Energizer 2012 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2012 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

(Dollars in millions, except per share and percentage data)

margin and overheads as a percent of sales. In addition, approximately a quarter of the gross savings will be used to increase

investment in brand building and innovation to drive future growth, and enable investments in information technology systems

to improve capabilities and reduce costs.

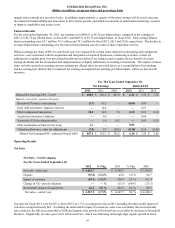

Financial Results

For the year ended September 30, 2012, net earnings were $408.9, or $6.22 per diluted share, compared to net earnings of

$261.2 or $3.72 per diluted share, in fiscal 2011 and $403.0, or $5.72 per diluted share, in fiscal 2010. Total average diluted

shares outstanding were 65.7 million, 70.3 million and 70.5 million for fiscal 2012, 2011 and 2010, respectively. The decline in

average diluted shares outstanding over the time period presented was the result of share repurchase activity.

Diluted earnings per share (EPS) for each fiscal year were impacted by certain items related to restructuring and realignment

activities, costs associated with the acquisition and integration of acquired businesses, refinancing activities, certain tax

adjustments to update prior year provisions/benefits and net deferred tax balances and recognize the tax benefit of certain

foreign dividends and the devaluation and implementation of highly inflationary accounting in Venezuela. The impacts of these

items on both reported net earnings and net earnings per diluted share are provided below as a reconciliation of net earnings

and net earnings per diluted share to adjusted net earnings and adjusted net earnings per diluted share, which are non-GAAP

measures.

