Energizer 2012 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2012 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

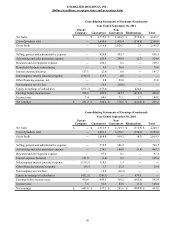

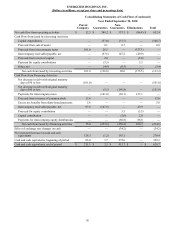

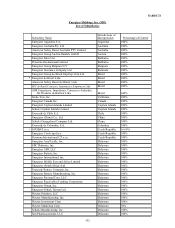

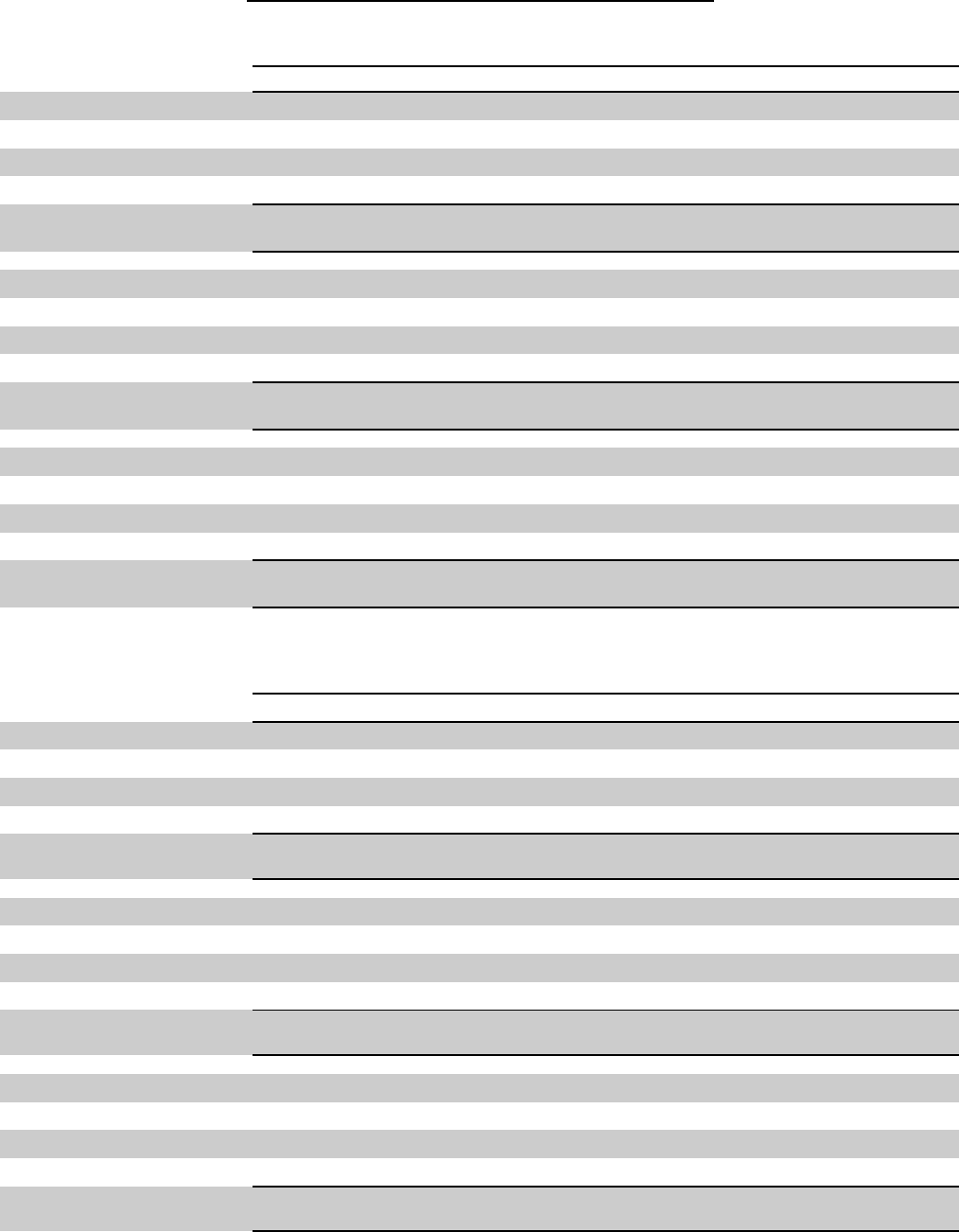

ENERGIZER HOLDINGS, INC.

