Energizer 2012 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2012 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per share and percentage data)

defined contribution benefit in conjunction with this action, but this change is expected to result in an overall reduction in the

costs of retirement service benefits for U.S. colleagues. We expect to recognize a curtailment gain in pre-tax earnings of

between $30 to $40 in the first fiscal quarter of 2013 as a result of this plan change. This estimate may vary from the actual

curtailment gain recorded due primarily to changes in market interest rates and other factors.

The Company also sponsors or participates in a number of other non-U.S. pension arrangements, including various retirement

and termination benefit plans, some of which are required by local law or coordinated with government-sponsored plans, which

are not significant in the aggregate and, therefore, are not included in the information presented in the following tables.

The Company currently provides other postretirement benefits, consisting of health care and life insurance benefits for certain

groups of retired employees. Certain retirees are eligible for a fixed subsidy, provided by the Company, toward their total cost

of health care benefits. Retiree contributions for health care benefits are adjusted periodically to cover the entire increase in

total plan costs. Cost trend rates no longer materially impact the Company’s future cost of the plan due to the fixed nature of

the subsidy.

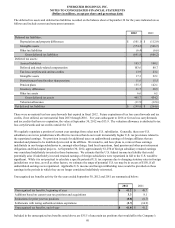

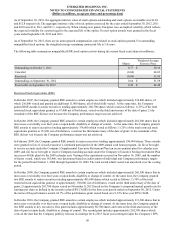

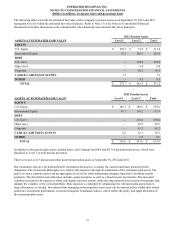

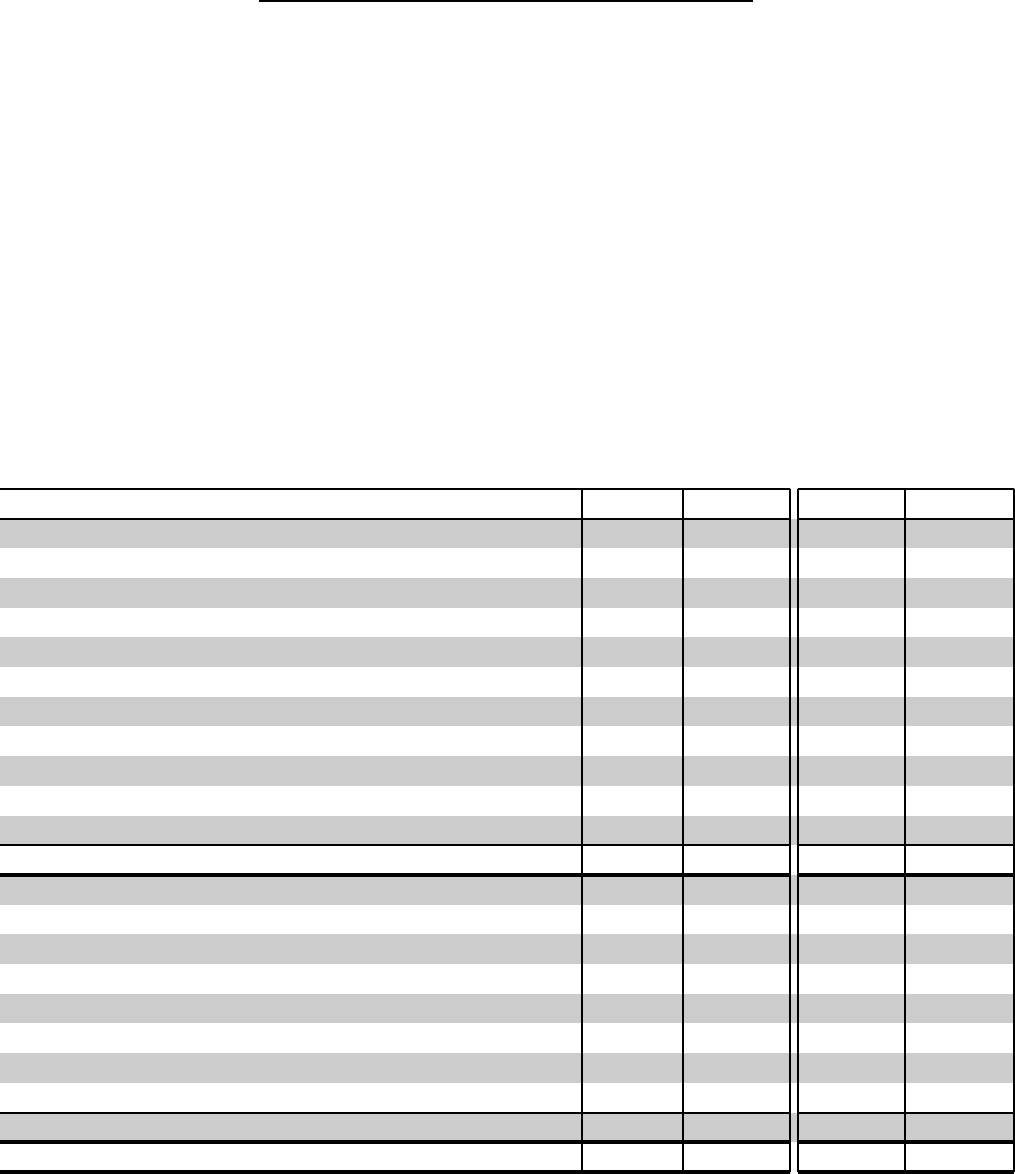

The following tables present the benefit obligation, plan assets and funded status of the plans:

September 30,

Pension Postretirement

2012 2011 2012 2011

Change in Projected Benefit Obligation

Benefit obligation at beginning of year $ 1,261.5 $ 1,046.9 $ 50.5 $ 44.4

Service cost 26.7 28.9 0.5 0.5

Interest cost 55.8 55.9 2.3 2.7

Plan participants' contributions 0.4 1.1 5.6 5.0

Actuarial loss/(gain) 124.1 15.0 (2.9)(7.1)

Benefits paid, net (71.7)(78.1)(8.1)(7.3)

Plan amendments ——(8.9)—

Special termination benefits —9.6 ——

Net transfer primarily due to acquisition —177.7 —12.5

Foreign currency exchange rate changes 0.1 4.5 0.7 (0.2)

Projected Benefit Obligation at end of year $ 1,396.9 $ 1,261.5 $ 39.7 $ 50.5

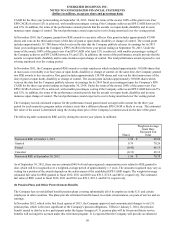

Change in Plan Assets

Estimated fair value of plan assets at beginning of year $ 815.0 $ 752.8 $ 0.7 $ 1.0

Net transfer primarily due to acquisition —72.5 ——

Actual return on plan assets 125.9 12.3 ——

Company contributions 63.2 52.7 2.2 2.0

Plan participants' contributions 0.4 1.1 5.6 5.0

Benefits paid (71.7)(78.1)(8.1)(7.3)

Foreign currency exchange rate changes 4.4 1.7 ——

Estimated fair value of plan assets at end of year $ 937.2 $ 815.0 $ 0.4 $ 0.7

Funded status at end of year $(459.7)$(446.5)$(39.3)$(49.8)

70