Energizer 2012 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2012 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

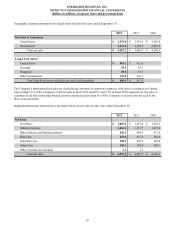

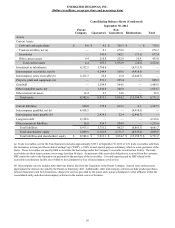

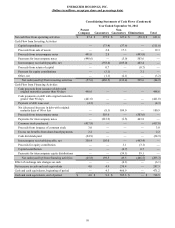

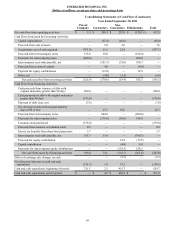

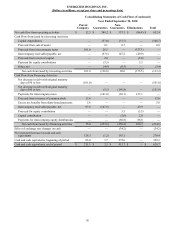

ENERGIZER HOLDINGS, INC.

(Dollars in millions, except per share and percentage data)

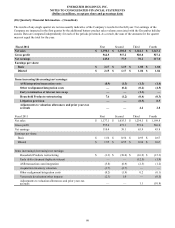

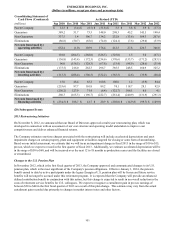

The Company revised its Condensed Consolidating Statements of Earnings to eliminate the incorrect inclusion of intercompany

dividends. These revisions resulted in a reduction of the Guarantors net earnings with a corresponding reduction to

Eliminations. The reported net earnings of the Parent and Non-Guarantors was not impacted by this error. The Company also

revised its Condensed Consolidating Balance Sheets to present intercompany notes between the Parent, Guarantor and the Non-

Guarantor subsidiaries on a gross basis, rather than showing intercompany obligations on a net basis. Additionally, the

Company revised its Condensed Consolidating Statements of Cash Flows to correct the presentation of certain intercompany

activities between the Parent, Guarantor and Non-Guarantor subsidiaries for loans, capital contributions/returns, return on

equity and repayments. These revisions resulted in offsetting amounts to certain line items and did not impact total cash flow

for any of the subsidiaries presented. The Company assessed the materiality of these items on previously issued annual and

interim financial statements in accordance with SEC Staff Accounting Bulletin No. 99 and No. 108, and concluded that the

revisions were not material to the Condensed Consolidating Financial Statements for any period presented. The prior period

quarterly Condensed Consolidating Financial Statements will also be presented in our Form 10-Q filings in fiscal year 2013 as

revised consistent with the presentation below. There were no changes to the Company's Consolidated Financial Statements as

a result of these revisions. The impact of these revisions is shown in the following tables.

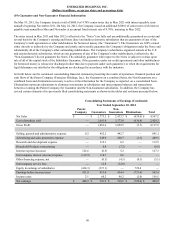

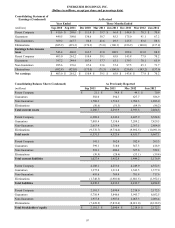

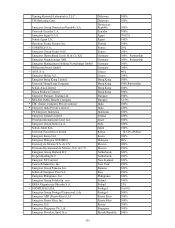

Consolidating Statement of

Earnings (Condensed) As Previously Reported

Year Ended Three Months Ended

(millions) Sep 2010 Sep 2011 Dec 2010 Mar 2011 Jun 2011 Dec 2011 Mar 2012 Jun 2012

Parent Company $ 410.6 $ 268.6 $ 111.4 $ 39.7 $ 66.4 $ 144.8 $ 78.3 $ 70.4

Guarantors 536.3 433.1 189.3 65.6 93.7 182.6 112.5 72.1

Non-Guarantors 369.2 247.7 86.8 41.6 49.3 125.5 83.6 88.6

Eliminations (772.7) (543.4) (225.0)(85.9)(108.5)(244.5)(161.4)(142.3)

Earnings before income

taxes 543.4 406.0 162.5 61.0 100.9 208.4 113.0 88.8

Parent Company 403.0 261.2 110.4 39.1 65.9 143.8 77.9 70.2

Guarantors 484.0 368.5 158.1 52.6 71.5 146.9 99.5 70.8

Non-Guarantors 285.6 176.6 67.6 33.6 37.4 97.5 65.1 71.7

Eliminations (769.6) (545.1) (225.7)(86.2)(108.9)(244.4)(164.6)(142.5)

Net earnings $ 403.0 $ 261.2 $ 110.4 $ 39.1 $ 65.9 $ 143.8 $ 77.9 $ 70.2

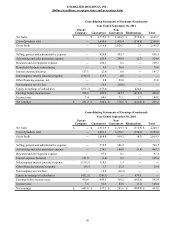

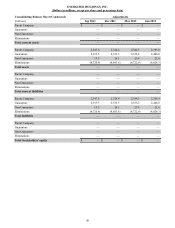

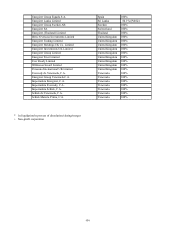

Consolidating Statement of

Earnings (Condensed) Adjustments

Year Ended Three Months Ended

(millions) Sep 2010 Sep 2011 Dec 2010 Mar 2011 Jun 2011 Dec 2011 Mar 2012 Jun 2012

Parent Company $ — $ — $ — $ — $ — $ — $ — $ —

Guarantors (86.8) (124.1) (50.7)(14.9)(8.4)(7.6)(21.4)(4.9)

Non-Guarantors — — — — — — — —

Eliminations 86.8 124.1 50.7 14.9 8.4 7.6 21.4 4.9

Earnings before income

taxes —— ———— ——

Parent Company — — — — — — — —

Guarantors (86.8) (124.1) (50.7)(14.9)(8.4)(7.6)(21.4)(4.9)

Non-Guarantors — — — — — — — —

Eliminations 86.8 124.1 50.7 14.9 8.4 7.6 21.4 4.9

Net earnings $—$—$ —$—$—$—$ —$—

96