(Dollars in millions, except per share and percentage data)

Consolidating Statement of

Cash Flows (Condensed) As Previously Reported (YTD)

(millions) Sep 2010 Dec 2010 Mar 2011 Jun 2011 Sep 2011 Dec 2011 Mar 2012 Jun 2012

Parent Company $ 211.2 $ (59.0) $ (11.1)$ (57.1) $ 303.4 $ (17.8) $ 5.7 $ (36.1)

Guarantors (17.5) 33.8 (12.5) 76.5 (73.4) 64.2 117.8 178.1

Non-Guarantors 458.7 24.2 129.5 157.0 182.5 (18.6) 103.2 204.8

Eliminations ————————

Net cash from/(used by

operating activities 652.4 (1.0) 105.9 176.4 412.5 27.8 226.7 346.8

Parent Company — (267.1) (267.1)(267.1)(267.1)— — —

Guarantors (61.8) (14.0) (23.3)(39.5)(55.2)(13.7)(37.3)(55.0)

Non-Guarantors (51.5) (7.3) (16.1)(25.6)(41.2) 11.1 1.4 (5.4)

Eliminations ————————

Net cash (used by) investing

activities (113.3) (288.4) (306.5)(332.2)(363.5)(2.6)(35.9)(60.4)

Parent Company (82.6) 166.6 66.7 126.7 (247.7) 24.3 (0.7) 36.1

Guarantors 78.2 (13.8) 38.6 (34.4) 130.4 (40.3)(78.1)(122.9)

Non-Guarantors (230.1) (44.1) (63.6)(71.4)(84.7) 1.1 (20.9)(23.1)

Eliminations ————————

Net cash (used by)/from

financing activities $ (234.5) $ 108.7 $ 41.7 $ 20.9 $ (202.0)$ (14.9)$ (99.7)$ (109.9)

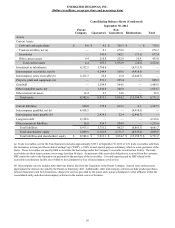

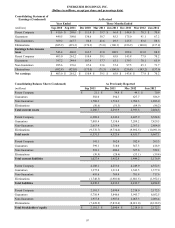

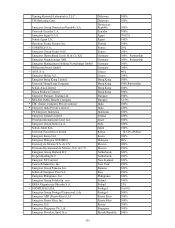

Consolidating Statement of

Cash Flows (Condensed) Adjustments (YTD)

(millions) Sep 2010 Dec 2010 Mar 2011 Jun 2011 Sep 2011 Dec 2011 Mar 2012 Jun 2012

Parent Company $ (198.7) $ 55.6 $ 2.4 $ 25.3 $ (297.9) $ 21.6 $ 0.2 $ 18.8

Guarantors 406.7 17.9 86.0 71.5 371.7 (19.0) 27.7 12.3

Non-Guarantors (121.2) (22.8) (22.8)(22.8) 50.3 5.0 1.1 2.8

Eliminations (86.8) (50.7) (65.6)(74.0)(124.1)(7.6)(29.0)(33.9)

Net cash from/(used by)

operating activities ————————

Parent Company 101.0 62.6 (0.9)(59.4)(57.9) 1.5 3.0 (67.1)

Guarantors (75.0) (129.4) (149.2)(195.1)(315.4)(140.0)(133.9)(228.1)

Non-Guarantors 147.5 (149.2) (112.2)(42.2)(12.2)(110.0)(30.0)(30.0)

Eliminations (173.5) 216.0 262.3 296.7 385.5 248.5 160.9 325.2

Net cash from/(used by)

investing activities ————————

Parent Company 97.6 (118.2) (1.5) 34.1 355.7 (23.1)(3.2) 48.3

Guarantors (331.8) 111.5 63.2 123.6 (56.3) 159.0 106.2 215.8

Non-Guarantors (26.1) 172.0 135.0 65.0 (38.0) 105.0 28.9 27.2

Eliminations 260.3 (165.3) (196.7)(222.7)(261.4)(240.9)(131.9)(291.3)

Net cash from/(used by)

financing activities $—$—$—$—$—$—$—$—

100