Energizer 2012 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2012 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

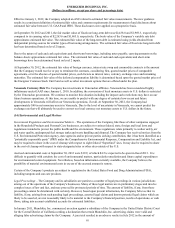

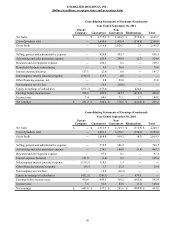

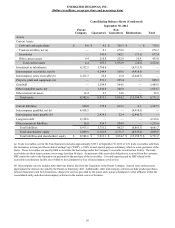

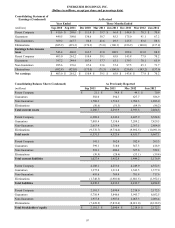

ENERGIZER HOLDINGS, INC.

(Dollars in millions, except per share and percentage data)

Consolidating Statements of Earnings (Condensed)

Year Ended September 30, 2011

Parent

Company Guarantors

Non-

Guarantors Eliminations Total

Net Sales $ — $ 2,775.2 $ 2,444.5 $ (574.0) $ 4,645.7

Cost of products sold — 1,658.4 1,418.4 (576.8) 2,500.0

Gross Profit — 1,116.8 1,026.1 2.8 2,145.7

Selling, general and administrative expense — 420.4 435.7 — 856.1

Advertising and sales promotion expense — 285.9 240.8 (2.7) 524.0

Research and development expense — 108.2 0.1 — 108.3

Household Products restructuring — 3.0 76.0 — 79.0

Interest expense/(income) 137.1 (2.4) 6.6 — 141.3

Intercompany interest (income)/expense (134.5) 133.7 0.8 — —

Other financing expense, net — 2.0 29.0 — 31.0

Intercompany service fees — 10.6 (10.6)— —

Equity in earnings of subsidiaries (271.2)(153.6) — 424.8 —

Earnings before income taxes 268.6 309.0 247.7 (419.3) 406.0

Income taxes 7.4 64.6 71.1 1.7 144.8

Net earnings $ 261.2 $ 244.4 $ 176.6 $ (421.0) $ 261.2

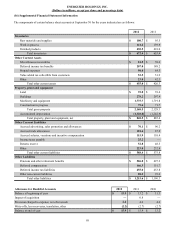

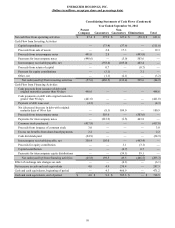

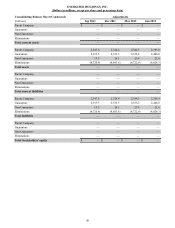

Consolidating Statements of Earnings (Condensed)

Year Ended September 30, 2010

Parent

Company Guarantors

Non-

Guarantors Eliminations Total

Net Sales $ — $ 2,551.9 $ 2,229.3 $ (532.9) $ 4,248.3

Cost of products sold — 1,483.1 1,270.1 (524.2) 2,229.0

Gross Profit — 1,068.8 959.2 (8.7) 2,019.3

Selling, general and administrative expense — 379.5 386.2 — 765.7

Advertising and sales promotion expense — 274.3 188.8 (1.8) 461.3

Research and development expense — 97.0 0.1 — 97.1

Interest expense/(income) 121.5 (1.4) 5.3 — 125.4

Intercompany interest (income)/expense (119.5) 118.2 1.3 — —

Other financing (income)/expense (0.1) 1.3 25.2 — 26.4

Intercompany service fees — 16.9 (16.9)— —

Equity in earnings of subsidiaries (412.5)(266.5) — 679.0 —

Earnings before income taxes 410.6 449.5 369.2 (685.9) 543.4

Income taxes 7.6 52.3 83.6 (3.1) 140.4

Net earnings $ 403.0 $ 397.2 $ 285.6 $ (682.8) $ 403.0

90