Dish Network 2015 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2015 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-18

x “Other subscriber acquisition costs” includes net costs related to promotional incentives and costs related

to installation and other promotional subsidies for our DISH branded pay-TV service as well as our direct

sales efforts and commissions for our Sling branded pay-TV services.

x “Subscriber acquisition advertising” includes advertising and marketing expenses related to the acquisition

of new Pay-TV and Broadband subscribers. Advertising costs are expensed as incurred.

We characterize amounts paid to our independent retailers as consideration for equipment installation services and

for equipment buydowns (incentives and rebates) as a reduction of revenue. We expense payments for equipment

installation services as “Other subscriber acquisition costs.” Our payments for equipment buydowns represent a

partial or complete return of the independent retailer’s purchase price and are, therefore, netted against the proceeds

received from the independent retailer. We report the net cost from our various sales promotions through our

independent retailer network as a component of “Other subscriber acquisition costs.”

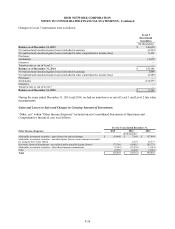

Derivative Financial Instruments

We may purchase and hold derivative financial instruments for, among other reasons, strategic or speculative

purposes. We record all derivative financial instruments on our Consolidated Balance Sheets at fair value as either

assets or liabilities. Changes in the fair values of derivative financial instruments are recognized in our results of

operations and included in “Other, net” within “Other Income (Expense)” on our Consolidated Statements of

Operations and Comprehensive Income (Loss). We currently have not designated any derivative financial

instrument for hedge accounting.

As of December 31, 2015 and 2014, we held derivative financial instruments indexed to the trading price of

common equity securities with a fair value of $557 million and $383 million, respectively. The fair value of the

derivative financial instruments is dependent on the trading price of the indexed common equity securities, which

may be volatile and vary depending on, among other things, the issuer’s financial and operational performance and

market conditions.

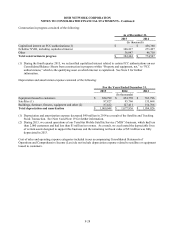

Equipment Lease Programs

DISH branded pay-TV subscribers have the choice of leasing or purchasing the satellite receiver and other

equipment necessary to receive our DISH branded pay-TV service. Most of our new DISH branded pay-TV

subscribers choose to lease equipment and thus we retain title to such equipment. New Broadband subscribers lease

the modem and other equipment necessary to receive broadband services. Equipment leased to new and existing

DISH branded pay-TV and Broadband subscribers is capitalized and depreciated over their estimated useful lives.

New Accounting Pronouncements

Revenue from Contracts with Customers. On May 28, 2014, the Financial Accounting Standards Board (“FASB”)

issued Accounting Standards Update 2014-09 (“ASU 2014-09”), Revenue from Contracts with Customers. This

converged standard on revenue recognition was issued jointly with the International Accounting Standards Board

(“IASB”) to improve financial reporting by creating common revenue recognition guidance for GAAP and

International Financial Reporting Standards (“IFRS”). ASU 2014-09 provides a framework for revenue recognition

that replaces most existing GAAP revenue recognition guidance when it becomes effective. ASU 2014-09 allows for

either a full retrospective or modified retrospective adoption. We are evaluating the effect that ASU 2014-09 will

have on our consolidated financial statements and related disclosures. We have not yet selected an adoption method

nor have we determined the effect of the standard on our ongoing financial reporting. The new standard could impact

revenue and cost recognition for a significant number of our contracts, as well as our business processes and

information technology systems. As a result, our evaluation of the effect of the new standard will likely extend over

several future periods. On July 9, 2015, the FASB approved a one year deferral on the effective date for

implementation of this standard, which changed the effective date for us to January

1, 2018.