Energizer 2012 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2012 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

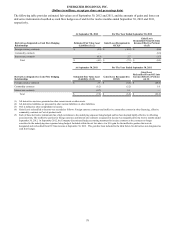

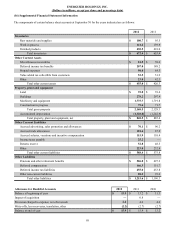

ENERGIZER HOLDINGS, INC.

(Dollars in millions, except per share and percentage data)

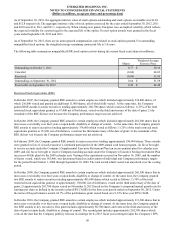

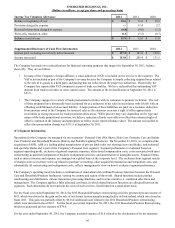

contracts and the change in the cost of our zinc supplies. Due to this volatility, the zinc forward contracts do not meet the

effectiveness requirements for treatment as cash flow hedges under the accounting guidelines.

The pre-tax gain recognized on these zinc contracts that were no longer considered cash flow hedges was $1.6 at September 30,

2012 and was included in other financing in the Consolidated Statement of Earnings and Comprehensive Income.

Contract maturities for these hedges extend into 2014. There were 17 open contracts at September 30, 2012 with a total

notional value of approximately $31.

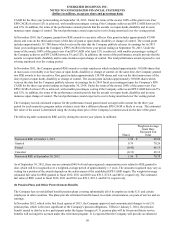

Foreign Currency Risk A significant portion of the Company’s product cost is more closely tied to the U.S. dollar than to the

local currencies in which the product is sold. As such, a weakening of currencies relative to the U.S. dollar, results in margin

declines unless mitigated through pricing actions, which are not always available due to the competitive environment.

Conversely, a strengthening in currencies relative to the U.S. dollar, and to a lesser extent, the Euro can improve margins. As a

result, the Company has entered into a series of forward currency contracts to hedge the cash flow uncertainty of forecasted

inventory purchases due to short term currency fluctuations. The Company’s primary foreign affiliates, which are exposed to

U.S. dollar purchases, have the Euro, the Japanese yen, the British pound, the Canadian dollar and the Australian dollar as their

local currencies. At September 30, 2012 and 2011, the Company had an unrealized pre-tax loss on these forward currency

contracts accounted for as cash flow hedges of $5.9 and an unrealized pre-tax gain of $3.3, respectively, included in

Accumulated other comprehensive loss on the Consolidated Balance Sheets. Assuming foreign exchange rates versus the U.S.

dollar remain at September 30, 2012 levels, over the next twelve months, approximately $5.3 of the pre-tax loss included in

Accumulated other comprehensive loss will be included in earnings. Contract maturities for these hedges extend into fiscal year

2014. There were 61 open contracts at September 30, 2012 with a total notional value of approximately $359.

Interest Rate Risk The Company has interest rate risk with respect to interest expense on variable rate debt. At September 30,

2012, the Company has a remaining term loan outstanding of $106.5, which will mature in December 2012. As a result of the

permanent repayment of $335 of our existing term loan, the Company terminated a then-existing interest rate swap agreement,

which previously hedged our interest rate exposure on $200 of our then-existing term loan balance. A charge of $1.7 is

included in interest expense in the third fiscal quarter related to the early termination of this hedging instrument. The Company

remains party to an interest rate swap agreement with one major financial institution that fixes the variable benchmark

component (LIBOR) of the Company’s interest rate on $100.0 of the Company’s remaining variable rate term loan debt through

December 2012. At September 30, 2012 and 2011, respectively, the Company had an unrealized pre-tax loss on these interest

rate swap agreements of $0.3 and $4.7 included in Accumulated other comprehensive loss on the Consolidated Balance Sheets.

Over the next three months the interest rate swap agreement will be fully settled and the total $0.3 pre-tax loss included in

Accumulated other comprehensive loss is expected to be included in earnings.

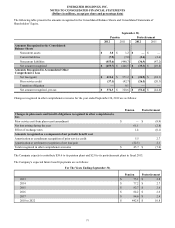

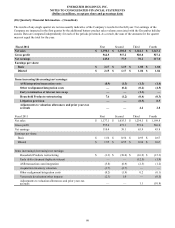

Cash Flow Hedges The Company maintains a number of cash flow hedging programs, as discussed above, to reduce risks

related to foreign currency and interest rate risk. Each of these derivative instruments have a high correlation to the underlying

exposure being hedged and have been deemed highly effective for accounting purposes in offsetting the associated risk.

Derivatives not Designated in Hedging Relationships The Company holds a share option with a major financial institution to

mitigate the impact of changes in certain of the Company’s deferred compensation liabilities, which are tied to the Company’s

common stock price. Period activity related to the share option is classified in the same category in the cash flow statement as

the period activity associated with the Company’s deferred compensation liability, which was cash flow from operations.

In addition, the Company enters into foreign currency derivative contracts which are not designated as cash flow hedges for

accounting purposes to hedge existing balance sheet exposures. Any losses on these contracts would be offset by exchange

gains on the underlying exposures; thus, they are not subject to significant market risk.

78