GameStop 2005 Annual Report Download - page 106

Download and view the complete annual report

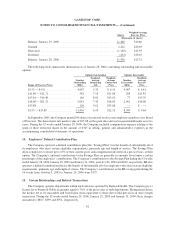

Please find page 106 of the 2005 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Company will be entitled to redeem the Rights at any time prior to the acquisition by a person or group of

15% or more of the voting power of the outstanding Common Stock of the Company, at a price of $.01 per Right.

The Rights will expire on October 28, 2014.

The Company has 5,000 shares of $.001 par value preferred stock authorized for issuance, of which 500 shares

have been designated by the Board of Directors as Series A Preferred Stock and reserved for issuance upon exercise

of the Rights. Each such share of Series A Preferred Stock will be nonredeemable and junior to any other series of

preferred stock the Company may issue (unless otherwise provided in the terms of such stock) and will be entitled to

a preferred dividend equal to the greater of $1.00 or one thousand times any dividend declared on the Company’s

Common Stock. In the event of liquidation, the holders of Series A Preferred Stock will receive a preferred

liquidation payment of $1,000.00 per share, plus an amount equal to accrued and unpaid dividends and distributions

thereon. Each share of Series A Preferred Stock will have ten thousand votes, voting together with the Company’s

Common Stock. However, in the event that dividends on the Series A Preferred Stock shall be in arrears in an

amount equal to six quarterly dividends thereon, holders of the Series A Preferred Stock shall have the right, voting

as a class, to elect two of the Company’s Directors. In the event of any merger, consolidation or other transaction in

which the Company’s Common Stock is exchanged, each share of Series A Preferred Stock will be entitled to

receive one thousand times the amount and type of consideration received per share of the Company’s Common

Stock. At January 28, 2006 there were no shares of Series A Preferred Stock outstanding.

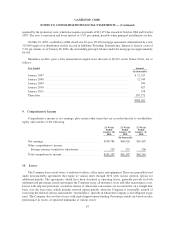

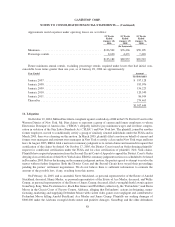

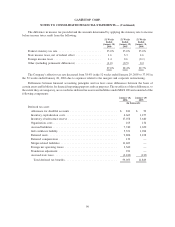

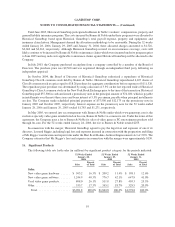

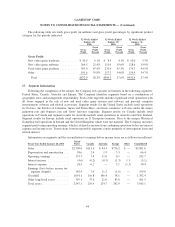

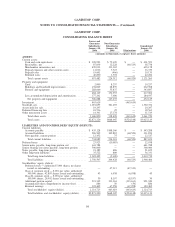

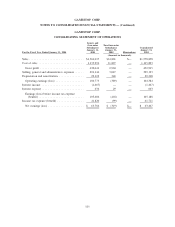

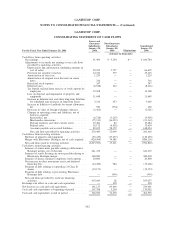

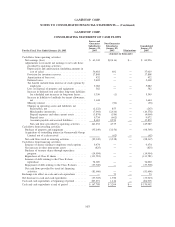

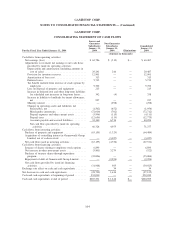

21. Consolidating Financial Statements

In order to finance the merger, as described in Note 8, on September 28, 2005, the Company, along with

GameStop, Inc. as co-issuer, completed the offering of the Notes. The direct and indirect domestic wholly-owned

subsidiaries of the Company, excluding GameStop, Inc., as co-issuer, have guaranteed the Notes on a senior

unsecured basis with unconditional guarantees.

The following condensed consolidating financial statements present the financial position as of January 28,

2006 and January 29, 2005 and results of operations and cash flows for the fiscal years ended January 28, 2006,

January 29, 2005 and January 31, 2004 of the Company’s guarantor and non-guarantor subsidiaries.

97

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)