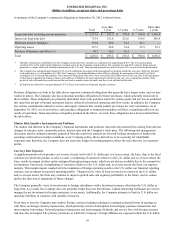

Energizer 2012 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2012 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

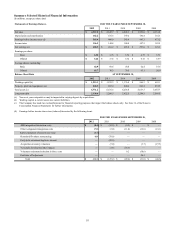

ENERGIZER HOLDINGS, INC.

(Dollars in millions, except per share and percentage data)

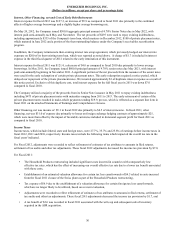

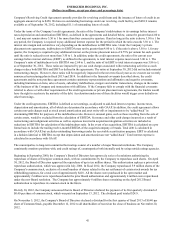

On May 24, 2012, the Company issued $500.0 aggregate principal amount of 4.70% Senior Notes due in May 2022, with

interest paid semi-annually each May and November. The net proceeds of $495 were used to repay existing indebtedness,

including approximately $335 of the Company's term loan, which matures in December 2012, $100 of private placement notes,

which matured in June 2012 and a portion of the then-outstanding balance under the Company's receivables securitization

program.

At this time, the Company has a remaining term loan outstanding of $106.5, which will mature in December 2012. We expect

to fund this repayment with available cash and other borrowing capacity.

As a result of the permanent repayment of $335 of our existing term loan, the Company terminated a then-existing interest rate

swap agreement, which previously hedged our interest rate exposure on $200 of our then-existing term loan balance. The

interest rate swap agreement was terminated following repayment of the debt associated with the interest rate swap derivative.

A charge of $1.7 was included in interest expense in fiscal 2012 related to the early termination of this hedging instrument. The

Company remains a party to an interest rate swap agreement with one major financial institution that fixes the variable

benchmark component (LIBOR) of the Company’s interest rate on $100.0 of the Company’s remaining variable rate term loan

debt through December 2012 at an interest rate of 1.9%.

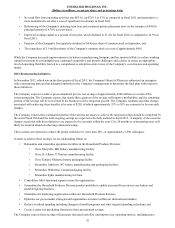

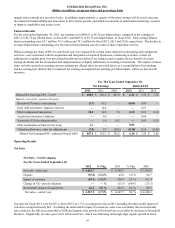

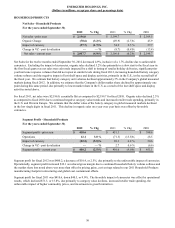

Operating Activities

Cash flow from operating activities is the primary funding source for operating needs and capital investments. Cash flow from

operating activities was $631.6 in fiscal 2012, an increase of $219.1, or 53%, as compared to fiscal 2011. Cash flow from

operating activities was $412.5 in fiscal 2011, a decrease of $239.9 as compared to $652.4 for fiscal 2010. The increase in cash

flow from operating activities in fiscal 2012 was due primarily to higher operating cash flow before changes in working capital

as fiscal 2011 included significant costs in support of the continued Schick Hydro launch as well as the 2011 Household

Products restructuring. These same factors were the drivers for the decrease in fiscal 2011 as compared to fiscal 2010.

From a working capital perspective, changes in assets and liabilities used in operations (working capital) resulted in a positive

cash flow of approximately $45 in fiscal 2012 as compared to fiscal 2011. The most significant impact was in accounts

payable due to an improvement in year over year days payable outstanding during fiscal 2012. The changes in the remaining

components of working capital essentially offset, with lower accounts receivable offset by slightly higher inventory and other

current assets.

From a working capital perspective, changes in assets and liabilities used in operations (working capital) resulted in a negative

cash flow of approximately $110 in fiscal 2011 as compared to fiscal 2010. The most significant impact was in accounts

payable and other current liabilities, which decreased collectively by approximately $120 in fiscal 2011 due primarily to the

level of promotional activities and the timing of payments. The unfavorable cash flow impact due to lower levels of accounts

payable and other current liabilities at the end of fiscal 2011 was partially offset by lower inventory of approximately $65 as we

anniversary the inventory build to support the initial Schick Hydro launch and the impact of hurricane-related inventory

reduction in the fourth quarter of fiscal 2011.

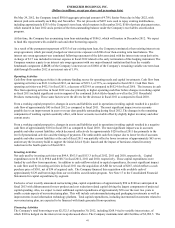

Investing Activities

Net cash used by investing activities was $94.9, $363.5 and $113.3 in fiscal 2012, 2011 and 2010, respectively. Capital

expenditures were $111.0, $98.0 and $108.7 in fiscal 2012, 2011 and 2010, respectively. These capital expenditures were

funded by cash flow from operations. In addition to cash outflows related to capital expenditures, the most significant impact

to cash flow used by investing activities in fiscal 2011 was the acquisition of ASR for net cash of $267, which reflects a cash

purchase price of $301, net of $34 of acquired cash. The Company financed this acquisition with available cash of

approximately $129 and borrowings from our receivables securitization program. See Note 17 to the Consolidated Financial

Statements for capital expenditures by segment.

Exclusive of our recently announced restructuring plan, capital expenditures of approximately $90 to $100 are anticipated in

fiscal 2013 with disbursements for new product and cost reduction-related capital driving the largest components of projected

capital spending. Also, we expect to incur additional capital expenditures of approximately $50 over the next two years to

enable certain aspects of our restructuring plan. This will include certain manufacturing and packaging investments as well as

improvements in our information technology platform. Total capital expenditures, including incremental investments related to

our restructuring plan, are expected to be financed with funds generated from operations.

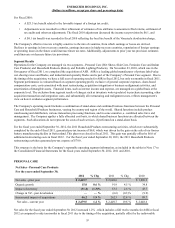

Financing Activities

The Company’s total borrowings were $2,532.5 at September 30, 2012, including $268.9 tied to variable interest rates, of

which $100 is hedged via the interest rate swap discussed above. The Company maintains total debt facilities of $2,982.5. The

41