GameStop 2005 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2005 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

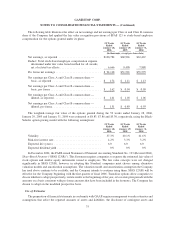

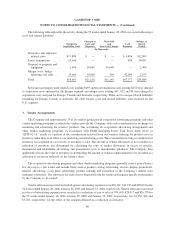

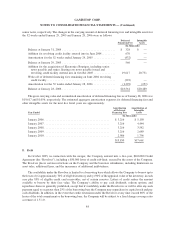

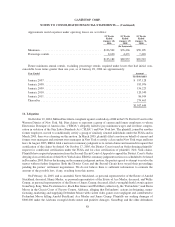

The following table represents the activity during the 52 weeks ended January 28, 2006 associated with merger

costs and related liabilities:

Charged to

Acquisition Costs

Charged to

Costs and

Expenses

Write-Offs

and

Non-Cash Charges

Cash

Payments

Balance at

End of

Period

(In thousands)

Severance and employee

related costs ......... $17,889 $ — $ — $ 4,984 $12,905

Lease terminations ...... 10,641 — — 584 10,057

Disposal of property and

equipment ........... 2,494 10,649 10,649 — 2,494

Merger costs, bridge

financing and other . . . . 34,669 10,469 496 42,009 2,633

Total ................. $65,693 $21,118 $11,145 $47,577 $28,089

Severance and employment related costs totaling $493 and lease termination costs totaling $272 were charged

to acquisition costs and paid for the Europe segment and merger costs totaling $41, $32 and $3 were charged to

acquisition costs and paid for Europe, Canada and Australia, respectively. There are no merger-related liabilities

remaining for Europe, Canada or Australia. All other merger costs and related liabilities were incurred for the

U.S. segment.

3. Vendor Arrangements

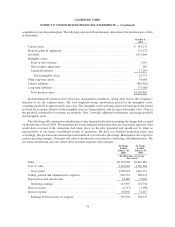

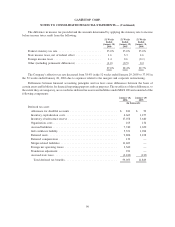

The Company and approximately 75 of its vendors participate in cooperative advertising programs and other

vendor marketing programs in which the vendors provide the Company with cash consideration in exchange for

marketing and advertising the vendors’ products. Our accounting for cooperative advertising arrangements and

other vendor marketing programs, in accordance with FASB Emerging Issues Task Force Issue 02-16 or

“EITF 02-16,” results in a portion of the consideration received from our vendors reducing the product costs in

inventory rather than as an offset to our marketing and advertising costs. The consideration serving as a reduction in

inventory is recognized in cost of sales as inventory is sold. The amount of vendor allowances to be recorded as a

reduction of inventory was determined by calculating the ratio of vendor allowances in excess of specific,

incremental and identifiable advertising and promotional costs to merchandise purchases. The Company then

applied this ratio to the value of inventory in determining the amount of vendor reimbursements to be recorded as a

reduction to inventory reflected on the balance sheet.

The cooperative advertising programs and other vendor marketing programs generally cover a period from a

few days up to a few weeks and include items such as product catalog advertising, in-store display promotions,

internet advertising, co-op print advertising, product training and promotion at the Company’s annual store

managers conference. The allowance for each event is negotiated with the vendor and requires specific performance

by the Company to be earned.

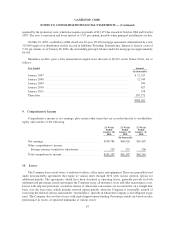

Vendor allowances received and netted against advertising expenses were $32,161, $21,913 and $20,035 in the

52 weeks ended January 28, 2006, January 29, 2005 and January 31, 2004, respectively. Vendor allowances received

in excess of advertising expenses were recorded as a reduction of cost of sales of $74,690, $29,917 and $26,779 for

the 52 weeks ended January 28, 2006, January 29, 2005 and January 31, 2004, respectively, less $4,150, $66 and

$5,210, respectively, for the effect of the amounts deferred as a reduction in inventory.

80

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)