sales also grew due to an increase in store count, efforts to increase the supply of used inventory

available for sale and the mergers, with an increase in sales of $296.2 million, or 57.9%, from fiscal 2004. Sales of

other product categories, including PC entertainment and other software and accessories, magazines and character-

related merchandise, grew 55.2%, or $190.6 million, from fiscal 2004 to fiscal 2005, due to the mergers.

Cost of sales increased by $886.3 million, or 66.5%, from $1,333.5 million in fiscal 2004 to $2,219.8 million in

fiscal 2005 as a result of the changes in gross profit discussed below.

Gross profit increased by $362.7 million, or 71.2%, from $509.3 million in fiscal 2004 to $872.0 million in

fiscal 2005. Gross profit as a percentage of sales increased from 27.6% in fiscal 2004 to 28.2% in fiscal 2005. This

increase was primarily the result of increases in vendor allowances received in excess of advertising expenses,

which are recorded as a reduction in cost of sales. In fiscal 2005, vendor allowances received in excess of

advertising expenses were $74.7 million compared to $29.9 million in fiscal 2004. This increase was due to the

ownership of EB during the fourth fiscal quarter, during which much of the year’s advertising allowances are

generated, and due to the launch of the Xbox 360, which generated additional advertising allowances. Gross profit

as a percentage of sales on new hardware, new software and other products increased due to the increase in vendor

allowances received as discussed above. The gross profit on new hardware increased from 4.1% of sales in fiscal

2004 to 6.1% in fiscal 2005. Because new hardware platforms typically have lower margins than established

hardware platforms, as expected, the launch of the Sony PSP and the Microsoft Xbox 360 had an offsetting effect on

new hardware gross profit as a percentage of sales. Gross profit as a percentage of sales on new software increased

from 19.6% in fiscal 2004 to 21.4% in fiscal 2005 due to the increase in vendor allowances received, as discussed

above. Gross profit as a percentage of sales on other products increased from 34.0% in fiscal 2004 to 35.8% in fiscal

2005. Gross profit as a percentage of sales on used video game products increased from 45.3% in fiscal 2004 to

47.4% in fiscal 2005 due to increased efforts to monitor margin rates and, following the mergers, the application of

GameStop’s merchandising algorithms to EB’s used video game category.

The Company expects gross profit as a percentage of sales in fiscal 2006 to be impacted by the anticipated

launch in late 2006 of two new hardware platforms in the United States and the March 2006 launch of Microsoft’s

Xbox 360 hardware platform in Australia.

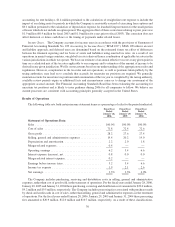

Selling, general and administrative expenses increased by $225.9 million, or 60.5%, from $373.4 million in

fiscal 2004 to $599.3 million in fiscal 2005. Approximately $165.9 million of this increase was attributable to the

mergers and the remainder was due to increases in the number of stores in operation, and the related increases in

store, distribution, and corporate office operating expenses. Selling, general and administrative expenses as a

percentage of sales decreased from 20.2% in fiscal 2004 to 19.4% in fiscal 2005. The decrease in selling, general

and administrative expenses as a percentage of sales was primarily due to combining the full year results of

Historical GameStop’s operations with the 16 weeks of EB’s operations, including the fourth quarter of the fiscal

year. The fourth quarter of the fiscal year typically experiences high leveraging of selling, general and admin-

istrative expenses due to the holiday selling season. Foreign currency transaction gains and (losses) are included in

selling, general and administrative expenses and amounted to $2.6 million in fiscal 2005, compared to an

immaterial amount of loss in fiscal 2004.

Depreciation and amortization expense increased from $36.8 million in fiscal 2004 to $66.4 million in fiscal

2005. This increase of $29.6 million was due primarily to depreciation of EB’s assets of $22.4 million after the

mergers, with the remaining increase due to capital expenditures for 296 new GameStop stores and management

information systems and the commencement in the third quarter of fiscal 2005 of full operations in the Company’s

new distribution facility. Depreciation and amortization expense will increase from fiscal 2005 to fiscal 2006 due to

the mergers, continued capital expenditures for new stores and management information systems and due to a full

year of depreciation on the Company’s new distribution facility.

The Company’s results of operations for fiscal 2005 include expenses believed to be of a one-time or short-

term nature associated with the mergers, which included $13.6 million included in operating earnings and

$7.5 million included in interest expenses. The $13.6 million included $9.0 million in one-time charges associated

with assets of the Company considered to be impaired because they were redundant as a result of the mergers. The

$7.5 million of merger-related interest expense resulted primarily from a commitment fee of $7.1 million for bridge

33