Energizer 2012 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2012 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

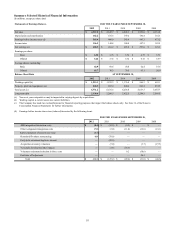

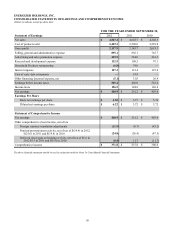

ENERGIZER HOLDINGS, INC.

(Dollars in millions, except per share and percentage data)

future service benefits will no longer be accrued under this retirement program. It is expected that the Company will

provide an enhanced defined contribution benefit in conjunction with this action, but this change is expected to result

in an overall reduction in the costs of retirement benefits for U.S. colleagues. We expect to recognize a curtailment

gain in pre-tax earnings of between $30 to $40 in the first fiscal quarter of 2013 as a result of this plan change. This

estimate may vary from the actual curtailment gain due primarily to changes in market interest rates and other factors.

• Share-Based Compensation The Company grants restricted stock equivalents, which generally vest over three to

four years. A portion of the restricted stock equivalents granted provide for the issuance of common stock to certain

managerial staff and executive management if the Company achieves specified performance targets. The estimated

fair value of each grant issued is estimated on the date of grant based on the current market price of the stock. The

total amount of compensation expense recognized reflects the initial assumption that target performance goals will be

achieved. Compensation expense may be adjusted during the life of the performance grant based on management’s

assessment of the probability that performance goals will be achieved. If such goals are not met or it is determined that

achievement of performance goals is not probable, compensation expense is adjusted to reflect the reduced expected

payout level. If it is determined that the performance goals will be exceeded, additional compensation expense is

recognized.

• Valuation of Long-Lived Assets The Company periodically evaluates its long-lived assets, including property, plant

and equipment, goodwill and intangible assets, for potential impairment indicators. Judgments regarding the existence

of impairment indicators, including lower than expected cash flows from acquired businesses, are based on legal

factors, market conditions and operational performance. Future events could cause the Company to conclude that

impairment indicators exist. The Company estimates fair value using valuation techniques such as discounted cash

flows. This requires management to make assumptions regarding future income, working capital and discount rates,

which would affect the impairment calculation. See the discussion on “Acquisitions, Goodwill and Intangible Assets”

included later in this section for further information.

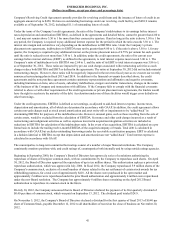

In November 2012, which is the first quarter of fiscal 2013, the Company's Board of Directors authorized an

enterprise-wide restructuring plan and has delegated authority to the company's management to determine the final

plan with respect to these initiatives.

The Company estimates one-time charges associated with the restructuring will include accelerated depreciation and

asset impairment charges on certain manufacturing assets including property, plant and equipment located at the

facilities targeted for closing or some form of streamlining in our recently announced restructuring plan. Based on our

initial assessment, we estimate that we will incur an impairment charge in fiscal 2013 in the range of $10 to $15, pre-

tax, which we expect to record in the first quarter of fiscal 2013. Additionally, we estimate accelerated depreciation on

this specific property, plant and equipment will be in the range of $50 to $60, and will be incurred over the next 12 to

18 months as facilities are closed or streamlined. We do not believe our restructuring plan will result in the

impairment of any other material long-lived assets, other than the identified property, plant and equipment. For further

discussion see the Company overview section above.

• Income Taxes Our annual tax rate is determined based on our income, statutory tax rates and the tax impacts of items

treated differently for tax purposes than for financial reporting purposes. Tax law requires certain items be included in

the tax return at different times than the items are reflected in the financial statements. Some of these differences are

permanent, such as expenses that are not deductible in our tax return, and some differences are temporary, reversing

over time, such as depreciation expense. These temporary differences create deferred tax assets and liabilities.

Deferred tax assets generally represent the tax effect of items that can be used as a tax deduction or credit in future

years for which we have already recorded the tax benefit in our income statement. Deferred tax liabilities generally

represent tax expense recognized in our financial statements for which payment has been deferred, the tax effect of

expenditures for which a deduction has already been taken in our tax return but has not yet been recognized in our

financial statements or assets recorded at estimated fair value in business combinations for which there was no

corresponding tax basis adjustment.

We regularly repatriate a portion of current year earnings from select non U.S. subsidiaries. Generally, these non-U.S.

subsidiaries are in tax jurisdictions with effective tax rates that do not result in materially higher U.S. tax provisions

related to the repatriated earnings. No provision is made for additional taxes on undistributed earnings of foreign

affiliates that are intended and planned to be indefinitely invested in the affiliate. We intend to, and have plans to,

reinvest these earnings indefinitely in our foreign subsidiaries to fund local operations, fund pension and other post

retirement obligations and fund capital projects.

The Company estimates income taxes and the income tax rate in each jurisdiction that it operates. This involves

48