Energizer 2012 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2012 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

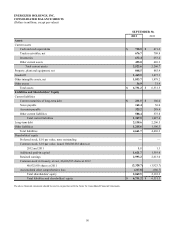

ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per share and percentage data)

Advertising and Sales Promotion Costs – The Company advertises and promotes its products through national and regional

media and expenses such activities in the year incurred.

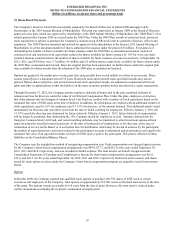

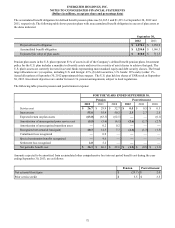

Share-Based Payments - The Company grants restricted stock equivalents, which generally vest over three to four years. A

portion of the restricted stock equivalents granted provide for the issuance of common stock to certain managerial staff and

executive management, if the Company achieves specified performance targets. The estimated fair value of each grant issued

is estimated on the date of grant based on the current market price of the stock. The total amount of compensation expense

recognized reflects the initial assumption that target performance goals will be achieved. Compensation expense may be

adjusted during the life of the performance grant based on management’s assessment of the probability that performance targets

will be achieved. If such targets are not met or, it is determined that achievement of performance goals is not probable,

compensation expense is adjusted to reflect the reduced expected payout level in the period the determination is made. If it is

determined that the performance targets will be exceeded, additional compensation expense is recognized.

Estimated Fair Values of Financial Instruments - Certain financial instruments are required to be recorded at the estimated

fair value. Changes in assumptions or estimation methods could affect the fair value estimates; however, we do not believe any

such changes would have a material impact on our financial condition, results of operations or cash flows. Other financial

instruments including cash and cash equivalents and short-term borrowings, including notes payable, are recorded at cost,

which approximates estimated fair value. The estimated fair values of long-term debt and financial instruments are disclosed in

Note 13 of the Notes to Consolidated Financial Statements.

Reclassifications - Certain reclassifications have been made to the prior year financial statements to conform to the current

presentation. See Note 16 of the Notes to Consolidated Financial Statements for further information.

Recently Issued Accounting Pronouncements – No new accounting pronouncement issued or effective during the fiscal year

has had or is expected to have a material impact on the consolidated financial statements.

On July 27, 2012, the Financial Accounting Standards Board (FASB) issued new guidance to simplify how entities test

indefinite-lived intangible assets for impairment. The new guidance allows an entity to first assess qualitative factors to

determine whether it is necessary to perform a quantitative indefinite-lived intangible asset impairment test. The new guidance

is effective for annual indefinite-lived intangible asset impairment tests to be performed in fiscal year 2013, with early adoption

permitted.

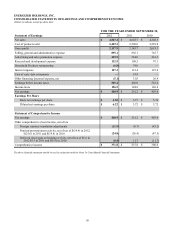

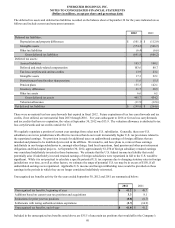

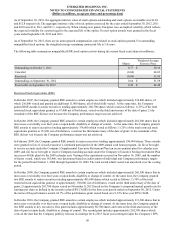

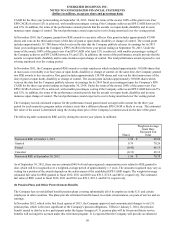

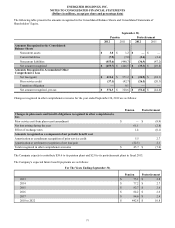

(3) Restructuring

2011 Household Products Restructuring

On March 7, 2011, the Company determined that, as part of its November 2010 restructuring initiative, it would close its

carbon zinc battery manufacturing facility in Cebu, Philippines and its alkaline battery manufacturing facility in La Chaux De

Fonds (LCF), Switzerland. The carbon zinc and alkaline batteries previously supplied by the Cebu and LCF facilities are now

produced in other manufacturing facilities.

In fiscal 2012 and 2011, the Company recorded pre-tax income for the 2011 Household Products restructuring of $6.8 and

charges of $79.0, respectively. The fiscal 2012 pre-tax income was driven by the gain on the sale of our former battery

manufacturing facility in Switzerland of $13.0, which was partially offset by $6.0 of additional restructuring costs in fiscal

2012, including severance and termination related costs of $1.2, pension settlement costs of $2.0 and related exit costs of $2.8.

The prior year charges included severance and termination related costs of $41.8, accelerated depreciation on property, plant

and equipment of $16.1, pension settlement costs of $6.1 and other related exit costs of $15.0. These costs, net of the gain on

the sale of the former LCF property in fiscal 2012, are included as a separate line item on the Consolidated Statements of

Earnings and Comprehensive Income.

The remaining accrual balance for the 2011 Household Products Restructuring at September 30, 2012 and 2011, was $0.9 and

$7.1, respectively.

In November 2012, which was the first quarter of fiscal 2013, the Company's Board of Directors authorized an enterprise-wide

restructuring plan and has delegated authority to the company's management to determine the final plan with respect to these

initiatives. See Note 20 of the Notes to Consolidated Financial Statements for further information.

62