GameStop 2005 Annual Report Download - page 82

Download and view the complete annual report

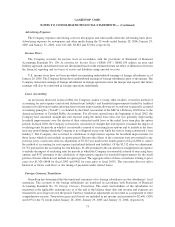

Please find page 82 of the 2005 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Advertising Expenses

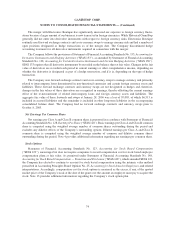

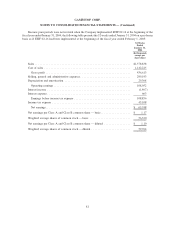

The Company expenses advertising costs for newspapers and other media when the advertising takes place.

Advertising expenses for newspapers and other media during the 52 weeks ended January 28, 2006, January 29,

2005 and January 31, 2004, were $12,448, $8,881 and $7,044, respectively.

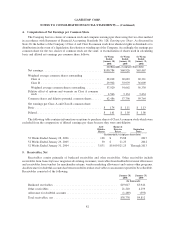

Income Taxes

The Company accounts for income taxes in accordance with the provisions of Statement of Financial

Accounting Standards No. 109, Accounting for Income Taxes (“SFAS 109”). SFAS 109 utilizes an asset and

liability approach, and deferred taxes are determined based on the estimated future tax effect of differences between

the financial reporting and tax bases of assets and liabilities using enacted tax rates.

U.S. income taxes have not been provided on remaining undistributed earnings of foreign subsidiaries as of

January 28, 2006. The Company did not have undistributed earnings of foreign subsidiaries prior to the merger. The

Company reinvested earnings of foreign subsidiaries in foreign operations since the merger and expects that future

earnings will also be reinvested in foreign operations indefinitely.

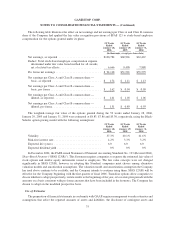

Lease Accounting

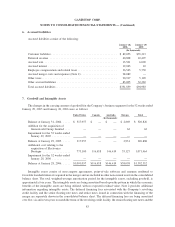

As previously disclosed, in fiscal 2004, the Company, similar to many other retailers, revised its method of

accounting for rent expense (and related deferred rent liability) and leasehold improvements funded by landlord

incentives for allowances under operating leases (tenant improvement allowances) to conform to generally accepted

accounting principles (“GAAP”), as clarified by the Chief Accountant of the SEC in a February 2005 letter to the

American Institute of Certified Public Accountants. For all stores opened since the beginning of fiscal 2002, the

Company had calculated straight-line rent expense using the initial lease term, but was generally depreciating

leasehold improvements over the shorter of their estimated useful lives or the initial lease term plus the option

periods. In fiscal 2004, the Company corrected its calculation of straight-line rent expense to include the impact of

escalating rents for periods in which it is reasonably assured of exercising lease options and to include in the lease

term any period during which the Company is not obligated to pay rent while the store is being constructed (“rent

holiday”). The Company also corrected its calculation of depreciation expense for leasehold improvements for

those leases which do not include an option period. Because the effects of the correction were not material to any

previous years, a non-cash, after-tax adjustment of $3,312 was made in the fourth quarter of fiscal 2004 to correct

the method of accounting for rent expense (and related deferred rent liability). Of the $3,312 after-tax adjustment,

$1,761 pertained to the accounting for rent holidays, $1,404 pertained to the calculation of straight-line rent expense

to include the impact of escalating rents for periods in which the Company is reasonably assured of exercising lease

options and $147 pertained to the calculation of depreciation expense for leasehold improvements for the small

portion of leases which do not include an option period. The aggregate effect of these corrections relating to prior

years was $1,929 ($948 for fiscal 2003 and $981 for years prior to fiscal 2003). The correction does not affect

historical or future cash flows or the timing of payments under related leases.

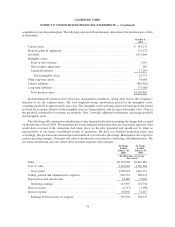

Foreign Currency Translation

GameStop has determined that the functional currencies of its foreign subsidiaries are the subsidiaries’ local

currencies. The accounts of the foreign subsidiaries are translated in accordance with Statement of Financial

Accounting Standards No. 52, Foreign Currency Translation. The assets and liabilities of the subsidiaries are

translated at the applicable exchange rate as of the end of the balance sheet date and revenue and expenses are

translated at an average rate over the period. Currency translation adjustments are recorded as a component of other

comprehensive income. Transaction gains and (losses) are included in net income and amounted to $2,606, ($20)

and $19 for the 52 weeks ended January 28, 2006, January 29, 2005 and January 31, 2004, respectively.

73

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)