Energizer 2012 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2012 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

(Dollars in millions, except per share and percentage data)

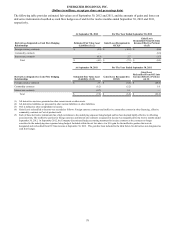

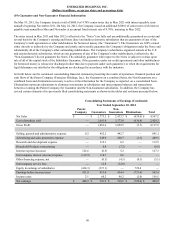

(19) Guarantor and Non-Guarantor Financial Information

On May 19, 2011, the Company issued a total of $600.0 of 4.70% senior notes due in May 2021 with interest payable semi-

annually beginning November 2011. On May 24, 2012, the Company issued an additional $500.0 of senior notes with interest

payable semi-annually in May and November at an annual fixed interest rate of 4.70%, maturing in May 2022.

The notes issued in May 2011 and May 2012 (collectively the "Notes") are fully and unconditionally guaranteed on a joint and

several basis by the Company's existing and future direct and indirect domestic subsidiaries that are guarantors of any of the

Company's credit agreements or other indebtedness for borrowed money (the “Guarantors”). The Guarantors are 100% owned

either directly or indirectly by the Company and jointly and severally guarantee the Company's obligations under the Notes and

substantially all of the Company's other outstanding indebtedness. The Company's subsidiaries organized outside of the U.S.

and certain domestic subsidiaries, which are not guarantors of any of the Company's other indebtedness, (collectively, the

“Non-Guarantors”) do not guarantee the Notes. The subsidiary guarantee with respect to the Notes is subject to release upon

sale of all of the capital stock of the Subsidiary Guarantor; if the guarantee under our credit agreements and other indebtedness

for borrowed money is released or discharged (other than due to payment under such guarantee); or when the requirements for

legal defeasance are satisfied or the obligations are discharged in accordance with the indenture.

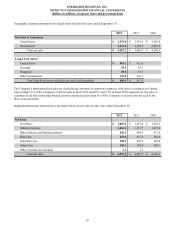

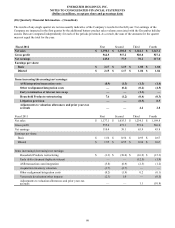

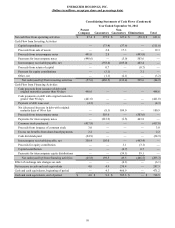

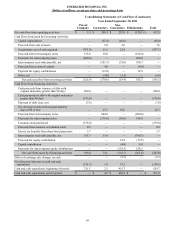

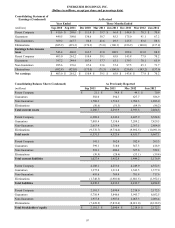

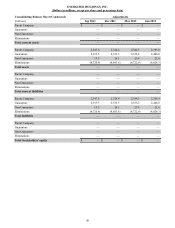

Set forth below are the condensed consolidating financial statements presenting the results of operations, financial position and

cash flows of the Parent Company (Energizer Holdings, Inc.), the Guarantors on a combined basis, the Non-Guarantors on a

combined basis and eliminations necessary to arrive at the information for the Company as reported, on a consolidated basis.

Eliminations represent adjustments to eliminate investments in subsidiaries and intercompany balances and transactions

between or among the Parent Company, the Guarantor and the Non-Guarantor subsidiaries. In addition, the Company has

revised certain elements of its previously filed consolidating statements as shown in the tables and revisions presented below.

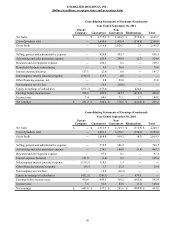

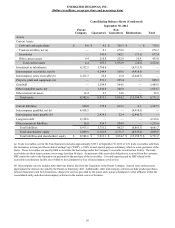

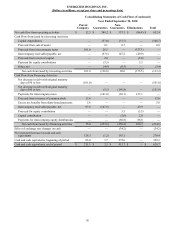

Consolidating Statements of Earnings (Condensed)

Year Ended September 30, 2012

Parent

Company Guarantors

Non-

Guarantors Eliminations Total

Net Sales $ — $ 2,773.5 $ 2,433.3 $ (639.6) $ 4,567.2

Cost of products sold — 1,691.9 1,373.8 (636.4) 2,429.3

Gross Profit — 1,081.6 1,059.5 (3.2) 2,137.9

Selling, general and administrative expense 0.2 452.2 442.7 — 895.1

Advertising and sales promotion expense — 249.9 200.7 (1.1) 449.5

Research and development expense — 112.3 0.2 — 112.5

Household Products restructuring — 0.4 (7.2)—

(6.8)

Interest expense/(income) 122.6 (0.5) 5.2 — 127.3

Intercompany interest (income)/expense (119.5) 118.7 0.8 — —

Other financing expense, net — (0.5)(4.5)(0.1)(5.1)

Intercompany service fees — 12.8 (12.8)— —

Equity in earnings of subsidiaries (414.3)(315.1) — 729.4 —

Earnings before income taxes 411.0 451.4 434.4 (731.4) 565.4

Income taxes 2.1 60.2 96.2 (2.0) 156.5

Net earnings $ 408.9 $ 391.2 $ 338.2 $ (729.4) $ 408.9

89