Energizer 2012 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2012 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5

Energizer Holdings, Inc. 2012 Annual Report

Strong sales by both Schick Hydro® men’s and Schick Hydro Silk® drove a

6 percent increase in overall Schick Hydro® system net sales during 2012,

adding one point to our share of the branded razor and blade market.

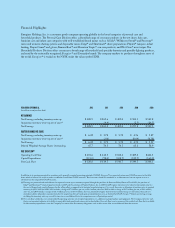

BRANDED WET SHAVE U.S. MARKET SHARE

21%

Our two sun care

brands, Banana Boat®

and Hawaiian Tropic®,

combined lead the

U.S. sun care market.

that maximize their growth by meeting the specic

needs of their consumers.

A history of investing in growth

We entered the Wet Shave business in 2003 with our

acquisition of Schick Wilkinson Sword, which formed the

basis of our Personal Care segment. Since this acquisition,

we have quadrupled segment sales from $625 million in

2002 to $2.5 billion in 2012. e result is a set of busi-

nesses that provide more than half of our revenues and

segment earnings and continued opportunities for growth.

at expansion has come through both innovation-

driven organic growth and strategic acquisitions:

• In 2003, we launched Schick Intuition for women and

the Schick Quattro® family of products.

• Our 2008 acquisition of Playtex brought us leading

domestic and international brands, including Playtex,

Hawaiian Tropic® and Banana Boat®.

• Our 2009 acquisition of Edge®

shaving gels for men and

Skintimate® shaving products

for women added leading brands

in the U.S. shave preparation

category.

• Our 2010 initial launch of

Schick Hydro® created a

powerful new platform for

growth, and the ASR acquisition

in 2011 broadened our presence

and product portfolio in the

private-label razors and blades

category.

Investments in eciency

Our 2011 initiatives to rationalize and improve the

eciency of our battery operations were completed

on schedule and on budget. Major projects included

closing two production facilities – in Switzerland and

the Philippines – and streamlining our battery plant

in Missouri.

e project delivered a total of $34 million in annual

savings, toward the high end of our expectations.

Our focus on eciency also drives the working

capital management improvement program we initiated

early in the scal year. During scal 2012, we lowered

working capital as a percent of net sales to 21.4 percent,

from 22.9 percent in scal 2011, reducing average

net working capital by nearly $88 million. Overall, we

expect to reduce average working capital by more than

$200 million, and we are on track to realize the full

benets of our initiatives by the end of scal 2014.

In November 2012, in response to continuing long-

term declines in the battery category and an aggressive

competitive environment, our Board of Directors

authorized an enterprise-wide restructuring plan that

represents a signicant, and necessary, change to our

overall cost structure and organization. We anticipate

annualized, pre-tax savings will be approximately

$200 million and will be fully achieved by Fiscal 2015.

We expect to re-invest about 25 percent of these

savings in our brands and our robust innovation pipeline,

with the rest – approximately $150 million – falling to

the bottom line.

We believe these initiatives, combined with our

on-going commitment to improve total shareholder

returns, will create substantial value for shareholders,