GameStop 2005 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2005 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

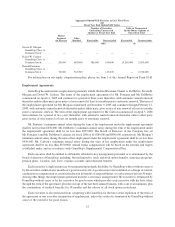

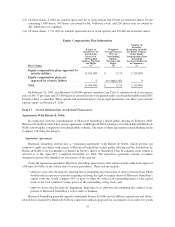

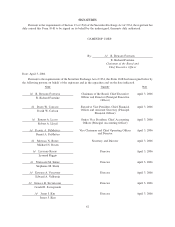

Name Shares % Shares %

%of

Total

Vote(2)

Class A Common

Stock(1)

Class B Common

Stock

Shares Beneficially Owned

Leonard Riggio .............................. 4,519,600(11) 9.5 5,154,461(12) 17.2 16.2

Stephanie M. Shern ........................... 42,600(7) * — — *

Stanley (Mickey) Steinberg . ..................... 9,600(9) * — — *

Gerald R. Szczepanski ......................... 53,600(7) * — — *

Edward A. Volkwein .......................... 42,600(13) * — — *

Lawrence S. Zilavy............................ 9,600(9) * — — *

All directors and executive officers as a group

(15 persons) ............................... 16,549,095(14) 32.6 5,158,709 17.3 19.5

* Less than 1.0%

(1) Shares of Class A common stock that an individual or group has a right to acquire within 60 days after

March 24, 2006 pursuant to the exercise of options, warrants or other rights are deemed to be outstanding for

the purpose of computing the beneficial ownership of shares and percentage of such individual or group, but

are not deemed to be outstanding for the purpose of computing the beneficial ownership of shares and

percentage of any other person or group shown in the table.

(2) After giving effect to the one vote per share of the Class A common stock and the ten votes per share of the

Class B common stock.

(3) Information compiled from Schedule 13G and Schedule 13F filings.

(4) Of these shares, 867,000 are issuable upon exercise of stock options and 60,000 are restricted shares.

(5) Of these shares, 651,000 are issuable upon exercise of stock options and 30,000 are restricted shares.

(6) Of these shares, 47,000 are issuable upon exercise of stock options and 21,000 are restricted shares.

(7) Of these shares, 22,000 are issuable upon exercise of stock options and 19,600 are restricted shares.

(8) These shares are owned by Mr. Rosen’s wife.

(9) Of these shares, 9,600 are restricted shares.

(10) Of these shares, 9,600 are restricted shares and the remaining shares are owned by EB Nevada Inc., which is a

wholly-owned subsidiary of The Electronics Boutique, Inc., all of the outstanding capital stock of which is

owned by James J. Kim, Agnes C. Kim, the David D. Kim Trust of December 31, 1987, the John T. Kim Trust

of December 31, 1987 and the Susan Y. Kim Trust of December 31, 1987. David D. Kim is the trustee of the

David D. Kim Trust, Susan Y. Kim is the trustee of the Susan Y. Kim Trust, and John T. Kim is the trustee of the

John T. Kim Trust (the trustees of each trust may be deemed to be the beneficial owners of the shares held by

such trust). In addition, the trust agreement for each of these trusts encourages the trustees of the trusts to vote

the shares of common stock held by them, in their discretion, in concert with James J. Kim’s family.

Accordingly, the trusts, together with their respective trustee and James J. and Agnes C. Kim, may be

considered a “group” under Section 13(d) of the Exchange Act. This group may be deemed to have beneficial

ownership of the shares owned by EB Nevada Inc.

(11) Of these shares, 4,500,000 are issuable upon exercise of stock options and 19,600 are restricted shares.

(12) Of these shares, Mr. Riggio is the direct beneficial owner of 3,472,602 shares of Class B common stock.

Mr. Riggio is the indirect beneficial owner of 1,126,913 shares of Class B common stock owned by Barnes &

Noble College Booksellers, Inc., a New York corporation, of which Mr. Riggio owns all of the currently

outstanding voting securities. As co-trustee of The Riggio Foundation, a charitable trust, Mr. Riggio is the

indirect beneficial owner of 554,946 shares of Class B common stock owned by The Riggio Foundation.

Excluded from these shares are 302,712 shares of Class B common stock held in a rabbi trust established by

Barnes & Noble for the benefit of Mr. Riggio pursuant to a deferred compensation arrangement, but over

which Mr. Riggio has no voting power.

54