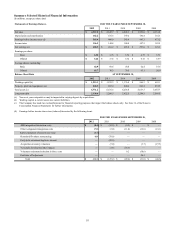

Energizer 2012 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2012 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

(Dollars in millions, except per share and percentage data)

the Euro, the Yen, the British pound, the Canadian dollar and the Australian dollar.

The Company uses natural hedging techniques, such as offsetting like foreign currency cash flows and foreign currency

derivatives with durations of generally one year or less, including forward exchange contracts. Certain of the foreign exchange

contracts have been designated and are accounted for as cash flow hedges.

The Company enters into foreign currency derivative contracts to hedge certain existing balance sheet exposures. Any losses on

these contracts would be fully offset by exchange gains on the underlying exposures, thus they are not subject to significant

market risk. The change in estimated fair value of the foreign currency contracts for fiscal 2012 and 2011 resulted in expense of

$1.9 and income of $4.5, respectively, and was recorded in Other financing expense, net on the Consolidated Statements of

Earnings and Comprehensive Income. In addition, the Company has entered into a series of forward currency contracts to

hedge the cash flow uncertainty of forecasted inventory purchases due to short term currency fluctuations. These transactions

are accounted for as cash flow hedges. At September 30, 2012 and 2011, the Company had an unrealized pre-tax loss on these

forward currency contracts accounted for as cash flow hedges of $5.9 and and unrealized pre-tax gain of $3.3, respectively,

included in Accumulated other comprehensive loss on the Consolidated Balance Sheets. Contract maturities for these hedges

extend into 2014. There were 61 open contracts at September 30, 2012 with a total notional value of approximately $359.

The Company has investments in Venezuelan affiliates. Venezuela has been considered highly inflationary under GAAP since

January 1, 2010. In addition, the conversion of local monetary assets to U.S. dollars is restricted by the Venezuelan

government. We continue to monitor this situation including the impact such restrictions may have on our future business

operations. At this time, we are unable to predict with any degree of certainty how recent and future developments in Venezuela

will affect our Venezuela operations, if at all. At September 30, 2012, the Company had approximately $40 in net monetary

assets in Venezuela. Due to the level of uncertainty in Venezuela, we cannot predict the exchange rate that will ultimately be

used to convert our local currency net monetary assets to U.S. dollars in the future.

Our ability to effectively manage sales and profit levels in Venezuela will be impacted by several factors, including the

Company's ability to mitigate the effect of any potential future devaluation, further actions of the Venezuelan government,

economic conditions in Venezuela, such as inflation and consumer spending, the availability of raw materials, utilities and

energy and the future state of exchange controls in Venezuela, including the availability of U.S. dollars at the official foreign

exchange rate.

Commodity Price Exposure

The Company uses raw materials that are subject to price volatility. At times, the Company has used, and may in the future use,

hedging instruments to reduce exposure to variability in cash flows associated with future purchases of certain materials and

commodities.

In September 2012, the Company discontinued hedge accounting treatment for its existing zinc contracts. These contracts no

longer meet the accounting requirements for classification as cash flow hedges because of an ineffective correlation to the

underlying zinc exposure being hedged. The zinc forward hedges were designed to offset movement in our purchased zinc

supplies, which include indium and certain conversion components. These two ancillary components of the Company's

purchased zinc supplies have been highly volatile, and have negatively impacted the correlation between the zinc hedging

contracts and the change in the cost of our zinc supplies. Due to this volatility, the zinc forward contracts no longer meet the

effectiveness requirements for treatment as cash flow hedges under the accounting guidelines.

The pre-tax gain recognized on these zinc contracts that were no longer considered cash flow hedges was $1.6 at September 30,

2012 and was included in other financing in the Consolidated Statement of Earnings and Comprehensive Income.

Contract maturities for these hedges extend into 2014. There were 17 open contracts at September 30, 2012 with a total

notional value of approximately $31.

Interest Rate Exposure

At September 30, 2012 and 2011, the fair market value of the Company's fixed rate debt is estimated at $2,438.0 and $1,969.3,

respectively, using yields obtained from independent pricing sources for similar types of borrowing arrangements. The

estimated fair value of debt is greater than the carrying value of the Company's debt by $174.4 and $104.3 at September 30,

2012 and 2011, respectively. A 10% decrease in interest rates on fixed-rate debt would have increased the fair market value by

$53.6 and $48.1 at September 30, 2012 and 2011, respectively. See Note 10 to the Consolidated Financial Statements for

additional information regarding the Company’s debt.

44