Energizer 2012 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2012 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

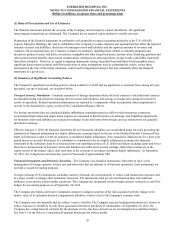

ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per share and percentage data)

for impairment as part of the Company's annual business planning cycle in the fourth quarter, or when indicators of a potential

impairment are present. The estimated fair value of each reporting unit is estimated using valuation models that incorporate

assumptions and projections of expected future cash flows and operating plans. Intangible assets with finite lives, and a

remaining weighted average life of approximately thirteen years, are amortized on a straight-line basis over expected lives of 3

years to 20 years. Such intangibles are also evaluated for impairment including ongoing monitoring of potential impairment

indicators.

Impairment of Long-Lived Assets – The Company reviews long-lived assets, other than goodwill and other intangible assets

for impairment, when events or changes in business circumstances indicate that the remaining useful life may warrant revision

or that the carrying amount of the long-lived asset may not be fully recoverable. The Company performs undiscounted cash

flow analysis to determine if impairment exists. If impairment is determined to exist, any related impairment loss is calculated

based on estimated fair value. Impairment losses on assets to be disposed of, if any, are based on the estimated proceeds to be

received, less cost of disposal.

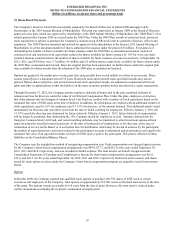

In November 2012, which is the first fiscal quarter of fiscal 2013, the Company's Board of Directors authorized an enterprise-

wide restructuring plan and has delegated authority to the company's management to determine the final plan with respect to

these initiatives.

The Company estimates one-time charges associated with the restructuring will include accelerated depreciation and asset

impairment charges on certain property, plant and equipment at facilities targeted for closing or some form of streamlining.

Based on our initial assessment, we estimate that we will incur an impairment charge in fiscal 2013 in the range of $10 to $15,

pre-tax, which we expect to record in the first quarter of fiscal 2013. Additionally, we estimate accelerated depreciation will be

in the range of $50 to $60, and will be incurred over the next 12 to 18 months as production ceases and the facilities are closed

or streamlined.

Revenue Recognition - The Company's revenue is from the sale of its products. Revenue is recognized when title, ownership

and risk of loss pass to the customer. Discounts are offered to customers for early payment and an estimate of the discounts is

recorded as a reduction of net sales in the same period as the sale. Our standard sales terms are final and returns or exchanges

are not permitted unless a special exception is made; reserves are established and recorded in cases where the right of return

does exist for a particular sale.

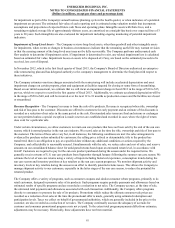

Under certain circumstances, we allow customers to return sun care products that have not been sold by the end of the sun care

season, which is normal practice in the sun care industry. We record sales at the time the title, ownership and risk of loss pass to

the customer. The terms of these sales vary but, in all instances, the following conditions are met: the sales arrangement is

evidenced by purchase orders submitted by customers; the selling price is fixed or determinable; title to the product has

transferred; there is an obligation to pay at a specified date without any additional conditions or actions required by the

Company; and collectability is reasonably assured. Simultaneously with the sale, we reduce sales and cost of sales, and reserve

amounts on our consolidated balance sheet for anticipated returns based upon an estimated return level, in accordance with

GAAP. Customers are required to pay for the sun care product purchased during the season under the required terms. We

generally receive returns of U.S. sun care products from September through January following the summer sun care season. We

estimate the level of sun care returns using a variety of inputs including historical experience, consumption trends during the

sun care season and inventory positions at key retailers as the sun care season progresses. We monitor shipment activity and

inventory levels at key retailers during the season in an effort to identify potential returns issues. This allows the Company to

manage shipment activity to our customers, especially in the latter stages of the sun care season, to reduce the potential for

returned product.

The Company offers a variety of programs, such as consumer coupons and similar consumer rebate programs, primarily to its

retail customers, designed to promote sales of its products. Such programs require periodic payments and allowances based on

estimated results of specific programs and are recorded as a reduction to net sales. The Company accrues, at the time of sale,

the estimated total payments and allowances associated with each transaction. Additionally, the Company offers programs

directly to consumers to promote the sale of its products. Promotions which reduce the ultimate consumer sale prices are

recorded as a reduction of net sales at the time the promotional offer is made, generally using estimated redemption and

participation levels. Taxes we collect on behalf of governmental authorities, which are generally included in the price to the

customer, are also recorded as a reduction of net sales. The Company continually assesses the adequacy of accruals for

customer and consumer promotional program costs not yet paid. To the extent total program payments differ from estimates,

adjustments may be necessary. Historically, these adjustments have not been material.

61