GameStop 2005 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2005 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

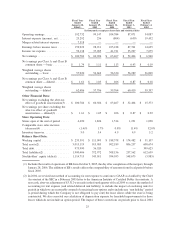

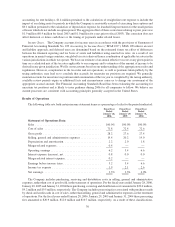

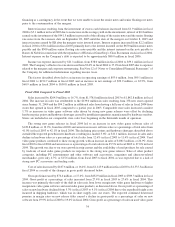

Securities Authorized for Issuance under Equity Compensation Plans

Information for our equity compensation plans in effect as of January 28, 2006, is as follows:

Plan Category

Number of Securities to

be Issued upon Exercise

of Outstanding Options,

Warrants and Rights

(a)

Weighted-Average

Exercise Price of

Outstanding

Options, Warrants

and Rights

(b)

Number of Securities

Remaining Available for

Future Issuance Under

Equity Compensation

Plans (Excluding

Securities Reflected in

Column(a))

(c)

Equity compensation plans approved by

security holders .................... 11,506,000 $ 12.31 3,329,000

Equity compensation plans not approved by

security holders .................... 0 notapplicable 0

Total .............................. 11,506,000 $ 12.31 3,329,000

On February 10, 2006, an additional 1,630,000 options to purchase our Class A common stock at an exercise

price of $41.37 per share and 257,400 shares of restricted stock were granted under our Amended and Restated 2001

Incentive Plan, as amended. These options and restricted shares vest in equal increments over three years and the

options expire on February 9, 2016.

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

There were no repurchases of the Company’s equity securities during the fourth quarter of fiscal 2005. As of

January 28, 2006, the Company had no amount available for purchases under any repurchase program.

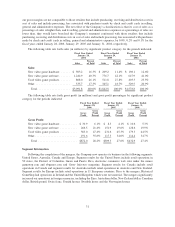

Item 6. Selected Consolidated Financial Data

The following table sets forth our selected consolidated financial and operating data for the periods and at the

dates indicated. Our fiscal year is composed of 52 or 53 weeks ending on the Saturday closest to January 31. The

fiscal years ended January 28, 2006, January 29, 2005, January 31, 2004, February 1, 2003 and February 2, 2002

consisted of 52 weeks. The “Statement of Operations Data” for the fiscal years 2005, 2004 and 2003 and the

“Balance Sheet Data” as of January 28, 2006 and January 29, 2005 are derived from, and are qualified by reference

to, our audited financial statements which are included elsewhere in this Form 10-K. The “Statement of Operations

Data” for fiscal years ended February 1, 2003 and February 2, 2002 and the “Balance Sheet Data” as of January 31,

2004, February 1, 2003 and February 2, 2002 are derived from our audited financial statements which are not

included elsewhere in this Form 10-K.

Our selected financial data set forth below should be read in conjunction with “Management’s Discussion and

Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and notes

thereto included elsewhere in this Form 10-K.

Fiscal Year

Ended

January 28,

2006(1)

Fiscal Year

Ended

January 29,

2005

Fiscal Year

Ended

January 31,

2004

Fiscal Year

Ended

February 1,

2003

Fiscal Year

Ended

February 2,

2002

In thousands, except per share data and statistical data

Statement of Operations Data:

Sales ......................... $3,091,783 $1,842,806 $1,578,838 $1,352,791 $1,121,138

Cost of sales .................... 2,219,753 1,333,506 1,145,893 1,012,145 855,386

Gross profit .................... 872,030 509,300 432,945 340,646 265,752

Selling, general and administrative

expenses(2) ................... 599,343 373,364 299,193 230,461 200,698

Depreciation and amortization(2) ..... 66,355 36,789 29,368 23,114 19,842

Amortization of goodwill .......... — — — — 11,125

Merger-related expenses ........... 13,600 — — — —

24