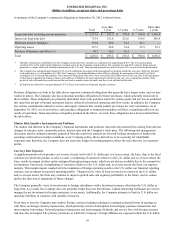

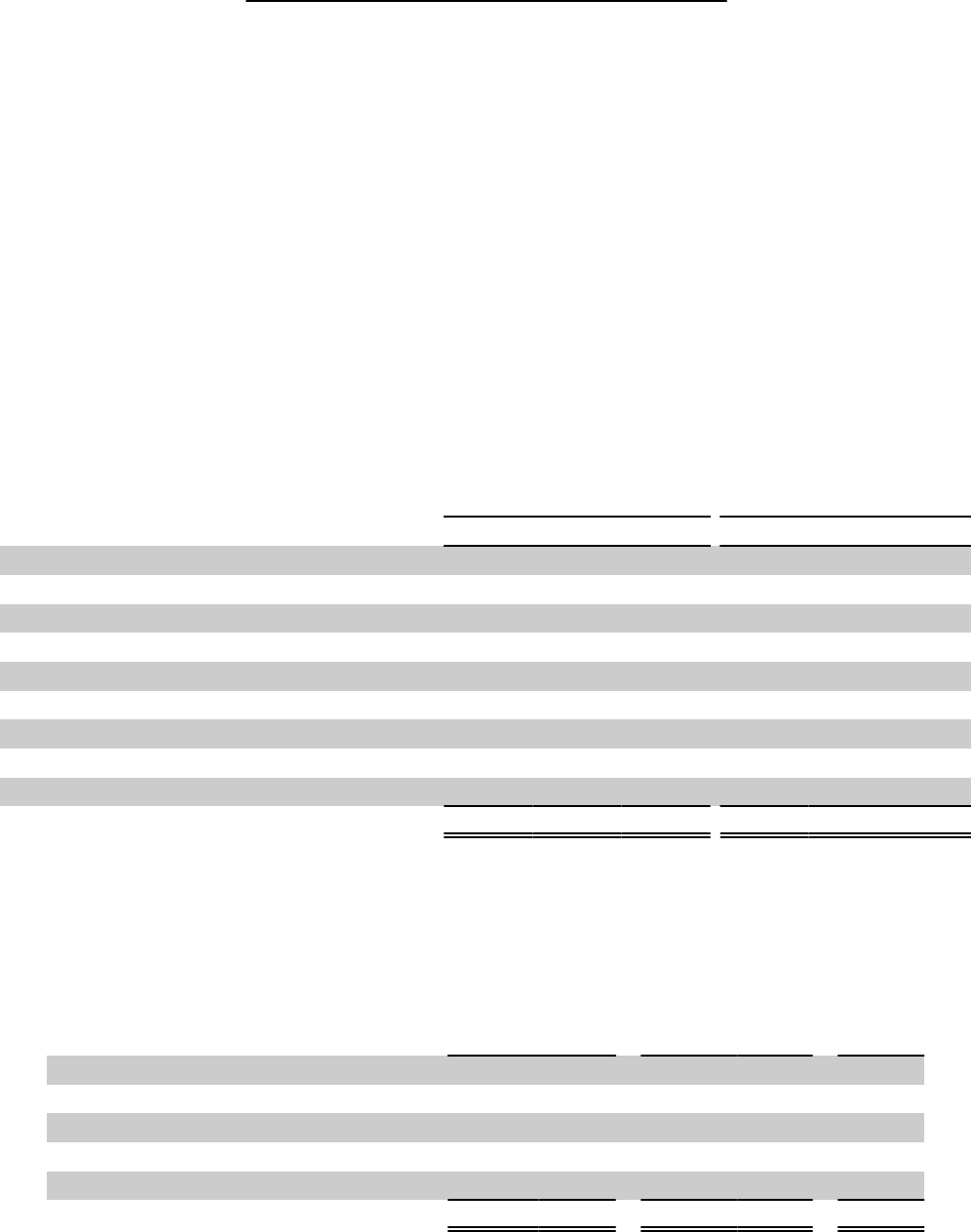

For The Years Ended September 30,

Net Earnings Diluted EPS

2012 2011 2010 2012 2011 2010

Diluted Net Earnings/EPS - GAAP $ 408.9 $ 261.2 $ 403.0 $ 6.22 $ 3.72 $ 5.72

Impacts, net of tax: expense (income)

Household Products restructuring (5.7)63.3 — (0.09)0.89 —

Early debt retirement / duplicate interest —14.4 — —0.21 —

Other realignment/integration 10.2 10.5 7.6 0.15 0.15 0.10

Acquisition inventory valuation —4.4 — —0.06 —

Venezuela (VZ) devaluation/other —1.8 14.2 —0.03 0.20

Early termination of interest rate swap 1.1 ——

0.02 ——

Valuation allowance, other tax adjustments (7.0)9.7 (29.6)(0.10)0.14 (0.42)

Diluted Net Earnings/EPS - adjusted (Non-GAAP) $ 407.5 $ 365.3 $ 395.2 $ 6.20 $ 5.20 $ 5.60

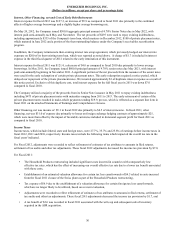

Operating Results

Net Sales

Net Sales - Total Company

For the Years Ended September 30,

2012 % Chg 2011 % Chg 2010

Net sales - prior year $ 4,645.7 $ 4,248.3 $ 3,999.8

Organic (55.6) (1.2)% 42.0 1.0 % 80.7

Impact of currency (69.1) (1.5)% 108.4 2.6 % 101.4

Change in VZ - post devaluation ——% (15.3) (0.4)% (23.3)

Incremental impact of acquisitions 46.2 1.0 % 262.3 6.2 % 89.7

Net sales - current year $ 4,567.2 (1.7)% $ 4,645.7 9.4 % $ 4,248.3

Net sales for fiscal 2012 were $4,567.2, down $78.5 or 1.7%, as compared to fiscal 2011 including the unfavorable impact of

currencies of approximately $69. Excluding the unfavorable impact of currencies, sales were essentially flat as incremental

sales related to the full year ownership of ASR and organic sales growth in Personal Care were offset by declines in Household

Products. Organically, net sales grew 0.6% in Personal Care, which was following mid-single digit organic growth in fiscal

34