Energizer 2012 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2012 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

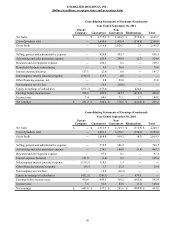

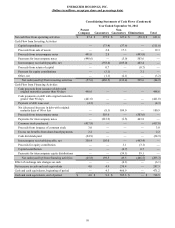

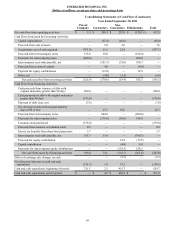

ENERGIZER HOLDINGS, INC.

(Dollars in millions, except per share and percentage data)

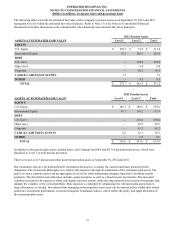

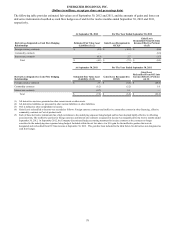

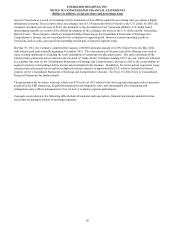

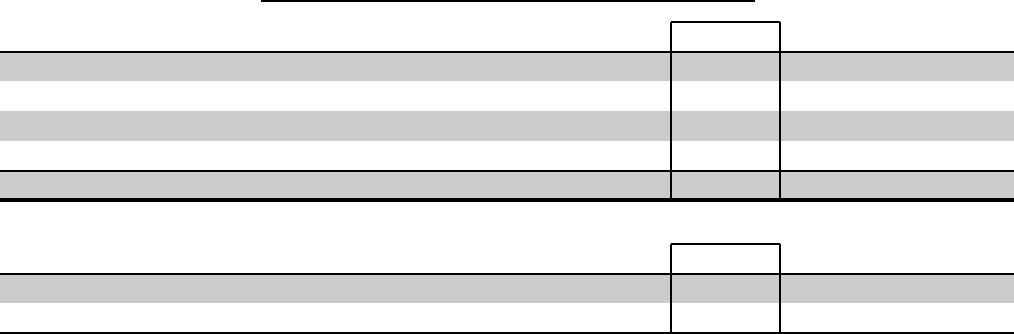

Income Tax Valuation Allowance 2012 2011 2010

Balance at beginning of year $ 12.6 $ 11.0 $ 10.3

Provision charged to expense —11.4 2.7

Reversal of provision charged to expense (0.8)(4.6)(1.3)

Write-offs, translation, other 0.1 (5.2)(0.7)

Balance at end of year $ 11.9 $ 12.6 $ 11.0

Supplemental Disclosure of Cash Flow Information 2012 2011 2010

Interest paid, including cost of early debt retirement $ 117.5 $ 141.8 $ 122.1

Income taxes paid $ 113.0 $ 206.4 $ 131.5

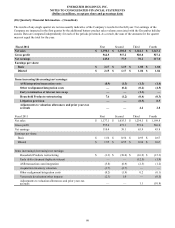

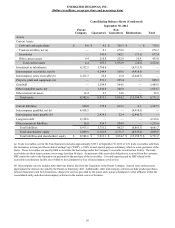

The Company has made two reclassifications for financial reporting purposes that impact the September 30, 2011, balance

sheet only. They are as follows:

• In many of the Company's foreign affiliates, a value-added tax (VAT) is included on the invoice to the customer. The

VAT is not included as part of the Company's revenue because the Company is simply collecting required taxes related

to the sale of its goods to a third party and passing that tax collection to the proper tax authorities. Historically, the

Company has reported this VAT component as part of trade receivables. We have reclassified this outstanding VAT

amount from trade receivables to other current assets. The amount of the reclassification at September 30, 2011 is

$51.9.

• The Company engages in a variety of trade promotional activities with its customers to promote its brands. The cost

of these programs have historically been accounted for as a reduction of net sales in accordance with GAAP, with an

offsetting establishment of an accrued liability. A large portion of these liabilities are paid via a customer deduction

from amounts owed to the Company for invoiced sales as the customer exercises a right of offset against trade

receivables to recoup payment for trade promotion allowances. While practice may vary depending on the type and

nature of the trade promotional activities, we believe reduction of trade receivables to reflect this estimated right of

offset is common in the industry and appropriate to reflect on the reported balance sheet. The amount reclassified to

reflect this presentation change was $131.9 at September 30, 2011.

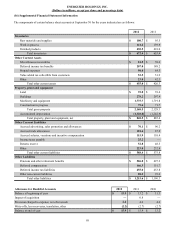

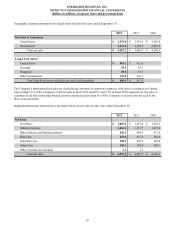

(17) Segment Information

Operations for the Company are managed via two segments - Personal Care (Wet Shave, Skin Care, Feminine Care and Infant

Care Products) and Household Products (Battery and Portable Lighting Products). On November 23, 2010, we completed the

acquisition of ASR. ASR is a leading global manufacturer of private label/value wet shaving razors and blades, and industrial

and specialty blades and is part of the Company' s Personal Care segment. Segment performance is evaluated based on

segment operating profit, exclusive of general corporate expenses, share-based compensation costs, costs associated with most

restructuring, acquisition integration or business realignment activities, and amortization of intangible assets. Financial items,

such as interest income and expense, are managed on a global basis at the corporate level. The exclusion from segment results

of charges such as inventory write-up related to purchase accounting, other acquisition transaction and integration costs, and

substantially all restructuring and realignment costs, reflects management's view on how it evaluates segment performance.

The Company's operating model includes a combination of stand-alone and combined business functions between the Personal

Care and Household Products businesses, varying by country and region of the world. Shared functions include product

warehousing and distribution, various transaction processing functions, and in some countries, a combined sales force and

management. The Company applies a fully allocated cost basis, in which shared business functions are allocated between the

segments. Such allocations do not represent the costs of such services, if performed on a stand-alone basis.

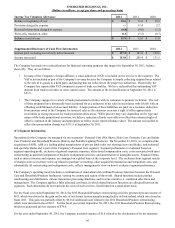

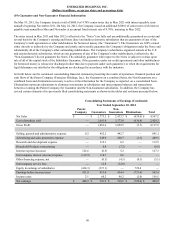

For the fiscal year ended September 30, 2012, the 2011 Household Products restructuring activities generated pre-tax income of

$6.8, which was driven by the gain on the sale of our former battery manufacturing facility in Switzerland, which was closed in

fiscal 2011. This gain was partially offset by $6.0 of additional costs related to the 2011 Household Products restructuring,

which were incurred in fiscal 2012. For the fiscal year ended September 30, 2011, the 2011 Household Products Restructuring

initiatives generated pre-tax expense of $79.0.

For the year ended September 30, 2011, the Company recorded expense of $1.8 related to the devaluation of its net monetary

84