Dish Network 2015 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2015 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.66

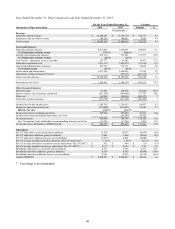

During the years ended December 31, 2015 and 2014, the amount of equipment capitalized under our lease program for

new DISH branded pay-TV subscribers totaled $429 million and $543 million, respectively. This decrease in capital

expenditures under our lease program for new DISH branded pay-TV subscribers resulted primarily from a decrease in

hardware costs per activation, discussed above.

To remain competitive we upgrade or replace subscriber equipment periodically as technology changes, and the costs

associated with these upgrades may be substantial. To the extent technological changes render a portion of our existing

equipment obsolete, we would be unable to redeploy all returned equipment and consequently would realize less benefit

from the Pay-TV SAC reduction associated with redeployment of that returned lease equipment.

Our “Subscriber acquisition costs” and “Pay-TV SAC” may materially increase in the future to the extent that we, among

other things, transition to newer technologies, introduce more aggressive promotions, or provide greater equipment

subsidies. See further information under “Liquidity and Capital Resources — Subscriber Acquisition and Retention

Costs.”

FCC auction expense. On October 1, 2015, Northstar Wireless and SNR Wireless notified the FCC that they would not

be paying the gross winning bid amounts on certain AWS-3 Licenses. As a result, the FCC retained those AWS-3

Licenses and Northstar Wireless and SNR Wireless owed the FCC an additional interim payment of approximately $516

million. See Note 15 in the Notes to our Consolidated Financial Statements in this Annual Report on Form 10-K for

further information.

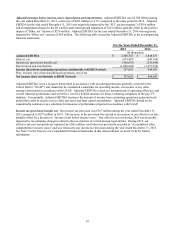

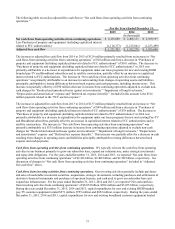

Depreciation and amortization. “Depreciation and amortization” expense totaled $1.000 billion during the year ended

December 31, 2015, a $78 million or 7.2% decrease compared to the same period in 2014. During the year ended

December 31, 2015, we had a decrease in depreciation expense from equipment leased to new and existing DISH

branded pay-TV subscribers and from certain assets that support the DISH branded pay-TV service, which became fully

depreciated during 2015. In addition, depreciation expense was lower in 2015 as a result of certain satellites transferred

to EchoStar as part of the Satellite and Tracking Stock Transaction.

Impairment of long-lived assets. “Impairment of long-lived assets” of $123 million during the year ended December 31,

2015 resulted from an impairment of the D1 satellite and related ground equipment. See Note 8 in the Notes to our

Consolidated Financial Statements in this Annual Report on Form 10-K for further information.

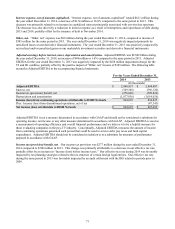

Interest expense, net of amounts capitalized. “Interest expense, net of amounts capitalized” totaled $494 million during

the year ended December 31, 2015, a decrease of $117 million or 19.2% compared to the same period in 2014. This

decrease was primarily related to an increase in capitalized interest principally associated with wireless spectrum and a

reduction in interest expense from debt redemptions during 2015 and 2014, partially offset by interest expense associated

with the issuance in November 2014 of our 5 7/8% Senior Notes due 2024. On October 27, 2015, the FCC granted the

Northstar Licenses to Northstar Wireless and the SNR Licenses to SNR Wireless. We began capitalizing interest

expense related to the commercialization of these wireless spectrum licenses in the fourth quarter 2015. See Note 2 in

the Notes to our Consolidated Financial Statements in this Annual Report on Form 10-K for further information.

Other, net. “Other, net” income was $278 million during the year ended December 31, 2015, compared to expense of

$69 million for the same period in 2014. The year ended December 31, 2015 was positively impacted by net realized

and/or unrealized gains on our marketable investment securities and derivative financial instruments. The year ended

December 31, 2014 was negatively impacted primarily by unrealized losses on our derivative financial instruments. See

Note 6 in the Notes to our Consolidated Financial Statements in this Annual Report on Form 10-K for further

information.