Energizer 2012 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2012 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per share and percentage data)

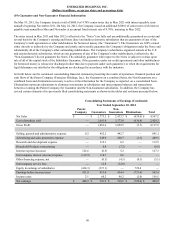

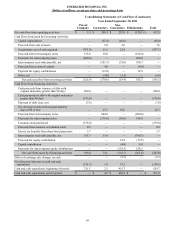

assets in Venezuela as a result of accounting for the translation of this affiliate under the accounting rules governing a highly

inflationary economy. These results reflect an exchange rate of 5.6 Venezuelan Bolivar Fuerte to one U.S. dollar. In 2010, the

Company recorded a pre-tax loss of $18.3 due primarily to the devaluation of our Venezuela affiliates' U.S. dollar based

intercompany payable as a result of the official devaluation of the exchange rate between the U.S. dollar and the Venezuelan

Bolivar Fuerte. These impacts, which are included in Other financing on the Consolidated Statements of Earnings and

Comprehensive Income, are not considered in the evaluation of segment profit. However, normal operating results in

Venezuela, such as sales, gross profit and spending remain part of reported segment totals.

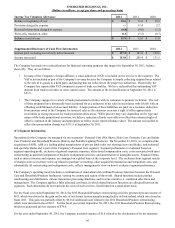

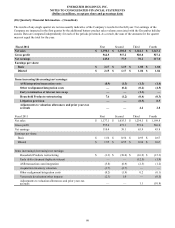

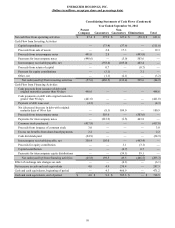

On May 19, 2011, the Company completed the issuance of $600.0 principal amount of 4.70% Senior Notes due May 2021,

with interest paid semi-annually beginning November, 2011. The vast majority of the proceeds of the offering were used to

repay existing indebtedness including the early redemption of certain private placement notes. The early retirement of the

certain private placement notes resulted in the payment of “make whole” premiums totaling $19.9, pre-tax, which are reflected

as a separate line item on the Consolidated Statements of Earnings and Comprehensive Income as well as the reconciliation of

segment results to total earnings before income taxes included in this footnote. In addition, the notice period required to repay

certain private placement notes resulted in duplicate interest expense of approximately $3.0, which is included in Interest

expense on the Consolidated Statements of Earnings and Comprehensive Income. See Note 10 of the Notes to Consolidated

Financial Statements for further details.

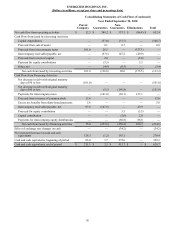

The presentation for inventory write-up, which was $7.0 in fiscal 2011 related to the write-up and subsequent sale of inventory

acquired in the ASR transaction, acquisition transaction and integration costs, and substantially all restructuring and

realignment costs, reflects management’s view on how it evaluates segment performance.

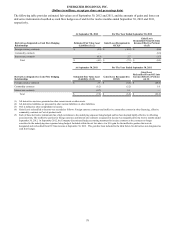

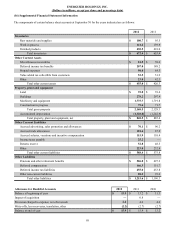

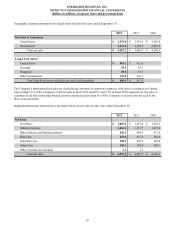

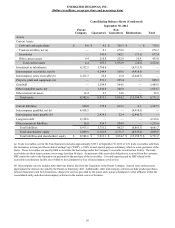

Corporate assets shown in the following table include all cash and cash equivalents, financial instruments and deferred tax

assets that are managed outside of operating segments.

85