GameStop 2005 Annual Report Download - page 86

Download and view the complete annual report

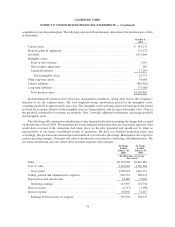

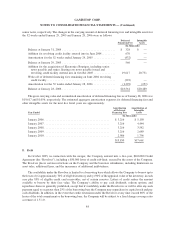

Please find page 86 of the 2005 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In October 2005, the FASB issued Statement of Financial Accounting Standard Staff Position No. 13-1,

Accounting for Rental Costs Incurred During a Construction Period (“SFAS SP 13-1”). This Statement requires

that rental costs associated with ground or building operating leases that are incurred during a construction period

shall be recognized as rental expense. The rental costs shall be included in income from continuing operations.

SFAS SP 13-1 will be effective for the Company beginning in fiscal 2006. However, the Company previously

corrected its calculation of straight-line rent expense to include in the lease term any period during which the

Company is not obligated to pay rent while the store is being constructed. The implementation of SFAS SP 13-1 is

not expected to have an impact on the Company’s financial condition or results of operations.

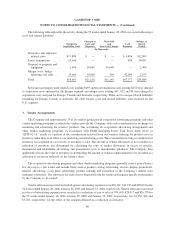

2. Acquisitions

On June 23, 2003, the Company acquired a controlling interest in Gamesworld Group Limited, an Ireland-

based electronic games retailer, for approximately $3,340. Gamesworld Group Limited was subsequently renamed

GameStop Group Limited. The acquisition was accounted for using the purchase method of accounting and,

accordingly, the results of operations for the period subsequent to the acquisition are included in the consolidated

financial statements. The excess of purchase price over the net assets acquired, in the amount of approximately

$2,931, has been recorded as goodwill.

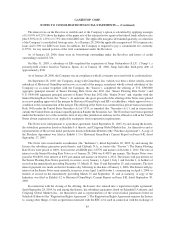

On October 8, 2005, Historical GameStop and EB completed their previously announced merger pursuant to

the Agreement and Plan of Merger, dated as of April 17, 2005 (the “Merger Agreement”). Upon the consummation

of the merger, Historical GameStop and EB became wholly-owned subsidiaries of the Company. Both management

and the respective Boards of Directors of EB and Historical Gamestop believed that the merger of the companies

would create significant synergies in operations when the companies were integrated and would enable the

Company to increase profitability as a result of combined market share.

Under the terms of the Merger Agreement, Historical GameStop’s stockholders received one share of the

Company’s Class A common stock for each share of Historical GameStop’s Class A common stock owned and one

share of the Company’s Class B common stock for each share of Historical GameStop’s Class B common stock

owned. Approximately 22.2 million shares of the Company’s Class A common stock were issued in exchange for all

outstanding Class A common stock of Historical GameStop based on the one-for-one ratio and approximately

29.9 million shares of the Company’s Class B common stock were issued in exchange for all outstanding Class B

common stock of Historical GameStop based on the one-for-one ratio. EB stockholders received $38.15 in cash and

.78795 of a share of the Company’s Class A common stock for each EB share owned. In aggregate, 20.2 million

shares of the Company’s Class A common stock were issued to EB stockholders at a value of approximately

$437,144 (based on the closing price of $21.61 of Historical GameStop’s Class A common stock on April 15, 2005,

the last trading day before the date the merger was announced). In addition, approximately $993,254 in cash was

paid in consideration for (i) all outstanding common stock of EB, and (ii) all outstanding stock options of EB.

Including transaction costs of $13,558 incurred by Historical GameStop, the total consideration paid was

approximately $1,443,956.

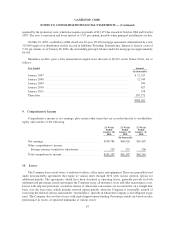

The consolidated financial statements include the results of EB from the date of acquisition. The purchase

price has been allocated based on estimated fair values as of the acquisition date. The purchase price allocation is

preliminary and a final determination of required purchase accounting adjustments will be made upon the

77

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)