Energizer 2012 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2012 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

(Dollars in millions, except per share and percentage data)

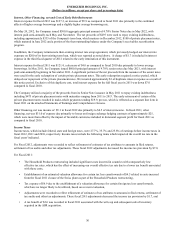

Inflation

Management recognizes that inflationary pressures may have an adverse effect on the Company through higher material, labor

and transportation costs, asset replacement costs and related depreciation, and other costs. In general, the Company has been

able to offset or minimize inflation effects through other cost reductions and productivity improvements. We can provide no

assurance that such mitigation will be available in the future.

Legal and other contingencies

The Company and its subsidiaries are parties to a number of legal proceedings in various jurisdictions arising out of the

operations of the Company's businesses. Many of these legal matters are in preliminary stages and involve complex issues of

law and fact, and may proceed for protracted periods of time. The amount of liability, if any, from these proceedings cannot be

determined with certainty. However, based upon present information, the Company believes that its liability, if any, arising

from such pending legal proceedings, asserted legal claims and known potential legal claims which are likely to be asserted, are

not reasonably likely to be material to the Company's financial position, results of operations, or cash flows, taking into account

established accruals for estimated liabilities.

In January 2011, Munchkin, Inc. commenced an action against a subsidiary of the Company in the United States District Court

for the Central District of California seeking a declaration that certain Munchkin, Inc. advertising claims were valid and

alleging false advertising claims by the Company. A jury trial resulted in an adverse verdict in July 2012 in the amount of

approximately $13.5 million. As a result of the jury verdict, the Company recorded an accrual of $13.5 million as of June 30,

2012. In September 2012, the court ordered a new trial with respect to the claims on which the jury awarded damages, which

set aside the previous jury verdict. Based on this development and our current assessment of the matter, the Company reversed

the previously established litigation reserve.

In October 2012, after receiving five reports from consumers, the Company announced a voluntary market withdrawal of

certain continuous spray Banana Boat sun care products due to a potential risk of product igniting on the skin if contact was

made with a source of ignition before the product was completely dry. The Company is voluntarily removing these products

from retail outlets because of this potential safety concern. The Company has provided for the costs associated with the

voluntary withdrawal in its fiscal 2012 financial statements, and is unable to determine with any degree of certainty what, if

any, other liabilities may arise.

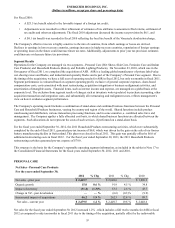

Critical Accounting Policies

The methods, estimates, and judgments the Company uses in applying its most critical accounting policies have a significant

impact on the results the Company reports in its consolidated financial statements. Specific areas, among others, requiring the

application of management's estimates and judgment include assumptions pertaining to accruals for consumer and trade-

promotion programs, pension and postretirement benefit costs, share-based compensation, future cash flows associated with

impairment testing of goodwill and other long-lived assets, credit worthiness of customers, uncertain tax positions, tax

valuation allowances, and legal and environmental matters. On an ongoing basis, the Company evaluates its estimates, but

actual results could differ from those estimates.

The Company's most critical accounting policies are: revenue recognition; pension and other postretirement benefits, share-

based compensation, the valuation of long-lived assets including property, plant and equipment, income taxes including

uncertain tax positions and the carrying value of intangible assets and the related impairment testing of goodwill and other

indefinite-lived intangible assets. The Company's critical accounting policies have been reviewed with the Audit Committee of

the Board of Directors. A summary of the Company's significant accounting policies is contained in Note 2 of the Notes to

Consolidated Financial Statements. This listing is not intended to be a comprehensive list of all of the Company's accounting

policies.

• Revenue Recognition The Company derives revenues from the sale of its products. Revenue is recognized when title,

ownership and risk of loss pass to the customer. When discounts are offered to customers for early payment, an

estimate of the discounts is recorded as a reduction of net sales in the same period as the sale. Standard sales terms are

final and, except for seasonal sun care returns, which are discussed in detail in the next paragraph, returns or

exchanges are not permitted unless a special exception is made; reserves are established and recorded in cases where

the right of return exists for a particular sale.

Under certain circumstances, we allow customers to return sun care products that have not been sold by the end of the

sun care season, which is normal practice in the sun care industry. We record sales at the time the title, ownership and

risk of loss pass to the customer. The terms of these sales vary but, in all instances, the following conditions are met:

46