Dish Network 2015 Annual Report Download - page 115

Download and view the complete annual report

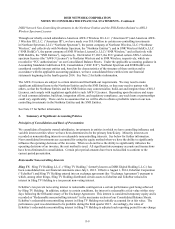

Please find page 115 of the 2015 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-11

Discontinued Operations

On April 26, 2011, we completed the acquisition of most of the assets of Blockbuster, Inc. (the “Blockbuster

Acquisition”). As of December 31, 2013, Blockbuster had ceased material operations. The results of Blockbuster

are presented for all periods as discontinued operations in our consolidated financial statements. On January 14,

2014, we completed the sale of our Blockbuster operations in Mexico. See Note 9 for additional information

regarding our discontinued operations.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United

States (“GAAP”) requires us to make estimates and assumptions that affect the reported amounts of assets and

liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported

amounts of revenue and expense for each reporting period. Estimates are used in accounting for, among other

things, allowances for doubtful accounts, self-insurance obligations, deferred taxes and related valuation allowances,

uncertain tax positions, loss contingencies, fair value of financial instruments, fair value of options granted under

our stock-based compensation plans, fair value of assets and liabilities acquired in business combinations, fair value

of multi-element arrangements, capital leases, asset impairments, estimates of future cash flows used to evaluate

impairments, useful lives of property, equipment and intangible assets, retailer incentives, programming expenses

and subscriber lives. Economic conditions may increase the inherent uncertainty in the estimates and assumptions

indicated above. Actual results may differ from previously estimated amounts, and such differences may be

material to our consolidated financial statements. Estimates and assumptions are reviewed periodically, and the

effects of revisions are reflected prospectively in the period they occur.

Cash and Cash Equivalents

We consider all liquid investments purchased with a remaining maturity of 90 days or less at the date of acquisition

to be cash equivalents. Cash equivalents as of December 31, 2015 and 2014 may consist of money market funds,

government bonds, corporate notes and commercial paper. The cost of these investments approximates their fair

value.

Marketable Investment Securities

We currently classify all marketable investment securities as available-for-sale, except for investments accounted for

under the fair value option, discussed below. We adjust the carrying amount of our available-for-sale securities to

fair value and report the related temporary unrealized gains and losses as a separate component of “Accumulated

other comprehensive income (loss)” within “Total stockholders’ equity (deficit),” net of related deferred income tax.

Declines in the fair value of a marketable investment security which are determined to be “other-than-temporary”

are recognized in the Consolidated Statements of Operations and Comprehensive Income (Loss), thus establishing a

new cost basis for such investment.

For certain of our marketable investment securities, we have elected to

recognize the changes in fair value through “Other, net” within “Other Income (Expense)” on our Consolidated

Statements of Operations and Comprehensive Income (Loss) (the “Fair Value Option”).

We evaluate our marketable investment securities portfolio on a quarterly basis to determine whether declines in the

fair value of these securities are other-than-temporary. This quarterly evaluation consists of reviewing, among other

things:

x the fair value of our marketable investment securities compared to the carrying amount,

x the historical volatility of the price of each security, and

x any market and company specific factors related to each security.