Energizer 2012 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2012 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

(Dollars in millions, except per share and percentage data)

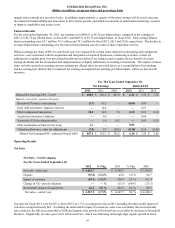

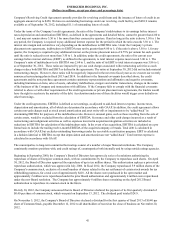

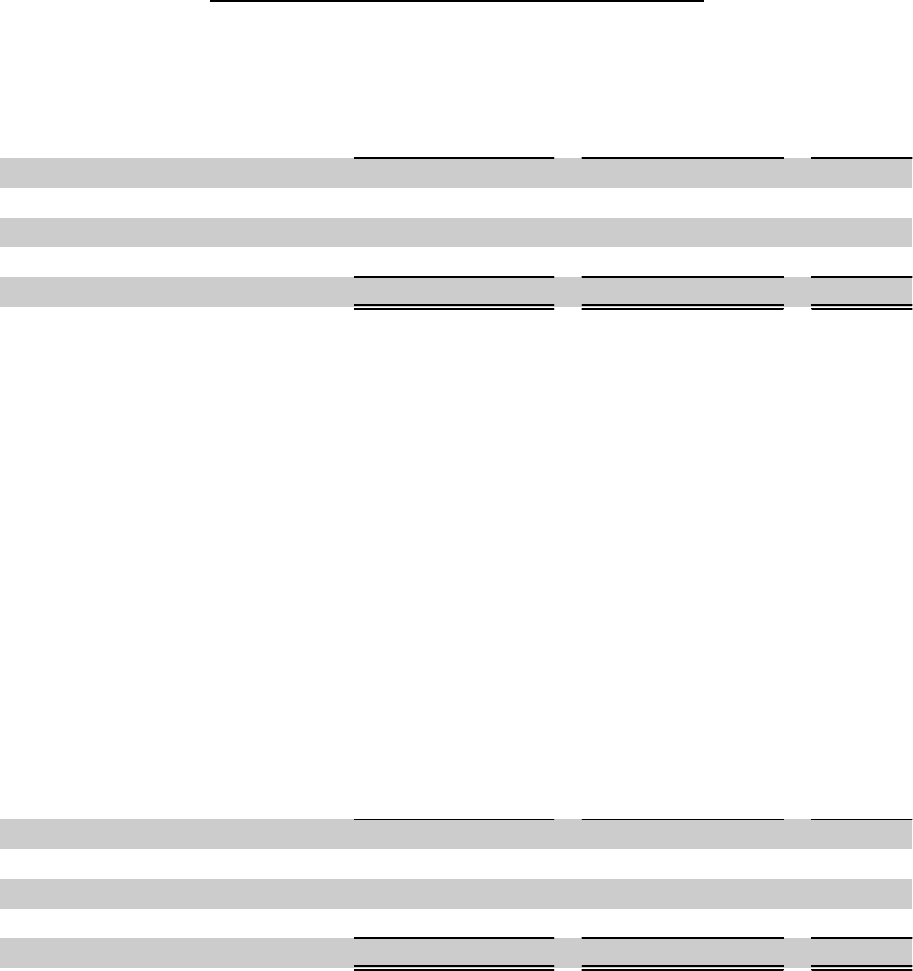

HOUSEHOLD PRODUCTS

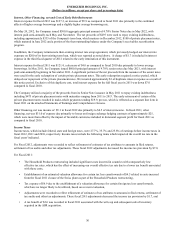

Net Sales - Household Products

For the years ended September 30,

2012 % Chg 2011 % Chg 2010

Net sales - prior year $ 2,196.0 $ 2,199.7 $ 2,109.5

Organic Change (70.6) (3.2)% (49.9) (2.3)% 45.9

Impact of currency (37.7) (1.7)% 54.9 2.5 % 57.7

Change in VZ - post devaluation ——% (8.7) (0.4)% (13.4)

Net sales - current year $ 2,087.7 (4.9)% $ 2,196.0 (0.2)% $ 2,199.7

Net Sales for the twelve months ended September 30, 2012 decreased 4.9%, inclusive of a 1.7% decline due to unfavorable

currencies. Excluding the impact of currencies, organic sales declined 3.2% due primarily to a slow start to the fiscal year in

the first fiscal quarter as net sales were adversely impacted by a shift in timing of retailer holiday deliveries, significant prior

year hurricane response volumes that did not repeat at similar levels during fiscal 2012, increasing household battery category

volume softness and the negative impact of lost shelf space and display activities, primarily in the U.S., in the second half of

the fiscal year. We estimate that battery category unit volumes declined approximately 5% in the Company's global measured

markets during fiscal 2012. In addition, we estimate that the Company's dollar market share declined by approximately one

point during this same period, due primarily to lower market share in the U.S. as a result of the lost shelf space and display

activities noted above.

For fiscal 2011, net sales were $2,196.0, essentially flat as compared to $2,199.7 for fiscal 2010. Organic sales declined 2.3%

as compared to fiscal 2010 due to continued negative category value trends and increased retailer trade spending, primarily in

the U.S. and Western Europe. We estimate that the dollar value of the battery category in global measured markets declined

in the low single digits in fiscal 2011. This decline in organic sales on a year over year basis was offset by favorable

currencies.

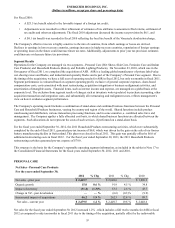

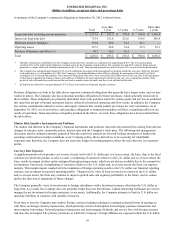

Segment Profit - Household Products

For the years ended September 30,

2012 % Chg 2011 % Chg 2010

Segment profit - prior year $ 410.6 $ 451.1 $ 398.6

Operations 12.1 3.0 % (71.3) (15.8)% 28.5

Impact of currency (22.5) (5.5)% 28.1 6.2 % 30.6

Change in VZ - post devaluation ——% 2.7 0.6 % (6.6)

Segment profit - current year $ 400.2 (2.5)% $ 410.6 (9.0)% $ 451.1

Segment profit for fiscal 2012 was $400.2, a decrease of $10.4, or 2.5%, due primarily to the unfavorable impact of currencies.

Operationally, segment profit increased $12.1 as reduced gross margin due to continued household battery volume softness and

the market share loss noted above was more than offset by pricing gains, cost savings related to our 2011 Household Products

manufacturing footprint restructuring and global cost containment efforts.

Segment profit for fiscal 2011 was $410.6, down $40.5, or 9.0%. The favorable impact of currencies was offset by operational

results, which declined $71.3, or 15.8%, due primarily to category value declines, increased retailer trade spending, the

unfavorable impact of higher commodity prices, and investments in growth initiatives.

39