Energizer 2012 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2012 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per share and percentage data)

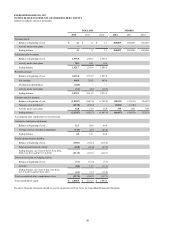

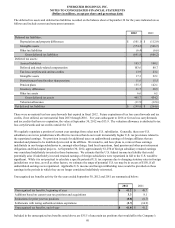

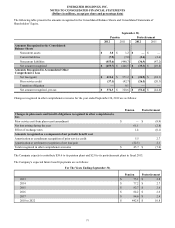

(7) Share-Based Payments

The Company's Incentive Stock Plan was initially adopted by the Board of Directors in March 2000 and approved by

shareholders at the 2001 Annual Meeting of Shareholders. This plan was superseded in January 2009 as the Board of Directors

approved a new plan, which was approved by shareholders at the 2009 Annual Meeting of Shareholders (the "2009 Plan"). New

awards granted after January 2009 are issued under the 2009 Plan. Under the 2009 Plan, awards of restricted stock, restricted

stock equivalents or options to purchase the Company's common stock (ENR stock) may be granted to directors, officers and

employees. The 2009 Plan was amended and restated by approval of the shareholders at the January 2011 Annual Meeting of

Shareholders to set the maximum number of shares authorized for issuance under the plan to 8.0 million. For purposes of

determining the number of shares available for future issuance under the 2009 Plan, as amended and restated, awards of

restricted stock and restricted stock equivalents reduces the shares available for future issuance by 1.95 for every one share

awarded. Options awarded reduces the number of shares available for future issuance on a one-for-one basis. At September 30,

2012, 2011, and 2010 there were 3.3 million, 4.6 million and 2.0 million shares, respectively, available for future awards under

the 2009 Plan, as amended and restated. Since the original plan has been superseded, no further shares under this original plan

were available for future awards after the adoption of the 2009 plan, as amended and restated.

Options are granted at the market price on the grant date and generally have vested ratably over three to seven years. These

awards typically have a maximum term of 10 years. Restricted stock and restricted stock equivalent awards may also be

granted. Option shares and prices, and restricted stock and stock equivalent awards, are adjusted in conjunction with stock

splits and other recapitalizations so that the holder is in the same economic position before and after these equity transactions.

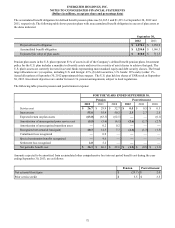

Through December 31, 2012, the Company permits employee deferrals of bonus and, in the past, permitted deferrals of

retainers and fees for directors, under the terms of its Deferred Compensation Plan. Under this plan, employees or directors,

that defer amounts into the Energizer Common Stock Unit Fund are credited with a number of stock equivalents based on the

estimated fair value of ENR stock at the time of deferral. In addition, the participants are credited with an additional number of

stock equivalents, equal to 25% for employees and 33 1/3% for directors, of the amount deferred. This additional match vested

immediately for directors and vests three years from the date of initial crediting for employees. Effective January 1, 2011, the

33 1/3% match for directors was eliminated for future deferrals. Effective January 1, 2013, future deferrals of compensation

will no longer be permitted, thus eliminating the 25% Company match for employees as well. Amounts deferred into the

Energizer Common Stock Unit Fund, and vested matching deferrals, may be transferred to other investment options offered

under the plan after specified restriction periods. At the time of termination of employment, or for directors, at the time of

termination of service on the Board, or at such other time for distribution, which may be elected in advance by the participant,

the number of equivalents then vested and credited to the participant's account is determined and an amount in cash equal to the

estimated fair value of an equivalent number of shares of ENR stock is paid to the participant. This plan is reflected in Other

liabilities on the Consolidated Balance Sheets.

The Company uses the straight-line method of recognizing compensation cost. Total compensation cost charged against income

for the Company’s share-based compensation arrangements was $44.9, $37.3, and $28.2 for the years ended September 30,

2012, 2011 and 2010, respectively, and was recorded in SG&A expense. The total income tax benefit recognized in the

Consolidated Statements of Earnings and Comprehensive Income for share-based compensation arrangements was $16.8,

$13.9, and $10.2 for the years ended September 30, 2012, 2011 and 2010, respectively. Restricted stock issuance and shares

issued for stock option exercises under the Company’s share-based compensation program are generally issued from treasury

shares.

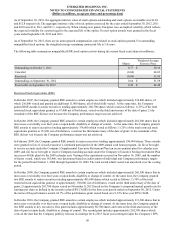

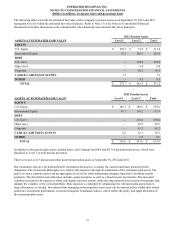

Options

In October 2009, the Company granted non-qualified stock options to purchase 266,750 shares of ENR stock to certain

executives and employees of the Company. Total options of approximately 215,500 vested on the third anniversary of the date

of the grant. The options remain exercisable for 10 years from the date of grant. However, this term may be reduced under

certain circumstances including the recipient’s termination of employment.

67