GameStop 2005 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2005 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.March 2005, there was a hearing on this motion. In March 2005, plaintiffs filed a motion on behalf of current and

former store managers and assistant store managers in New York to certify a class under New York wage and hour

laws. In August 2005, EBOA filed a motion for summary judgment as to certain claims and renewed its request that

certification of the claims be denied. On October 17, 2005, the District Court issued an Order denying plaintiffs’

request for conditional certification under the FLSA and for class certification of plaintiffs’ New York claims.

Plaintiffs have requested permission from the Second Circuit Court of Appeals to appeal the District Court’s Order

denying class certification of their New York claims. EBOA’s summary judgment motion was scheduled to be heard

in December 2005. Before the hearing on the summary judgment motion, the parties agreed to attempt to resolve the

matter without further litigation. Both the District Court and the Second Circuit have stayed their proceedings

pending the parties’ settlement negotiations. We do not believe there is sufficient information to estimate the

amount of the possible loss, if any, resulting from this matter.

On February 14, 2005, and as amended, Steve Strickland, as personal representative of the Estate of Arnold

Strickland, deceased, Henry Mealer, as personal representative of the Estate of Ace Mealer, deceased, and Willie

Crump, as personal representative of the Estate of James Crump, deceased, filed a wrongful death lawsuit against

GameStop, Sony, Take-Two Interactive, Rock Star Games and Wal-Mart (collectively, the “Defendants”) and Devin

Moore in the Circuit Court of Fayette County, Alabama, alleging that Defendants’ actions in designing, manu-

facturing, marketing and supplying Defendant Moore with violent video games were negligent and contributed to

Defendant Moore killing Arnold Strickland, Ace Mealer and James Crump. Plaintiffs are seeking damages of

$600 million under the Alabama wrongful death statute and punitive damages. GameStop and the other defendants

intend to vigorously defend this action. The Defendants filed a motion to dismiss the case on various grounds, which

was heard in November 2005 and was denied. The Defendants appealed the denial of the motion to dismiss and on

March 24, 2006, the Alabama Supreme Court denied the Defendants’ application. Discovery is proceeding.

Mr. Moore was found guilty of capital murder in a criminal trial in Alabama and was sentenced to death in August

2005. We do not believe there is sufficient information to estimate the amount of the possible loss, if any, resulting

from the lawsuit.

In the ordinary course of our business, we are from time to time subject to various other legal proceedings. We

do not believe that any such other legal proceedings, individually or in the aggregate, will have a material adverse

effect on our operations or financial condition.

Item 4. Submission of Matters to a Vote of Security Holders

There were no matters submitted to a vote of security holders during the 13 weeks ended January 28, 2006.

PART II

Item 5. Market For Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of

Equity Securities

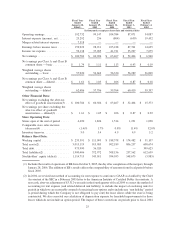

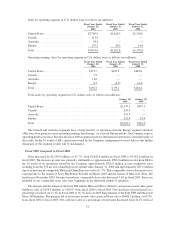

Price Range of Common Stock

The Company’s Class A common stock is traded on the New York Stock Exchange (“NYSE”) under the

symbol “GME”. The Company’s Class B common stock began trading on the NYSE under the symbol “GME.B” on

November 12, 2004. As such, there was no public trading market for the Company’s Class B common stock prior to

that time.

22