Energizer 2012 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2012 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

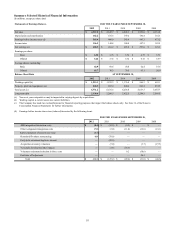

ENERGIZER HOLDINGS, INC.

(Dollars in millions, except per share and percentage data)

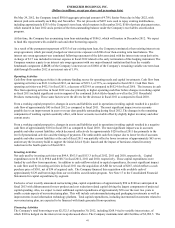

Company's Revolving Credit Agreement currently provides for revolving credit loans and the issuance of letters of credit in an

aggregate amount of up to $450. We have no outstanding borrowings under our revolving credit facility, and $438.9 remains

available as of September 30, 2012, including $11.1 of outstanding letters of credit.

Under the terms of the Company’s credit agreements, the ratio of the Company’s indebtedness to its earnings before interest

taxes depreciation and amortization (EBITDA), as defined in the agreements and detailed below, cannot be greater than 4.00 to

1, and may not remain above 3.50 to 1 for more than four consecutive quarters. If and so long as the ratio is above 3.50 to 1 for

any period, the Company is required to pay additional interest expense for the period in which the ratio exceeds 3.50 to 1. The

interest rate margin and certain fees vary depending on the indebtedness to EBITDA ratio. Under the Company’s private

placement note agreements, indebtedness to EBITDA may not be greater than 4.00 to 1; if the ratio is above 3.50 to 1, for any

quarter, the Company is required to pay additional interest on the private placement notes of 0.75% per annum for each quarter

until the ratio is reduced to not more than 3.50 to 1. In addition, under the credit agreements, the ratio of its current year

earnings before interest and taxes (EBIT), as defined in the agreements, to total interest expense must exceed 3.00 to 1. The

Company’s ratio of indebtedness to its EBITDA was 2.64 to 1, and the ratio of its EBIT to total interest expense was 5.86 to 1,

as of September 30, 2012. These ratios are impacted by pre-tax cash charges associated with restructuring activities as such

charges reduce both EBITDA and EBIT as defined in the agreements. The ratios at September 30, 2012 did not include material

restructuring charges. However, these ratios will be negatively impacted in the next two fiscal years as we execute our recently

announced restructuring plan in fiscal 2013 and 2014. In addition to the financial covenants described above, the credit

agreements and the note purchase agreements contain customary representations and affirmative and negative covenants,

including limitations on liens, sales of assets, subsidiary indebtedness, mergers and similar transactions, changes in the nature

of the business of the Company and transactions with affiliates. If the Company fails to comply with the financial covenants

referred to above or with other requirements of the credit agreements or private placement note agreements, the lenders would

have the right to accelerate the maturity of the debt. Acceleration under one of these facilities would trigger cross defaults on

other borrowings.

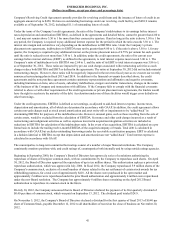

Under the credit agreements, EBITDA is defined as net earnings, as adjusted to add-back interest expense, income taxes,

depreciation and amortization, all of which are determined in accordance with GAAP. In addition, the credit agreement allows

certain non-cash charges such as stock award amortization and asset write-offs or impairments to be “added-back” in

determining EBITDA for purposes of the indebtedness ratio. However, unusual gains, such as those resulting from the sale of

certain assets, would be excluded from the calculation of EBITDA. Severance and other cash charges incurred as a result of

restructuring and realignment activities as well as expenses incurred in acquisition integration activities are included as

reductions in EBITDA for calculation of the indebtedness ratio. In the event of an acquisition, EBITDA is calculated on a pro

forma basis to include the trailing twelve-month EBITDA of the acquired company or brands. Total debt is calculated in

accordance with GAAP, but excludes outstanding borrowings under the receivable securitization program. EBIT is calculated

in a fashion identical to EBITDA except that depreciation and amortization are not “added-back”. Total interest expense is

calculated in accordance with GAAP.

The counterparties to long-term committed borrowings consist of a number of major financial institutions. The Company

consistently monitors positions with, and credit ratings of, counterparties both internally and by using outside ratings agencies.

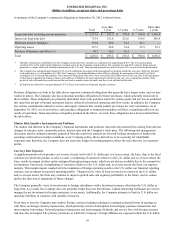

Beginning in September 2000, the Company’s Board of Directors has approved a series of resolutions authorizing the

repurchase of shares of Energizer common stock, with no commitments by the Company to repurchase such shares. On April

30, 2012, the Board of Directors approved the repurchase of up to ten million shares. This authorization replaces a prior stock

repurchase authorization, which was approved in July 2006. In fiscal 2012, the Company repurchased 5.9 million shares of the

Company's common stock, exclusive of a small number of shares related to the net settlement of certain stock awards for tax

withholding purposes, for a total cost of approximately $418. All the shares were purchased in the open market and

approximately 2 million were repurchased under the prior Board authorization and approximately 4 million were repurchased

under the new Board resolution. The Company has approximately 6 million shares remaining on the April 2012 Board

authorization to repurchase its common stock in the future.

On July 30, 2012, the Company announced that its Board of Directors declared the payment of its first quarterly dividend of

$0.40 per share of common stock, which was paid on September 13, 2012. The dividend paid totaled $24.9.

On November 5, 2012, the Company's Board of Directors declared a dividend for the first quarter of fiscal 2013 of $0.40 per

share of Common Stock, payable December 12, 2012 to all shareholders of record on the close of business on November 20,

2012.

42