Energizer 2012 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2012 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

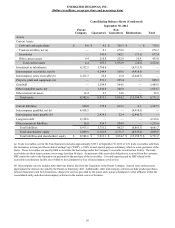

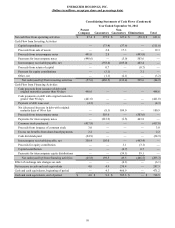

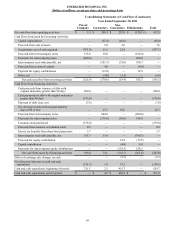

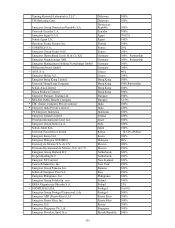

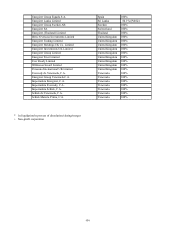

ENERGIZER HOLDINGS, INC.

(Dollars in millions, except per share and percentage data)

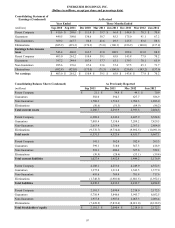

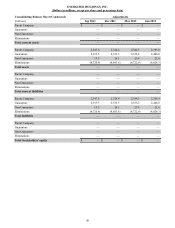

Consolidating Statement of

Cash Flows (Condensed) As Revised (YTD)

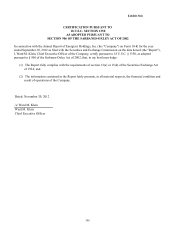

(millions) Sep 2010 Dec 2010 Mar 2011 Jun 2011 Sep 2011 Dec 2011 Mar 2012 Jun 2012

Parent Company $ 12.5 $ (3.4) $ (8.7)$ (31.8) $ 5.5 $ 3.8 $ 5.9 $ (17.3)

Guarantors 389.2 51.7 73.5 148.0 298.3 45.2 145.5 190.4

Non-Guarantors 337.5 1.4 106.7 134.2 232.8 (13.6) 104.3 207.6

Eliminations (86.8) (50.7) (65.6)(74.0)(124.1)(7.6)(29.0)(33.9)

Net cash from/(used by)

operating activities 652.4 (1.0) 105.9 176.4 412.5 27.8 226.7 346.8

Parent Company 101.0 (204.5) (268.0)(326.5)(325.0) 1.5 3.0 (67.1)

Guarantors (136.8) (143.4) (172.5)(234.6)(370.6)(153.7)(171.2)(283.1)

Non-Guarantors 96.0 (156.5) (128.3)(67.8)(53.4)(98.9)(28.6)(35.4)

Eliminations (173.5) 216.0 262.3 296.7 385.5 248.5 160.9 325.2

Net cash from/(used by)

investing activities (113.3) (288.4) (306.5)(332.2)(363.5)(2.6)(35.9)(60.4)

Parent Company 15.0 48.4 65.2 160.8 108.0 1.2 (3.9) 84.4

Guarantors (253.6) 97.7 101.8 89.2 74.1 118.7 28.1 92.9

Non-Guarantors (256.2) 127.9 71.4 (6.4)(122.7) 106.1 8.0 4.1

Eliminations 260.3 (165.3) (196.7)(222.7)(261.4)(240.9)(131.9)(291.3)

Net cash from/(used by)

financing activities $ (234.5) $ 108.7 $ 41.7 $ 20.9 $ (202.0)$ (14.9)$ (99.7)$ (109.9)

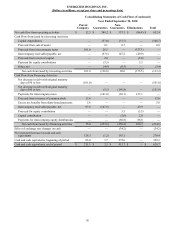

(20) Subsequent Events

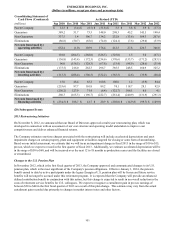

2013 Restructuring Initiatives

On November 8, 2012, we announced that our Board of Directors approved a multi-year restructuring plan, which was

developed in connection with an assessment of our cost structure and operating model undertaken to improve cost

competitiveness and deliver enhanced financial returns.

The Company estimates one-time charges associated with the restructuring will include accelerated depreciation and asset

impairment charges on certain property, plant and equipment at facilities targeted for closing or some form of streamlining.

Based on our initial assessment, we estimate that we will incur an impairment charge in fiscal 2013 in the range of $10 to $15,

pre-tax, which we expect to record in the first quarter of fiscal 2013. Additionally, we estimate accelerated depreciation will be

in the range of $50 to $60, and will be incurred over the next 12 to 18 months as production ceases and the facilities are closed

or streamlined.

Changes to the U.S. Pension Plan

In November 2012, which is the first fiscal quarter of 2013, the Company approved and communicated changes to its U.S.

pension plan, which is the most significant of the Company's pension obligations. Effective January 1, 2014, the pension

benefit earned to date by active participants under the legacy Energizer U.S. pension plan will be frozen and future service

benefits will no longer be accrued under this retirement program. It is expected that the Company will provide an enhanced

defined contribution benefit in conjunction with this action, but this change is expected to result in an overall reduction in the

costs of retirement service benefits for U.S. colleagues. We expect to recognize a curtailment gain in pre-tax earnings of

between $30 to $40 in the first fiscal quarter of 2013 as a result of this plan change. This estimate may vary from the actual

curtailment gain recorded due primarily to changes in market interest rates and other factors.

101