Energizer 2012 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2012 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

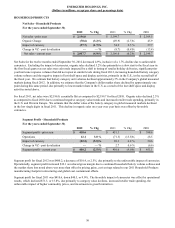

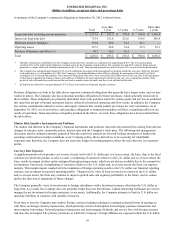

ENERGIZER HOLDINGS, INC.

(Dollars in millions, except per share and percentage data)

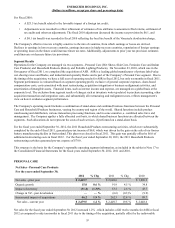

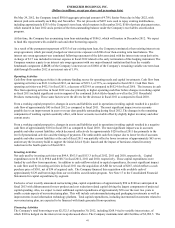

• Net cash flow from operating activities was $631.6, up $219.1 or 53% as compared to fiscal 2011 and returning to a

more normalized level after a year of significant investments in fiscal 2011,

• Refinancing of the Company's maturing term loan and a matured private placement note via the issuance of $500.0

principal amount of 4.70% ten year notes,

• Improved working capital as a percent of net sales, which declined to 21.4% for fiscal 2012 as compared to 22.9% in

fiscal 2011,

• Payment of the Company's first quarterly dividend of $0.40 per share of common stock in September, and

• The repurchase of 5.9 million shares of the Company's common stock at a cost of approximately $418.

While the Company has made improvements to its battery manufacturing footprint, and has initiated efforts to reduce working

capital investment in a meaningful way, continued competitive and growth challenges and a desire to ensure an appropriate

level of operating flexibility has led to a comprehensive enterprise-wide review of the Company's cost structure and operating

model.

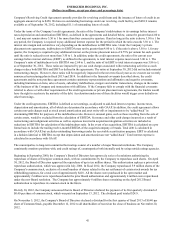

2013 Restructuring Initiatives

In November 2012, which was in the first quarter of fiscal 2013, the Company's Board of Directors authorized an enterprise-

wide restructuring plan and has delegated authority to the Company's management to determine the final plan with respect to

these initiatives.

The Company expects to achieve gross annualized pre-tax cost savings of approximately $200 million as a result of this

restructuring plan. The Company expects that nearly three quarters of the savings will improve profitability, and the remaining

portion of the savings will be re-invested in the business to drive long-term growth. The Company estimates one-time charges

associated with achieving these benefits to be near of $250, of which approximately 25% to 30% are estimated to be non-cash

charges.

The Company expects that a substantial portion of the actions necessary to achieve the targeted savings should be completed by

the end of fiscal 2014 and the total on-going savings are expected to be fully realized in fiscal 2015. A majority of the one-time

charges associated with these initiatives are expected to be recorded within the next 12 to 20 months as restructuring costs will

likely be incurred ahead of achieving estimated savings.

These actions are expected to reduce the global workforce by more than 10%, or approximately 1,500 colleagues.

In order to achieve these savings, we are undertaking efforts to:

• Rationalize and streamline operations facilities in the Household Products Division:

Close Maryville, MO battery manufacturing facility

Close St. Albans, VT battery manufacturing facility

Close Tampoi, Malaysia battery packaging facility

Streamline Asheboro, NC battery manufacturing and packaging facilities

Streamline Walkerton, Canada packaging facility

Streamline lights manufacturing in China

• Consolidate G&A functional support across the organization;

• Streamline the Household Products Division product portfolio to enable increased focus on our core battery and

portable lighting business;

• Streamline the marketing organization within our Household Products division;

• Optimize our go-to-market strategies and organization structures within our international markets;

• Reduce overhead spending including changes to benefit programs and other targeted spending reductions; and

• Create a center-led purchasing function to drive procurement savings.

The Company expects these savings will generate increased cash flow and improve key operating metrics, including gross

33