Energizer 2012 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2012 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per share and percentage data)

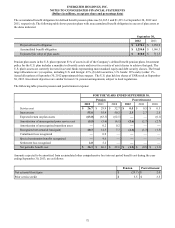

determining EBITDA for purposes of the indebtedness ratio. However, unusual gains, such as those resulting from the sale of

certain assets, would be excluded from the calculation of EBITDA. Severance and other cash charges incurred as a result of

restructuring and realignment activities as well as expenses incurred in acquisition integration activities are included as

reductions in EBITDA for calculation of the indebtedness ratio. In the event of an acquisition, EBITDA is calculated on a pro

forma basis to include the trailing twelve-month EBITDA of the acquired company or brands. Total debt is calculated in

accordance with GAAP, but excludes outstanding borrowings under the receivable securitization program. EBIT is calculated

in a fashion identical to EBITDA except that depreciation and amortization are not “added-back”. Total interest expense is

calculated in accordance with GAAP.

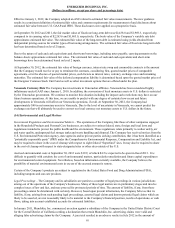

The counterparties to long-term committed borrowings consist of a number of major financial institutions. The Company

consistently monitors positions with, and credit ratings of, counterparties both internally and by using outside ratings agencies.

Advances under the Company's existing receivables securitization program, as amended, which may not exceed $200, are not

considered debt for purposes of the Company’s debt compliance covenants. At September 30, 2012 and 2011, $140.0 and

$35.0, respectively, was outstanding under this facility.

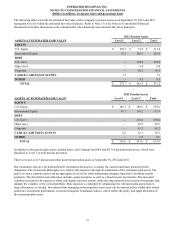

On May 24, 2012, the Company issued $500.0 aggregate principal amount of 4.70% senior notes due in May 2022 with interest

payable semi-annually in May and November (the "2012 Notes"). The net proceeds of $495 were used to repay existing

indebtedness including approximately $335 of our term loan, which matures in December 2012, $100 of private placement

notes, which matured in June 2012, and a portion of our outstanding balance under our receivables securitization program. The

2012 Notes contain the same provisions as the senior notes issued in 2011 and described below.

At this time, the Company has a remaining term loan outstanding of $106.5, which will mature in December 2012. We expect

to fund this repayment with available cash and other borrowing capacity.

As a result of the permanent repayment of $335 of our existing term loan, the Company terminated a then-existing interest rate

swap agreement, which previously hedged our interest rate exposure on $200 of our then-existing term loan balance. The

interest rate swap agreement was terminated following repayment of the debt associated with the interest rate swap derivative.

A charge of $1.7 is included in interest expense in the third fiscal quarter related to the early termination of this hedging

instrument. The Company remains a party to an interest rate swap agreement with one major financial institution that fixes the

variable benchmark component (LIBOR) of the Company’s interest rate on $100 of the Company’s remaining variable rate

term loan debt through December 2012 at an interest rate of 1.9%.

On May 19, 2011, the Company issued $600.0 aggregate principal amount of senior, unsecured notes with interest paid semi-

annually in May and November at an annual fixed interest rate of 4.70% (the "2011 Notes"). The 2011 Notes mature in May

2021, and are guaranteed by all of our existing and future subsidiaries that are guarantors under any of our credit agreements or

other indebtedness, and such subsidiaries will remain guarantors of the 2011 Notes for as long as they remain a guarantor on

other indebtedness. The 2011 Notes are redeemable at our option from time to time in accordance with the optional redemption

provisions of the notes, including potential make-whole premiums. In addition, upon the occurrence of a change in control, the

holders of the 2011 Notes have the right to require the Company to repurchase all or a portion of the notes at a specified

redemption price. The 2011 Notes also contain certain limitations regarding the merger, consolidation or sale of the Company's

assets.

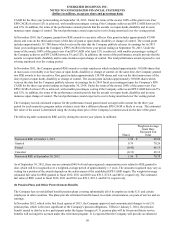

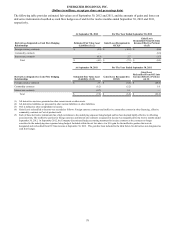

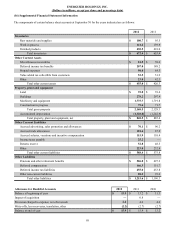

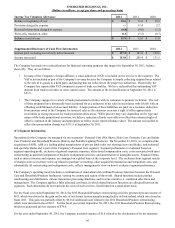

Aggregate maturities of long-term debt, including current maturities, at September 30, 2012 are as follows for the fiscal years’

noted: $231.5 in 2013, $140.0 in 2014, $230.0 in 2015, $210.0 in 2016, $150.0 in 2017 and $1,410.0 thereafter. At this time,

the Company intends to repay only scheduled debt maturities over the course of the next fiscal year with the intent to preserve

committed liquidity.

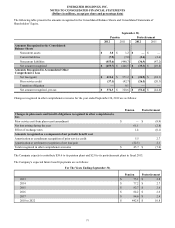

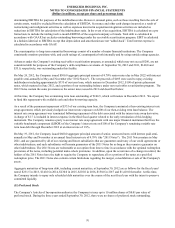

(11) Preferred Stock

The Company’s Articles of Incorporation authorize the Company to issue up to 10 million shares of $0.01 par value of

preferred stock. During the three years ended September 30, 2012, there were no shares of preferred stock outstanding.

76