GameStop 2005 Annual Report Download - page 94

Download and view the complete annual report

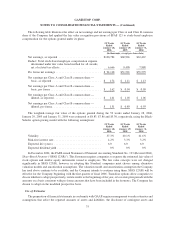

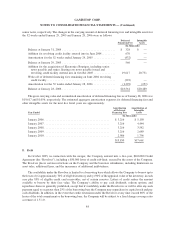

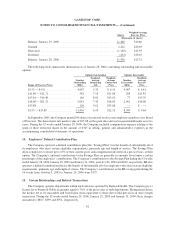

Please find page 94 of the 2005 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The interest rate on the Revolver is variable and, at the Company’s option, is calculated by applying a margin

of (1) 0.0% to 0.25% above the higher of the prime rate of the administrative agent or the federal funds effective rate

plus 0.50% or (2) 1.25% to 1.75% above the LIBO rate. The applicable margin is determined quarterly as a function

of the Company’s consolidated leverage ratio. As of January 28, 2006 the applicable margin was 0.0% for prime rate

loans and 1.50% for LIBO rate loans. In addition, the Company is required to pay a commitment fee, currently

0.375%, for any unused portion of the total commitment under the Revolver.

As of January 28, 2006, there were no borrowings outstanding under the Revolver and letters of credit

outstanding totaled $2,326.

On May 31, 2005, a subsidiary of EB completed the acquisition of Jump Ordenadores S.L.U. (“Jump”), a

privately-held retailer based in Valencia, Spain. As of January 28, 2006, Jump had other third-party debt of

approximately $561.

As of January 28, 2006, the Company was in compliance with all covenants associated with its credit facilities.

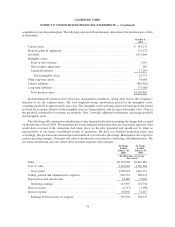

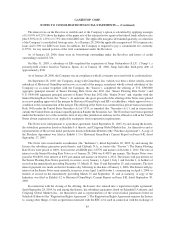

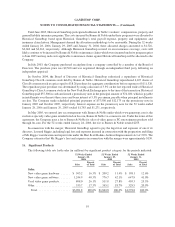

On September 28, 2005, the Company, along with GameStop, Inc. (which was then a direct wholly-owned

subsidiary of Historical GameStop and is now, as a result of the merger, an indirect wholly-owned subsidiary of the

Company) as co-issuer (together with the Company, the “Issuers”), completed the offering of U.S. $300,000

aggregate principal amount of Senior Floating Rate Notes due 2011 (the “Senior Floating Rate Notes”) and

U.S. $650,000 aggregate principal amount of Senior Notes due 2012 (the “Senior Notes” and, together with the

Senior Floating Rate Notes, the “Notes”). At such time, the gross proceeds of the offering of the Notes were placed

in escrow pending approval of the merger by Historical GameStop’s and EB’s stockholders, which approval was a

condition to the consummation of the merger. The offering of the Notes was conducted in a private transaction under

Rule 144A under the United States Securities Act of 1933, as amended (the “Securities Act”), and in transactions

outside the United States in reliance upon Regulation S under the Securities Act. The Notes have not been registered

under the Securities Act or the securities laws of any other jurisdiction and may not be offered or sold in the United

States absent registration or an applicable exemption from registration requirements.

The Notes were sold pursuant to a purchase agreement, dated September 21, 2005, by and among the Issuers,

the subsidiary guarantors listed on Schedule I-A thereto, and Citigroup Global Markets Inc., for themselves and as

representatives of the several initial purchasers listed on Schedule II thereto (the “Purchase Agreement”). A copy of

the Purchase Agreement was filed as Exhibit 1.1 to Historical GameStop’s Current Report on Form 8-K, dated

September 27, 2005.

The Notes were issued under an indenture (the “Indenture”), dated September 28, 2005, by and among the

Issuers, the subsidiary guarantors party thereto, and Citibank, N.A., as trustee (the “Trustee”). The Senior Floating

Rate Notes were priced at 100%, bear interest at LIBOR plus 3.875% and mature on October 1, 2011. The rate of

interest on the Senior Floating Rate Notes as of January 28, 2006 was 8.405% per annum. The Senior Notes were

priced at 98.688%, bear interest at 8.0% per annum and mature on October 1, 2012. The Issuers will pay interest on

the Senior Floating Rate Notes quarterly, in arrears, every January 1, April 1, July 1 and October 1, to holders of

record on the immediately preceding December 15, March 15, June 15 and September 15, and at maturity. The first

interest payment was made on the first business day following its due date of January 1, 2006. The Issuers will pay

interest on the Senior Notes semi-annually, in arrears, every April 1 and October 1, commencing on April 1, 2006, to

holders of record on the immediately preceding March 15 and September 15, and at maturity. A copy of the

Indenture was filed as Exhibit 4.2 to Historical GameStop’s Current Report on Form 8-K, dated September 30,

2005.

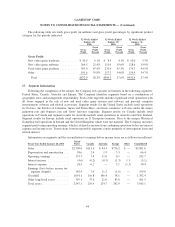

In connection with the closing of the offering, the Issuers also entered into a registration rights agreement,

dated September 28, 2005, by and among the Issuers, the subsidiary guarantors listed on Schedule I-A thereto, and

Citigroup Global Markets Inc., for themselves and as representatives of the several initial purchasers listed on

Schedule II thereto (the “Registration Rights Agreement”). The Registration Rights Agreement requires the Issuers

to, among other things, (1) file a registration statement with the SEC to be used in connection with the exchange of

85

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)