GameStop 2005 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2005 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

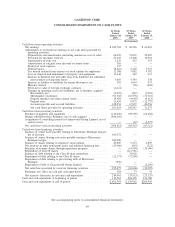

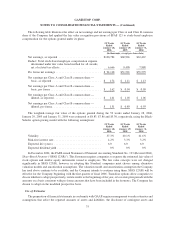

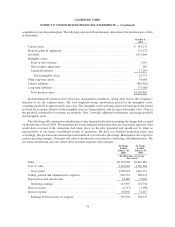

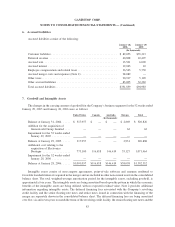

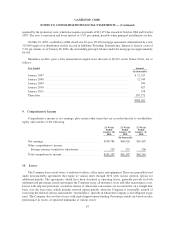

52 Weeks

Ended

January 28,

2006

52 Weeks

Ended

January 29,

2005

(In thousands, except per

share data)

Income tax expense ........................................ 49,482 38,477

Net earnings ........................................... $ 86,086 $ 66,058

Net earnings per Class A and Class B common share — basic......... $ 1.20 $ 0.88

Weighted average shares of common stock — basic ................ 71,925 74,891

Net earnings per Class A and Class B common share — diluted ....... $ 1.13 $ 0.85

Weighted average shares of common stock — diluted ............... 76,491 78,025

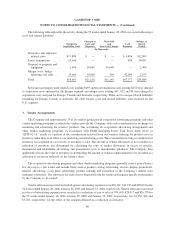

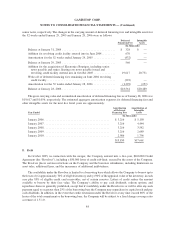

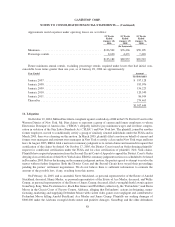

In connection with the merger, management incurred merger-related costs and commenced integration

activities which have resulted in, or will result in, involuntary employment terminations, lease terminations,

disposals of property and equipment and other costs and expenses. The liability for involuntary termination benefits

covers severance amounts, payroll taxes and benefit costs for approximately 680 employees, primarily in general

and administrative functions in EB’s Pennsylvania corporate office and distribution center and Nevada call center,

which are expected to be closed in the first half of fiscal 2006. Termination of these employees began in October

2005 and is expected to be completed by July 2006. Certain senior executives with EB received payments in the

amount of $3,960 in accordance with employment contracts. The Pennsylvania corporate office and distribution

center are owned facilities which are currently being marketed for sale and are classified in the accompanying

balance sheet as “Assets held for sale”.

The liability for lease terminations is associated with stores and the Nevada call center to be closed and will be

paid over the remaining lease terms through 2015, if the Company is unsuccessful in negotiating lease terminations

or sublease agreements. The Company began closing these stores in fiscal 2005 and intends to close the remainder

of these stores in the next year. The disposals of property and equipment are related to assets of Historical GameStop

which are either impaired or have been, or will be, either abandoned or disposed of due to the merger. Certain costs

associated with the disposition of these assets remain as an accrual until the assets are disposed of and the costs are

paid, which is expected to occur in the next few months.

Merger-related costs include professional fees, financing costs and other costs associated with the merger and

include certain ongoing costs associated with integrating the operations of Historical GameStop and EB, including

relocation costs. The Company is working to finalize integration plans which may result in additional involuntary

employment terminations, lease and other contractual terminations and employee relocations. The Company will

finalize integration plans and related liabilities in fiscal 2006 and management anticipates completion of all

integration activities in fiscal 2006. Finalization of integration plans may result in additional liabilities which will

increase goodwill.

79

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)