Dish Network 2015 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2015 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.47

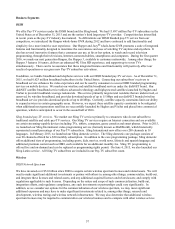

Our debt levels could have significant consequences, including:

x making it more difficult to satisfy our obligations;

x a dilutive effect on our outstanding equity capital or future earnings;

x increasing our vulnerability to general adverse economic conditions, including changes in interest rates;

x requiring us to devote a substantial portion of our cash to make interest and principal payments on our debt,

thereby reducing the amount of cash available for other purposes. As a result, we would have limited financial

and operating flexibility in responding to changing economic and competitive conditions;

x limiting our ability to raise additional debt because it may be more difficult for us to obtain debt financing on

attractive terms; and

x placing us at a disadvantage compared to our competitors that are less leveraged.

In addition, we may incur substantial additional debt in the future. The terms of the indentures relating to our senior

notes permit us to incur additional debt. If new debt is added to our current debt levels, the risks we now face could

intensify.

It may be difficult for a third party to acquire us, even if doing so may be beneficial to our shareholders, because of

our ownership structure.

Certain provisions of our certificate of incorporation and bylaws may discourage, delay or prevent a change in control of

our company that a shareholder may consider favorable. These provisions include the following:

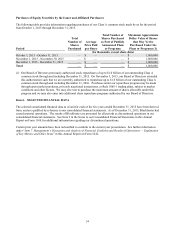

x a capital structure with multiple classes of common stock: a Class A that entitles the holders to one vote per

share, a Class B that entitles the holders to ten votes per share, a Class C that entitles the holders to one vote per

share, except upon a change in control of our company in which case the holders of Class C are entitled to ten

votes per share;

x a provision that authorizes the issuance of “blank check” preferred stock, which could be issued by our Board of

Directors to increase the number of outstanding shares and thwart a takeover attempt;

x a provision limiting who may call special meetings of shareholders; and

x a provision establishing advance notice requirements for nominations of candidates for election to our Board of

Directors or for proposing matters that can be acted upon by shareholders at shareholder meetings.

In addition, pursuant to our certificate of incorporation we have a significant amount of authorized and unissued stock

which would allow our Board of Directors to issue shares to persons friendly to current management, thereby protecting

the continuity of its management, or which could be used to dilute the stock ownership of persons seeking to obtain

control of us.

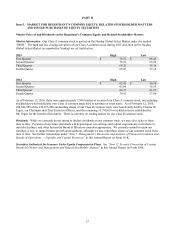

We are controlled by one principal stockholder who is also our Chairman and Chief Executive Officer.

Charles W. Ergen, our Chairman and Chief Executive Officer, owns approximately 44.8% of our total equity securities

(assuming conversion of all Class B Common Stock into Class A Common Stock) and beneficially owns approximately

48.4% of our total equity securities (assuming conversion of only the Class B Common Stock held by Mr. Ergen into

Class A Common Stock). Under either a beneficial or equity calculation method, Mr. Ergen controls approximately

78.5% of the total voting power. Mr. Ergen’s beneficial ownership of shares of Class A Common Stock excludes

33,790,620 shares of Class A Common Stock issuable upon conversion of shares of Class B Common Stock currently

held by certain trusts established by Mr. Ergen for the benefit of his family. These trusts own approximately 7.3% of our

total equity securities (assuming conversion of all Class B Common Stock into Class A Common Stock) and beneficially

own approximately 13.1% of our total equity securities (assuming conversion of only the Class B Common Stock held

by such trusts into Class A Common Stock). Under either a beneficial or equity calculation method, these trusts possess

approximately 13.0% of the total voting power. Through his voting power, Mr. Ergen has the ability to elect a majority