Dish Network 2015 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2015 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-30

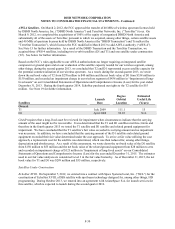

AWS-4 Satellites. On March 2, 2012, the FCC approved the transfer of 40 MHz of wireless spectrum licenses held

by DBSD North America, Inc. (“DBSD North America”) and TerreStar Networks, Inc. (“TerreStar”) to us. On

March 9, 2012, we completed the acquisitions of 100% of the equity of reorganized DBSD North America and

substantially all of the assets of TerreStar, pursuant to which we acquired, among other things, certain satellite assets

and 40 MHz of spectrum licenses held by DBSD North America (the “DBSD Transaction”) and TerreStar (the

“TerreStar Transaction”), which licenses the FCC modified in March 2013 to add AWS-4 authority (“AWS-4”).

See Note 15 for further information. As a result of the DBSD Transaction and the TerreStar Transaction, we

acquired three AWS-4 satellites, including two in-orbit satellites (D1 and T1) and one satellite under construction

(T2). See below for further information.

Based on the FCC’s rules applicable to our AWS-4 authorizations no longer requiring an integrated satellite

component or ground spare and on our evaluation of the satellite capacity needed for our wireless segment, among

other things, during the second quarter 2013, we concluded that T2 and D1 represented excess satellite capacity for

the potential commercialization of our wireless spectrum. As a result, during the second quarter 2013, we wrote

down the net book value of T2 from $270 million to $40 million and the net book value of D1 from $358 million to

$150 million, and recorded an impairment charge in our wireless segment of $438 million in “Impairment of long-

lived assets” on our Consolidated Statements of Operations and Comprehensive Income (Loss) for the year ended

December 31, 2013. During the fourth quarter 2014, EchoStar purchased our rights to the T2 satellite for $55

million. See Note 19 for further information.

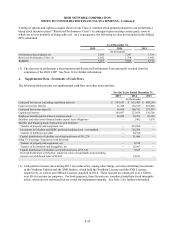

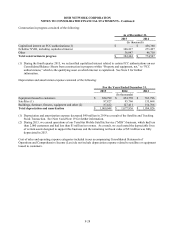

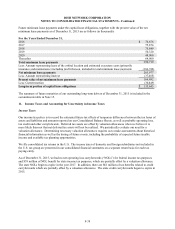

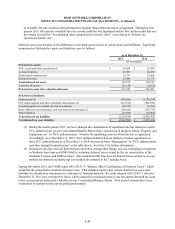

Degree Estimated

Launch Orbital Useful Life

Satellites Date Location (Years)

Owned:

T1 July 2009 111.1 15

D1 April 2008 92.85 N/A

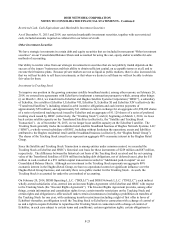

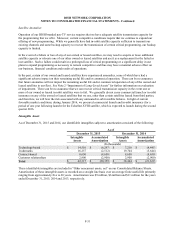

GAAP requires that a long-lived asset be reviewed for impairment when circumstances indicate that the carrying

amount of the asset might not be recoverable. It was determined that the T1 and D1 satellites met this criteria and

therefore in the fourth quarter 2015 we tested the T1 satellite and D1 satellite and related ground equipment for

impairment. We have concluded that the T1 satellite’s fair value exceeded its carrying amount and no impairment

was necessary. In addition, we have concluded that the carrying amount of the D1 satellite and related ground

equipment exceeded their fair value determined under the cost approach. To arrive at fair value utilizing the cost

approach, a replacement cost for the satellite was determined, which was then reduced for, among other things,

depreciation and obsolescence. As a result of this assessment, we wrote down the net book value of the D1 satellite

from $150 million to $55 million and the net book value of the related ground equipment from $28 million to zero

and recorded an impairment charge of $123 million in “Impairment of long-lived assets” on our Consolidated

Statements of Operations and Comprehensive Income (Loss) for the year ended December 31, 2015. The estimates

used in our fair value analysis are considered Level 3 in the fair value hierarchy. As of December 31, 2015, the net

book value for T1 and D1 was $299 million and $55 million, respectively.

Satellites Under Construction

EchoStar XVIII. On September 7, 2012, we entered into a contract with Space Systems/Loral, Inc. (“SS/L”) for the

construction of EchoStar XVIII, a DBS satellite with spot beam technology designed for, among other things, HD

programming. During October 2013, we entered into an agreement with ArianeSpace S.A. for launch services for

this satellite, which is expected to launch during the second quarter 2016.