Dish Network 2015 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2015 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

77

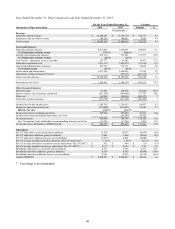

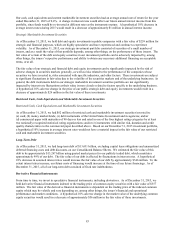

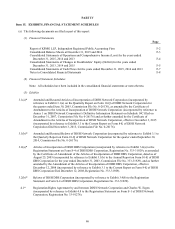

Obligations and Future Capital Requirements

Contractual Obligations and Off-Balance Sheet Arrangements

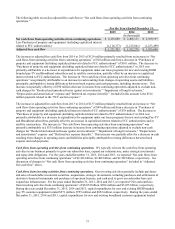

As of December 31, 2015, future maturities of our long-term debt, capital lease and contractual obligations are

summarized as follows:

Payments due by period

Total 2016 2017 2018 2019 2020 Thereafter

(In thousands)

Long-term debt obligations $ 13,630,996 $ 1,503,151 $ 903,170 $ 1,203,235 $ 1,403,305 $ 1,103,379 $ 7,514,756

Capital lease obligations 166,492 30,849 32,994 36,175 19,503 19,137 27,834

Interest expense on long-term debt

and capital lease obligations 4,206,125 772,289 716,328 646,445 618,716 479,170 973,177

Satellite-related obligations 1,960,083 411,734 336,526 327,197 301,102 241,371 342,153

Operating lease obligations 178,918 52,305 32,960 22,563 15,623 10,040 45,427

Purchase obligations 2,325,567 1,768,934 248,443 165,584 115,814 11,892 14,900

Total $ 22,468,181 $ 4,539,262 $ 2,270,421 $ 2,401,199 $ 2,474,063 $ 1,864,989 $ 8,918,247

In certain circumstances the dates on which we are obligated to make these payments could be delayed. These amounts

will increase to the extent that we procure launch and/or in-orbit insurance on our satellites or contract for the

construction, launch or lease of additional satellites.

The table above does not include $336 million of liabilities associated with unrecognized tax benefits that were accrued,

as discussed in Note 11 in the Notes to our Consolidated Financial Statements in this Annual Report on Form 10-K, and

are included on our Consolidated Balance Sheets as of December 31, 2015. We do not expect any portion of this amount

to be paid or settled within the next twelve months.

Other than the “Guarantees” disclosed in Note 15 in the Notes to our Consolidated Financial Statements in this Annual

Report on Form 10-K, we generally do not engage in off-balance sheet financing activities.

Satellite Insurance

We generally do not carry commercial launch or in-orbit insurance on any of the satellites that we use, other than certain

satellites leased from third parties. We generally do not use commercial insurance to mitigate the potential financial

impact of launch or in-orbit failures because we believe that the cost of insurance premiums is uneconomical relative to

the risk of such failures. In light of current favorable market conditions, during January 2016, we procured commercial

launch and in-orbit insurance (for a period of one year following launch) for the EchoStar XVIII satellite, which is

expected to launch during the second quarter 2016. We lease substantially all of our satellite capacity from third parties,

including the vast majority of our transponder capacity from EchoStar, and we do not carry commercial insurance on any

of the satellites that we lease from them. While we generally have had in-orbit satellite capacity sufficient to transmit

our existing channels and some backup capacity to recover the transmission of certain critical programming, our backup

capacity is limited. In the event of a failure or loss of any of our satellites, we may need to acquire or lease additional

satellite capacity or relocate one of our other satellites and use it as a replacement for the failed or lost satellite.

Purchase Obligations

Our 2016 purchase obligations primarily consist of binding purchase orders for receiver systems and related equipment,

broadband equipment, digital broadcast operations, transmission costs, engineering services, and other products and

services related to the operation of our Pay-TV services and broadband service. Our purchase obligations also include

certain fixed contractual commitments to purchase programming content. Our purchase obligations can fluctuate

significantly from period to period due to, among other things, management’s timing of payments and inventory

purchases, and can materially impact our future operating asset and liability balances, and our future working capital

requirements.