Dish Network 2015 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2015 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-31

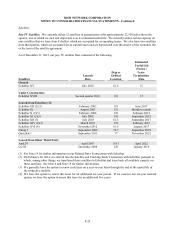

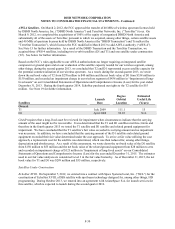

Satellite Anomalies

Operation of our DISH branded pay-TV service requires that we have adequate satellite transmission capacity for

the programming that we offer. Moreover, current competitive conditions require that we continue to expand our

offering of new programming. While we generally have had in-orbit satellite capacity sufficient to transmit our

existing channels and some backup capacity to recover the transmission of certain critical programming, our backup

capacity is limited.

In the event of a failure or loss of any of our owned or leased satellites, we may need to acquire or lease additional

satellite capacity or relocate one of our other owned or leased satellites and use it as a replacement for the failed or

lost satellite. Such a failure could result in a prolonged loss of critical programming or a significant delay in our

plans to expand programming as necessary to remain competitive and thus may have a material adverse effect on

our business, financial condition and results of operations.

In the past, certain of our owned and leased satellites have experienced anomalies, some of which have had a

significant adverse impact on their remaining useful life and/or commercial operation. There can be no assurance

that future anomalies will not impact the remaining useful life and/or commercial operation of any of the owned and

leased satellites in our fleet. See Note 2 “Impairment of Long-Lived Assets” for further information on evaluation

of impairment. There can be no assurance that we can recover critical transmission capacity in the event one or

more of our owned or leased in-orbit satellites were to fail. We generally do not carry commercial launch or in-orbit

insurance on any of the owned or leased satellites that we use, other than certain satellites leased from third parties,

and therefore, we will bear the risk associated with any uninsured in-orbit satellite failures. In light of current

favorable market conditions, during January 2016, we procured commercial launch and in-orbit insurance (for a

period of one year following launch) for the EchoStar XVIII satellite, which is expected to launch during the second

quarter 2016.

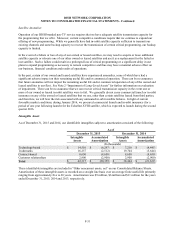

Intangible Assets

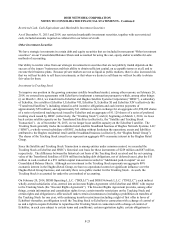

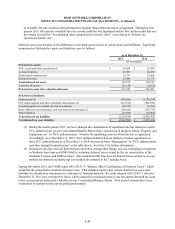

As of December 31, 2015 and 2014, our identifiable intangibles subject to amortization consisted of the following:

As of

December 31, 2015 December 31, 2014

Intangible Accumulated Intangible Accumulated

Assets Amortization Assets Amortization

(In thousands)

Technology-based $ 14,510 $ (6,297) $ 7,210 $ (4,445)

Trademarks 16,257 (2,512) 19,704 (5,644)

Contract-based 8,650 (8,650) 8,650 (8,650)

Customer relationships 2,900 (2,900) 2,900 (2,900)

Total $ 42,317 $ (20,359) $ 38,464 $ (21,639)

These identifiable intangibles are included in “Other noncurrent assets, net” on our Consolidated Balance Sheets.

Amortization of these intangible assets is recorded on a straight line basis over an average finite useful life primarily

ranging from approximately five to 20 years. Amortization was $9 million, $6 million and $11 million for the years

ended December 31, 2015, 2014 and 2013, respectively.